United Kingdom Gaming Market Size, Share, And COVID-19 Impact Analysis, By Game Type (Shooter, Action, Sports, Role Playing, and Others), By Device Type (PC/MMO, Table, Mobile Phone, and TV/Console), By End-User (Male and Female), and UK Gaming Market Insights, Industry Trend, Forecasts to 2033

Industry: Information & TechnologyThe United Kingdom Gaming Market Insights Forecasts to 2033

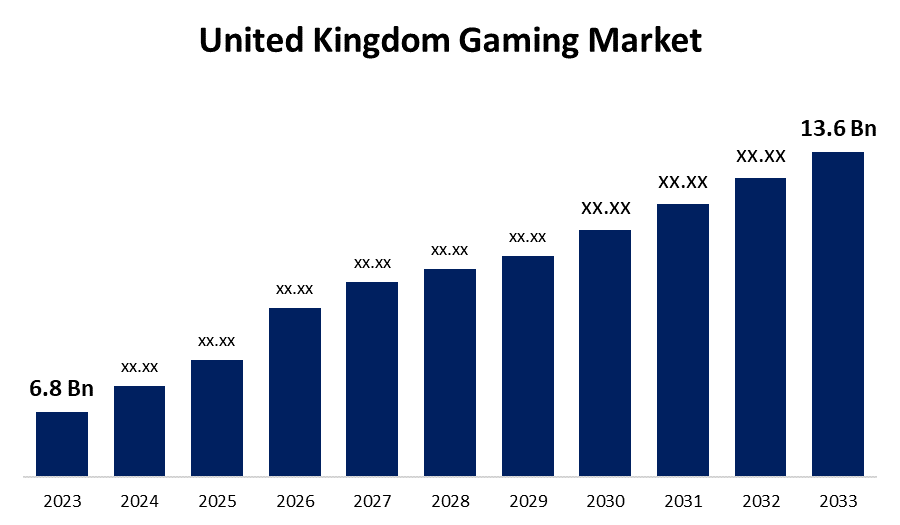

- The United Kingdom Gaming Market Size Was Valued at USD 6.8 Billion in 2023.

- The United Kingdom Gaming Market Size is Expected to Grow at a CAGR of 7.18% from 2023 to 2033.

- The United Kingdom Gaming Market Size is Expected to Reach USD 13.6 Billion by 2033.

Get more details on this report -

The United Kingdom gaming market size is predicted to grow from USD 6.8 billion in 2023 to USD 13.6 billion by 2033 at a CAGR of 7.18% during the forecast period. The growing internet penetration, the increasing popularity of mobile gaming, great technological advancements in gaming the strong esports culture, the increasing number of casual gamers and high consumer expenditure on entertainment are some of the key drivers of the growth of the market.

Market Overview

The production, sale, and use of video games and related peripherals in the UK make up the gaming business. Gaming services, in-game purchases, digital and physical game sales, and console, mobile, and PC gaming are some of its sectors. A diverse customer base, the advancement of technology, and a robust gaming ecosystem supported by both domestic and foreign businesses dominate the market. Also, the creation, marketing, and use of video games and related goods in the UK are all part of the gaming business. It encompasses a variety of markets, including gaming on consoles, mobile devices, and PCs; digital and physical game sales; in-game purchases; and gaming-related services. The sector is distinguished by a diverse customer base, cutting-edge technology, and a robust gaming ecosystem supported by both domestic and international businesses. Furthermore, the UK government actively supports the video game industry through schemes such as the High-end Television Tax Relief, which works to reduce production costs. In 2023, the government invested an additional Pound 77 million in creative industries, including Pound 5 million to cover the costs of the UK Games Fund to assist future game developers.

Report Coverage

This research report categorizes the UK gaming market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the UK gaming market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the UK gaming market.

United Kingdom Gaming Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 6.8 Billion |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | CAGR Of 7.18% |

| 2033 Value Projection: | USD 13.6 Billion |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Game Type, By Device Type and By End-User |

| Companies covered:: | TekRevol, Terahard Ltd, Marmalade Game Studio, SideQuestVR, Square Enix, Playmint, Entain, IGT, Playtech, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Technological innovations, including Virtual Reality (VR), Augmented Reality (AR), and new-generation gaming consoles, are improving the gaming experience and drawing more customers. For example, Sony introduced the PS VR 2 in 2023, which will be compatible with the PlayStation 5, delivering immersive gaming experiences. Moreover, the launch of Sandbox VR's location in Birmingham brought new immersive gaming experiences to the UK.

Restraints & Challenges

One of the biggest constraints on the UK gaming industry is the high expense of developing games, which can be prohibitive for small studios. Based on TIGA, the trade association that speaks for the UK video games industry, the cost of developing a AAA title averages over Pound 50 million and demands significant upfront capital. Although more established studios enjoy settled funding patterns, smaller developers may find it difficult to obtain financing, keeping them from being able to effectively compete within an increasingly saturated market.

Market Segmentation

The United Kingdom Gaming Market share is classified into game type, device type, and end-use.

- The shooter segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on game type, the UK gaming market is classified into shooter, action, sports, role playing, and others. Among these, the shooter segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The dominance in shooter games category in the UK market is propelled by the gameplay style of shooters being fast-moving and multiplayer mode, which engages a broad number of players. Also, the popularity of esports has increased the profile of shooter games, with their tournaments attracting huge crowds is propelling the expansion of the shooter games category in the UK market.

- The PC/ MMO segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on device type, the UK gaming market is classified into PC/MMO, table, mobile phone, TV/console. Among these, the PC/MMO segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The emergence of cross-platform play has broadened MMO gaming's audience, with the ability to transition between devices with ease. Sony's State of Play also points out that cross-platform games contribute to 40% of MMO-related income in the UK. Finally, the increasing dominance of esports and live streaming sites has increased the awareness and activity of MMO games, creating an active community of players.

- The male segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on end-user, the UK gaming market is classified into male, female. Among these, the male segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. The UK market is fueled by a deep cultural appeal for gaming by men, especially in shooter, sports, and action game genres. Games like Call of Duty and FIFA have long appealed more to men, playing a key role in their market dominance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK gaming market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TekRevol

- Terahard Ltd

- Marmalade Game Studio

- SideQuestVR

- Square Enix

- Playmint

- Entain

- IGT

- Playtech

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In April 2025, Metric Gaming, a new player in high-end sportsbook supply, announced a deal with betzone for the launch of the brand's new UK sportsbook business. The agreement came on the heels of the successful launch of Metric's highly anticipated sportsbook platform in the Netherlands that May. The agreement represented Metric's entrance into another highly regulated and strategically important marketplace, in light of the B2B provider's "whiter-than-white" regulatory approach.

- In May 2024, Ukie, the industry body for the video games sector, announced the opening of the 'Ask About Games' parent hub, a valuable resource designed to help parents, carers, and families navigate the world of video games. As technology advanced, so did parenting, with video game ownership becoming a standard in 70% of UK homes. This hub aimed to provide parents with the tools and knowledge needed to have constructive conversations about promoting healthy digital habits in their children.

Market Segment

This study forecasts revenue at the USA, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom gaming market based on the below-mentioned segments

UK Gaming Market, By Game Type

- Shooter

- Action

- Sports

- Role Playing

- Others

UK Gaming Market, By Device Type

- PC/MMO

- Table

- Mobile Phone

- TV/Console

UK Gaming Market, By End-User

- Male

- Female

Need help to buy this report?