United Kingdom Games and Puzzles Market Size, Share, and COVID-19 Impact Analysis, By Licensing (Licensed, Non-Licensed), By Type (Games, Puzzle), By Distribution Channel (E-commerce, Offline Stores), and United Kingdom Games and Puzzles Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Games and Puzzles Market Insights Forecasts to 2035

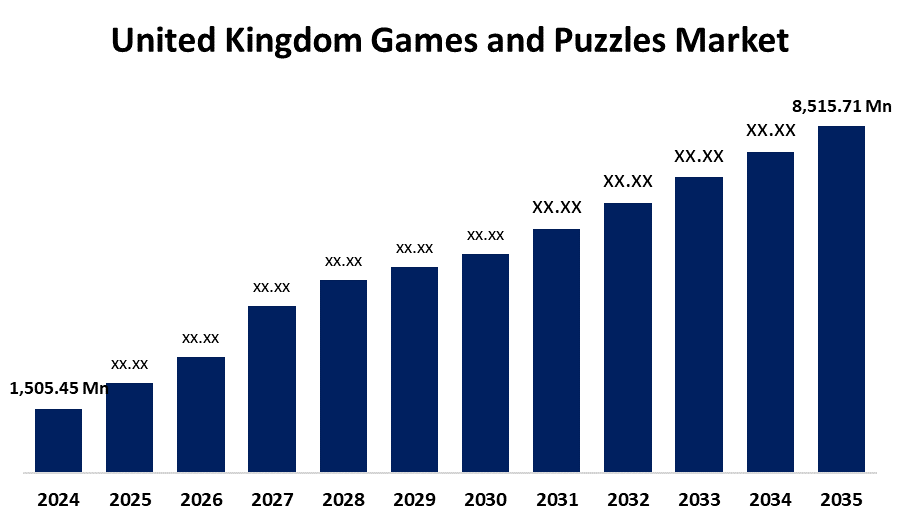

- The United Kingdom Games and Puzzles Market Size was Estimated at USD 1,505.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.06% from 2025 to 2035

- The United Kingdom Games and Puzzles Market Size is Expected to Reach USD 8,515.71 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Games and Puzzles Market Size is anticipated to reach USD 8,515.71 Million by 2035, growing at a CAGR of 17.06% from 2025 to 2035. The British market for games and puzzles is driven by an increasing need for educational toys, technological developments, and purpose for rising family-bonding pursuits.

Market Overview

The United Kingdom games and puzzles market refers to the business focused on the production, application, and distribution of merchandise and products used for entertainment. Further, amusement, education, and social interaction are encompassed with card games, board games, jigsaw puzzles, and logic-based tasks. All age groups enjoy using these products, which have both recreational and instructional uses. The market offers products from both domestic and foreign producers in both conventional formats and contemporary modifications. Customers can access a significant cultural appreciation for creative and intellectual pursuits, which contributes to the popularity of games and puzzles there. Seasonal demand, such as school and college vacations or holiday peaks, is often advantageous to the market, especially during holidays and school breaks. Moreover, local consumers frequently prioritize design, quality, and educational value when making purchases, which has an influence on revenue generation and market growth.

Report Coverage

This research report categorizes the market for the United Kingdom games and puzzles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom games and puzzles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom games and puzzles market.

United Kingdom Games and Puzzles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,505.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 17.06% |

| 2035 Value Projection: | USD 8,515.71 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 278 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Licensing, By Type and By Distribution Channel |

| Companies covered:: | Gibsons Games, Big Potato Games, Orchard Toys, Smart Games UK, Cheatwell Games, Jaques of London, The Happy Puzzle Company, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for United Kingdom games and puzzles is flourishing due to intellectual stimulation, the nostalgia that comes from playing games, the amount of social contact that games and puzzles offer, and the rising popularity of licensed games and puzzles are some of the causes driving the market's expansion. Traditional board games and puzzles are in more demand as a result of a growing emphasis on social contact and screen-free family time. Additionally, gaming experiences are being improved by digital innovation like augmented reality elements and app integration. The development of environmentally friendly and intellectually stimulating items that appeal to both children and adults which being supported by growing consumer awareness of mental wellness, cognitive development, and sustainability.

Restraining Factors

The price volatility, increasing competition from streaming services, and digital entertainment like video games are the major barriers stood up against the market growth. Challenges include limited shelf life, particularly for eco-friendly materials, and shifting consumer tastes may have an impact on particular game forms last, which might hinder the market expansion.

Market Segmentation

The United Kingdom Games and Puzzles Market share is classified into licensing, type, and distribution channel.

- The licensed segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The United Kingdom games and puzzles market is segmented by licensing into licensed, and non-licensed. Among these, the licensed segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. This is due to popular franchises and characters that can be featured in licensed games and puzzles, which can be an interesting and personalized experience, specifically for the age group of 10 to 14 years. Moreover, entertainment icons like Disney's Frozen, Spiderman, Pinkfong's Baby Shark, and others have unveiled some games and puzzles with licensed details or a subscription, which could expand the segment's growth.

- The puzzle segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom games and puzzles market is segmented by type into games, and puzzle. Among these, the puzzle segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is because they offer a physical movement among older and younger ones, consumers with intellectual exercises. Besides, the majority of them prefer puzzles in a physical format, like word problems, jigsaw puzzles, and numerical puzzles. Additionally, it helps to comumer specifically for children grow up and are nourished with wealthy surroundings.

- The e-commerce segment accounted for the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United Kingdom games and puzzles market is segmented by distribution channel into e-commerce, and offline stores. Among these, the e-commerce segment accounted for the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is due to the search for simple and safe ways to shop and pass the time at home or any remote location. Also, retailer investment in online capabilities, convenience, and customer comfort with online shopping all suggest that the internet sales channel for games and puzzles will continue to expand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom games and puzzles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gibsons Games

- Big Potato Games

- Orchard Toys

- Smart Games UK

- Cheatwell Games

- Jaques of London

- The Happy Puzzle Company

- Others

Recent Developments:

- In January 2025, Apple News+ subscribers in the UK recently gained access to new puzzle games! Apple expanded its puzzles section, which included Sudoku, Crossword, Crossword Mini, and Quartiles. The rollout of these games in the UK was part of a broader Apple News+ expansion, which featured more locally focused news coverage.

- In November 2024, the Happy Puzzle Company announced a new range of London Underground-themed puzzles, created in collaboration with Transport for London (TfL). These games, along with unique London Underground jigsaw puzzles, were designed to engage both new and lifelong fans of the iconic transport system.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom games and puzzles market based on the below-mentioned segments:

United Kingdom Games and Puzzles Market, By Licensing

- Licensed

- Non-Licensed

United Kingdom Games and Puzzles Market, By Type

- Games

- Puzzle

United Kingdom Games and Puzzles Market, By Distribution Channel

- E-commerce

- Offline Stores

Need help to buy this report?