United Kingdom Gastrointestinal Products Market Size, Share, and COVID-19 Impact Analysis, By Devices (Endoscopy Devices, Ablation Devices, Motility Testing Devices, Biopsy Devices, and Stenting Devices), By Indications (Gastrointestinal Cancers, Gastroesophageal Reflux Disease, Irritable Bowel Syndrome, Inflammatory Bowel Disease, and Other Diseases), and United Kingdom Gastrointestinal Products Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Gastrointestinal Products Market Insights Forecasts to 2035

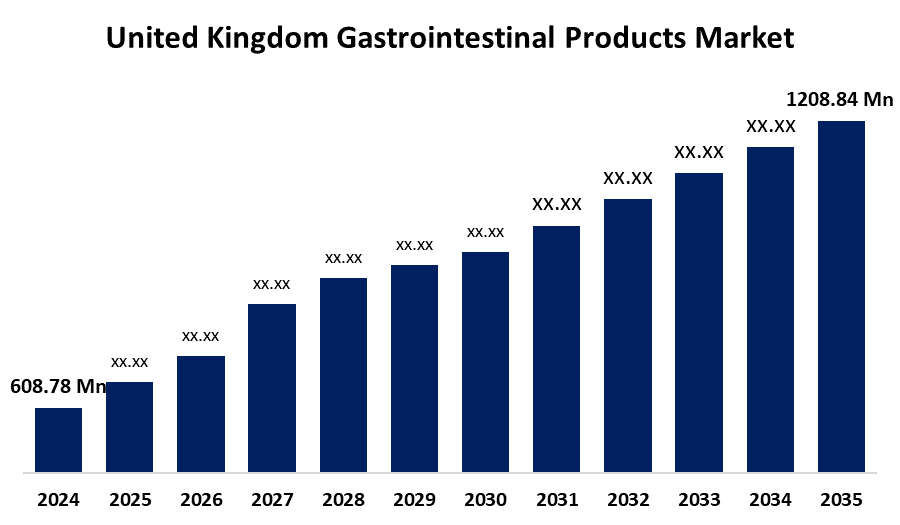

- The United Kingdom Gastrointestinal Products Market Size Was Estimated at USD 608.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.43% from 2025 to 2035

- The United Kingdom Gastrointestinal Products Market Size is Expected to Reach USD 1208.84 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Gastrointestinal Products Market Size is anticipated to reach USD 1208.84 Million by 2035, growing at a CAGR of 6.43% from 2025 to 2035. The increasing number of digestive illnesses, increasing awareness of gut health, improvements in medical care, an aging population, and an expanding healthcare system, all of which are contributing to the growing use of novel diagnostic and therapeutic tools.

Market Overview

The United Kingdom gastrointestinal products market refers to the industry that includes medications, medical equipment, and diagnostic instruments intended to prevent, identify, and cure gastrointestinal conditions such as ulcers, inflammatory bowel disease, acid reflux, and IBS. It includes pharmaceuticals, over-the-counter treatments, and cutting-edge technologies that medical professionals utilize to enhance digestive health. Rising illness prevalence, growing awareness of digestive health, and improvements in treatment options throughout the UK healthcare system all have an impact on market growth. The increasing awareness of digestive health issues and the rise in gastrointestinal illnesses. The need for efficient therapies is increased by the aging population and changing lifestyles. Product development is improved by technological advancements like tailored treatment and minimally invasive diagnostics. Market expansion is further supported by growing R&D expenditures and healthcare infrastructure expansion. Additionally, there is a lot of room for market growth given the growing use of over-the-counter gastrointestinal medications. The advanced targeted drug delivery systems, personalized treatment, and minimally invasive diagnostic techniques. The development of new medicines and biologics increases the effectiveness of treatment. The use of digital health technology for AI-driven diagnostics and remote monitoring improves patient care and the early identification of gastrointestinal problems.

Report Coverage

This research report categorizes the market for the United Kingdom gastrointestinal products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom gastrointestinal products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom gastrointestinal products market.

United Kingdom Gastrointestinal Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 608.78 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.43% |

| 2035 Value Projection: | USD 1208.84 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Devices and By Indications |

| Companies covered:: | SynMed, Penlon, Micro-Tech UK, Ethicon Endo-Surgery, Medtronic, Stryker, Smith & Nephew, Karl Storz, Hoya, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising incidence of gastrointestinal conditions brought on by aging populations and changing lifestyles, including inflammatory bowel disease, acid reflux, and irritable bowel syndrome. Increased demand for cutting-edge diagnostic and treatment solutions is a result of growing awareness of digestive health and early diagnosis. Biologic therapies and minimally invasive procedures are examples of technological innovations that enhance outcomes from therapy and promote acceptance. The industry is also growing as the outcome of government programs that boost healthcare accessibility and growing healthcare infrastructure. The UK market is expanding at a significant rate attributed to the growing availability of over-the-counter gastrointestinal drugs and the growing desire of patients for non-invasive therapies.

Restraining Factors

The high treatment expenses, strict regulatory approvals, and possible drug adverse effects. Growth is also hampered by supply chain interruptions, competition from alternative remedies, and low patient awareness in some areas. Furthermore, market saturation in some segments and reimbursement issues limit growth.

Market Segmentation

The United Kingdom gastrointestinal products market share is classified into device and indication.

- The endoscopy devices segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom gastrointestinal products market is segmented by device into endoscopy devices, ablation devices, motility testing devices, biopsy devices, and stenting devices. Among these, the endoscopy devices segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to rising incidences of gastrointestinal disorders, growing interest in minimally invasive therapies, improvements in imaging technologies, and a stronger focus on early detection. Adoption at medical facilities is further boosted by aging populations and improved health care infrastructure.

- The gastrointestinal cancers segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom gastrointestinal products market is segmented by indication into gastrointestinal cancers, gastroesophageal reflux disease, irritable bowel syndrome, inflammatory bowel disease, and other diseases. Among these, the gastrointestinal cancers segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of increasing rates of cancer, improved understanding of early screening, improvements in therapeutic and diagnostic tools, and an increase in the use of minimally invasive procedures. The need for efficient cancer management solutions is further accelerated by an aging population and improved access to healthcare.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom gastrointestinal products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SynMed

- Penlon

- Micro-Tech UK

- Ethicon Endo-Surgery

- Medtronic

- Stryker

- Smith & Nephew

- Karl Storz

- Hoya

- Others

Recent Developments:

- In April 2024, Medtronic has introduced ColonPRO, an advanced software for its GI Genius intelligent endoscopy system. This AI-driven tool enhances polyp detection accuracy by reducing false positives by 9%, streamlining workflows, and improving real-time image analysis during endoscopic procedures.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom gastrointestinal products market based on the below-mentioned segments:

United Kingdom Gastrointestinal Products Market, By Device

- Endoscopy Devices

- Ablation Devices

- Motility Testing Devices

- Biopsy Devices

- Stenting Devices

United Kingdom Gastrointestinal Products Market, By Indication

- Gastrointestinal Cancers

- Gastroesophageal Reflux Disease

- Irritable Bowel Syndrome

- Inflammatory Bowel Disease

- Other Diseases

Need help to buy this report?