United Kingdom Gardening Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Lawn Mowers, Handheld Power Tools, Water Equipment), By End Use (Residential, Commercial, and Government), and United Kingdom Gardening Equipment Market Insights, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingUnited Kingdom Gardening Equipment Market Insights Forecasts to 2035

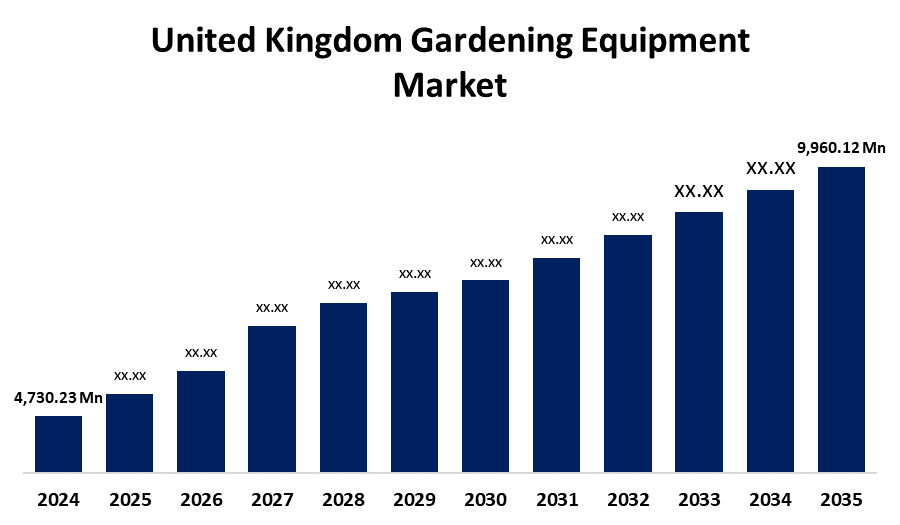

- The United Kingdom Gardening Equipment Market Size was estimated at USD 4,730.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.00% from 2025 to 2035

- The United Kingdom Gardening Equipment Market Size is Expected to Reach USD 9,960.12 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Gardening Equipment Market Size is Anticipated to reach USD 9,960.12 Million By 2035, Growing at a CAGR of 7.00% from 2025 to 2035. The growing popularity of housing or residential aesthetics outlook, and the need for additional spending on high-quality gardening tools to create green areas in cities, has increased due to urbanization.

Market Overview

The gardening equipment market refers to the industry that produces and distributes tools and machinery used for garden, lawn, and landscape maintenance. This encompasses a broad range of goods, including garden equipment (shovels, rakes, pruners), irrigation systems, lawnmowers, trimmers, edgers, and leaf blowers. Further, rising aesthetic preferences and the growing emphasis on environmental sustainability, the industry is characterized by a growing interest in home gardening, lawn care, and landscaping. The market's expansion has also been aided by government programs that support sustainable landscaping techniques, urban farming, and green space development. The use of sustainable and energy-efficient gardening equipment has been fueled by local governments and federal initiatives that encourage homeowners to cultivate their gardens. Further, some development news, like in March 2021, Dobies introduced a new generation of garden tools under the Pedigree by British Bulldog brand. These tools are designed with strength, elegance, and high performance, making them ideal for gardening enthusiasts and professionals.

Report Coverage

This research report categorizes the market for the United Kingdom gardening equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom gardening equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom gardening equipment market.

United Kingdom Gardening Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,730.23 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 7.00% |

| 2035 Value Projection: | USD 9,960.12 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Hillier Garden Centres, British Garden Centres, Andover Garden Machinery, Ron Smith & Co. Ltd., Sullivan’s Garden Machinery, L R S Lincs Ltd, Hardscape Products, Spear & Jackson Group, Keengardener Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for UK gardening equipment is primarily driven by the growing aesthetic urban gardening, especially in urban areas, and in smaller spaces. The adoption of eco-friendly equipment has also been fueled by growing interest in sustainable gardening techniques, including organic farming and water conservation. The industry has grown as such of the elderly population's desire for low-maintenance gardening solutions and the growing appeal of outdoor activity. The desire for contemporary, effective equipment has been further stimulated by technological developments, such as the novel fabrication of gardening tools that are battery-powered, intelligent, and automated.

Restraining Factors

The high cost of gardening equipment, especially sophisticated or electric-powered designs, is one of the market's problems in the British gardening equipment market. Additional factors impeding market growth and acceptance include demand fluctuations, low awareness among consumers of sustainable products, and rivalry from less expensive alternatives.

Market Segmentation

The United Kingdom gardening equipment market share is classified into product and end use.

- The lawn mowers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom gardening equipment market is differentiated by product into lawn mowers, handheld power tools, and water equipment. Among these, the lawn mowers segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The quick adoption of technologically sophisticated equipment that offers customers greater comfort and convenience is one of the factors driving this segment's growth. Further, the need for lightweight, ergonomic equipment, as well as Li-ion batteries, boosts the segment expansion.

- The residential segment held the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom gardening equipment market is segmented by end use into residential and commercial, and government. Among these, the residential segment held the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of its affordability and scalability in large-scale manufacturing. The metal injection molding produces precise and lightweight materials, it is becoming more and more popular in the aerospace and miniaturized electronics industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom gardening equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hillier Garden Centres

- British Garden Centres

- Andover Garden Machinery

- Ron Smith & Co. Ltd.

- Sullivan's Garden Machinery

- L R S Lincs Ltd

- Hardscape Products

- Spear & Jackson Group

- Keengardener Ltd

- Others

Recent Developments:

- In April 2025, A new garden machinery brand, Fiat Professional Garden, launched in the UK, bringing a fresh perspective to the industry. The company, which is backed by Engineering Eden Ltd., aimed to support dealers with a market price protection strategy that ensured strong profit margins.

- In September 2024, GARDENA officially launched its brand-new Dual Hose Box for 2025, designed to make garden watering more efficient and convenient. The slim, compact, and affordable hose box comes pre-assembled with a 1.5-meter connection hose and a 25-meter high-quality hose, ensuring effortless use.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom gardening equipment market based on the below-mentioned segments

United Kingdom Gardening Equipment Market, By Product

- Lawn Mowers

- Handheld Power Tools

- Water Equipment

United Kingdom Gardening Equipment Market, By End Use

- Residential

- Commercial

- Government

Need help to buy this report?