United Kingdom Gabapentin Market Size, Share, and COVID-19 Impact Analysis, By Dosage Form (Tablet, Capsule, and Oral Solution), By Application (Epilepsy, Neuropathic Pain, Restless Legs Syndrome, and Others), and UK Gabapentin Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Gabapentin Market Forecasts to 2035

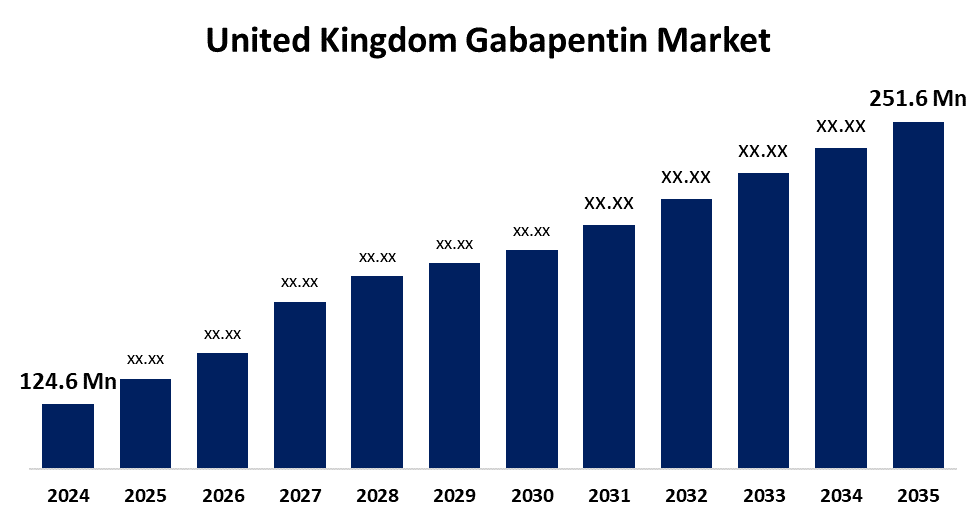

- The United Kingdom Gabapentin Market Size Was Estimated at USD 124.6 Million in 2024

- The UK Gabapentin Market Size is Expected to Grow at a CAGR of around 6.6% from 2025 to 2035

- The UK Gabapentin Market Size is Expected to Reach USD 251.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Gabapentin Market Size is Anticipated to Reach USD 251.6 Million by 2035, Growing at a CAGR of 6.6% from 2025 to 2035. The market for gabapentin is driven by people's growing awareness of health issues like diabetes and neuropathy brought on by constantly shifting lifestyles.

Market Overview

The UK gabapentin market refers to the medication is typically prescribed to treat neurological illnesses such as epilepsy and neuropathic pain. It operates by modulating nerve signals in the brain and nervous system. Gabapentin, which is widely used in healthcare, is essential in the treatment of disorders involving irregular nerve activity and persistent nerve-related pain. The changing lifestyles and demographics, illnesses like diabetic neuropathy are becoming more common in the UK, raising public health concerns and driving up demand for gabapentin. Gabapentin was first created to treat epilepsy, but its applications have grown considerably, and it is now increasingly prescribed off-label for anxiety, bipolar disorder, and other neurological conditions. Its market presence is being improved by this wider application. To lower the hazards associated with addiction and reliance, medical professionals are also increasingly selecting gabapentin over opioids for the treatment of pain. Its widespread use is also being aided by increased knowledge of neurological illnesses and an ageing population that is more vulnerable to them. Gabapentin's position as a safer, preferred treatment option in the healthcare industry is further reinforced by supportive reimbursement policies and a greater emphasis on mental health care, which consistently drives demand across a variety of medical disciplines.

Report Coverage

This research report categorizes the market for the UK gabapentin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom gabapentin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom gabapentin market.

United Kingdom Gabapentin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 124.6 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 6.6% |

| 2035 Value Projection: | USD 251.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Application, By Dosage Form and COVID-19 Impact Analysis. |

| Companies covered:: | Pfizer UK, Napp Pharmaceuticals Ltd, Teva Pharmaceuticals, Viatris (formerly Mylan/Upjohn), Aurobindo Pharma, Sun Pharmaceutical Industries, Glenmark Pharmaceuticals, Cipla Ltd, Amneal Pharmaceuticals, Apotex Inc., Arbor Pharmaceuticals and Other. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The widespread recognition for its efficacy in treating neuropathic pain and enhancing patients' quality of life, the increasing incidence of this ailment is a primary factor driving the demand for the UK gabapentin market. Gabapentin is essential for controlling seizures, so its prescriptions have increased in tandem with the rising prevalence of epilepsy. It is a popular choice among doctors because of its reputation as a dependable and safe therapeutic option. The growing market demand for gabapentin in the healthcare industry.

Restraining Factors

Concerns about side effects and patient noncompliance are the main factors limiting the gabapentin market. Market expansion is constrained and therapeutic efficacy is diminished when recommended regimens are not followed. Side effects can also make medical professionals uncomfortable and cautious, which makes them favour less harmful alternative medicines. These factors hamper the gabapentin market during the forecast period.

Market Segmentation

The United Kingdom gabapentin market share is classified into dosage form and application.

- The capsule segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom gabapentin market is segmented by dosage form into tablet, capsule, and oral solution. Among these, the capsule segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. They are perfect for patients, including the young and the elderly, because they are simple to administer. Because of their ease of use and quick absorption, capsules guarantee accurate dosage and are preferred by medical professionals, which enhances patient compliance.

- The epilepsy segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom gabapentin market is segmented by application into epilepsy, neuropathic pain, restless legs syndrome, and others. Among these, the epilepsy segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Its demonstrated effectiveness as an anticonvulsant is necessary for managing seizures in people with epilepsy. The growing demand for gabapentin in the UK is mostly due to the expanding number of affected individuals, rising diagnosis rates, and the growing need for reliable treatment choices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom gabapentin market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Pfizer UK

- Napp Pharmaceuticals Ltd

- Teva Pharmaceuticals

- Viatris (formerly Mylan/Upjohn)

- Aurobindo Pharma

- Sun Pharmaceutical Industries

- Glenmark Pharmaceuticals

- Cipla Ltd

- Amneal Pharmaceuticals

- Apotex Inc.

- Arbor Pharmaceuticals

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom gabapentin market based on the below-mentioned segments:

United Kingdom Gabapentin Market, By Dosage Form

- Tablet

- Capsule

- Oral Solution

United Kingdom Gabapentin Market, By Application

- Epilepsy

- Neuropathic Pain

- Restless Legs Syndrome

- Others

Need help to buy this report?