United Kingdom General Anesthesia Drugs Market Size, Share, and COVID-19 Impact Analysis, By Route of Administration (Intravenous, Inhaled), By Application (Heart Surgeries, Cancer, General Surgery, Knee and Hip Replacements, and Others), and United Kingdom General Anesthesia Drugs Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom General Anesthesia Drugs Market Insights Forecasts to 2035

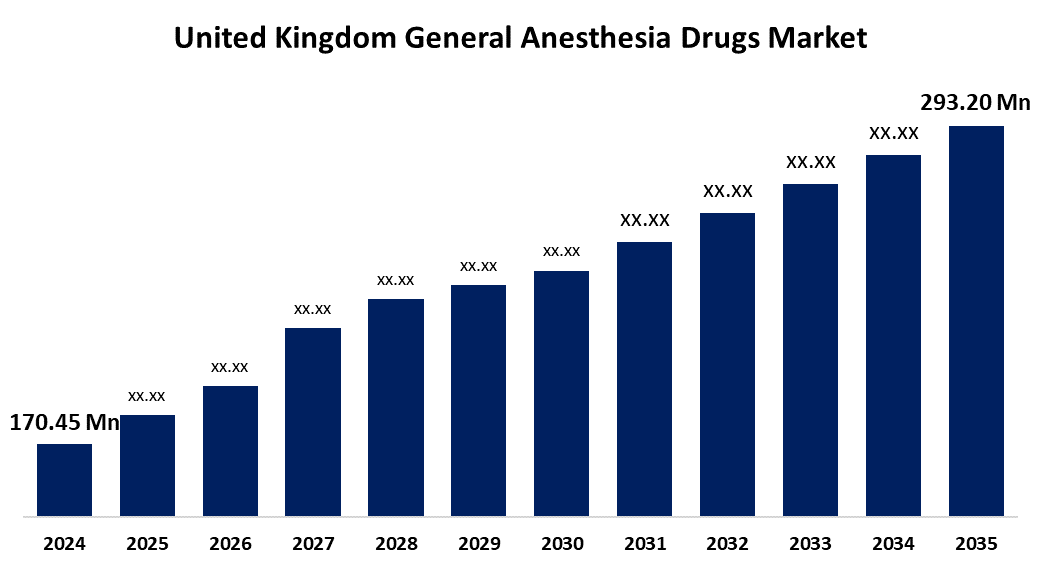

- The United Kingdom General Anesthesia Drugs Market Size was estimated at USD 170.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.05% from 2025 to 2035

- The United Kingdom General Anesthesia Drugs Market Size is Expected to Reach USD 293.20 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom General Anesthesia Drugs Market Size is Anticipated to reach USD 293.20 Million By 2035, Growing at a CAGR of 5.05% from 2025 to 2035. The growing incidence of chronic illnesses like diabetes, heart disease, and cancer is propelling the demand for general anesthetic medications.

Market Overview

The United Kingdom general anesthesia drugs market refers to the industry that assists to healthcare sector by focusing on the production and application of drugs used to generate a regulated, reversible state of unconsciousness are known as general anesthetic drugs. Further, to provide unconsciousness and pain-free treatment during surgery or medical intervention, general anesthesia is used to induce and maintain patients. General anesthesia pills are marketed by a pharmaceutical company that specializes in chemicals that induce reversible unconsciousness for medical and surgical operations. The medications manage a patient's reaction to treatments, reduce discomfort, and relax tense muscles. Intravenous and inhalation-based anesthetics are marketed to hospitals, ambulatory surgery centers, and specialized clinics. Further, government support that boosts the market expansion, like A £14 billion agreement reached between the UK government, NHS England, and the pharmaceutical industry to improve access to cutting-edge treatments, including anesthesia drugs.

Report Coverage

This research report categorizes the market for the United Kingdom general anesthesia drugs market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom general anesthesia drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom general anesthesia drugs market.

United Kingdom General Anesthesia Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 170.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.05% |

| 2035 Value Projection: | USD 293.20 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 191 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Route of Administration, By Application and COVID-19 Impact Analysis |

| Companies covered:: | AstraZeneca, Hikma Pharmaceuticals PLC, GlaxoSmithKline (GSK), Baxter International (UK Division), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom general anesthesia drugs is primarily driven by the growing number of surgeries associated with an older population and the prevalence of chronic disorders, including cancer, musculoskeletal problems, and cardiovascular diseases. Technological developments in medication formulation have lowered post-operative problems, accelerated recovery, and enhanced the safety and efficacy of anesthetics, which boosts the market expansion. Additionally, the market is expanding due in large part to the desire for short-acting, readily reversible anesthetics, which is being pushed by the trend toward outpatient care and minimally invasive procedures. Further, government actions have a big influence on the market for anesthetic drugs.

Restraining Factors

However, strict clearance criteria, safety standards, potential side effects, and high costs limit accessibility and affordability, impeding the expansion of the anesthetic drug industry in the UK.

Market Segmentation

The United Kingdom general anesthesia drugs market share is classified into route of administration and application.

- The inhaled segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom general anesthesia drugs market is segmented by route of administration into intravenous, and inhaled. Among these, the inhaled segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is due to the increasing prevalence of respiratory diseases such as asthma and chronic obstructive pulmonary disease (COPD). The segment growth is expected to expand due to advancements in inhalation technology, including smart inhalers and improved drug formulations. A majorly rising aging population, which makes a significant difference for segment growth.

- The cancer segment held the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom general anesthesia drugs market is segmented by application into heart surgeries, cancer, general surgery, knee and hip replacements, and others. Among these, the cancer segment held the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because the increase in cancer surgery, with chemotherapy and radiation therapy, is commonly used in combination to treat cancer. General anesthesia is typically necessary for procedures such as tumor resection, biopsies, and surgeries related to metastases to ensure patient comfort and immobility throughout invasive therapies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom general anesthesia drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca

- Hikma Pharmaceuticals PLC

- GlaxoSmithKline (GSK)

- Baxter International (UK Division)

- Others

Recent Developments:

- In August 2023, PAION received UK MHRA approval for Byfavo® (remimazolam), an ultra-short-acting intravenous benzodiazepine, for the induction and maintenance of general anesthesia in adults. This approval strengthens PAION’s position in anesthesia and sedation.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom general anesthesia drugs market based on the below-mentioned segments

United Kingdom General Anesthesia Drugs Market, By Route of Administration

- Intravenous

- Inhaled

United Kingdom General Anesthesia Drugs Market, By Application

- Heart Surgeries

- Cancer

- General Surgery

- Knee and Hip Replacements

- Others

Need help to buy this report?