United Kingdom Furniture Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Home Furniture, Office Furniture & Institutional Furniture), By Distribution Channel (Offline and Online), and United Kingdom Furniture Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Furniture Market Insights Forecasts to 2035

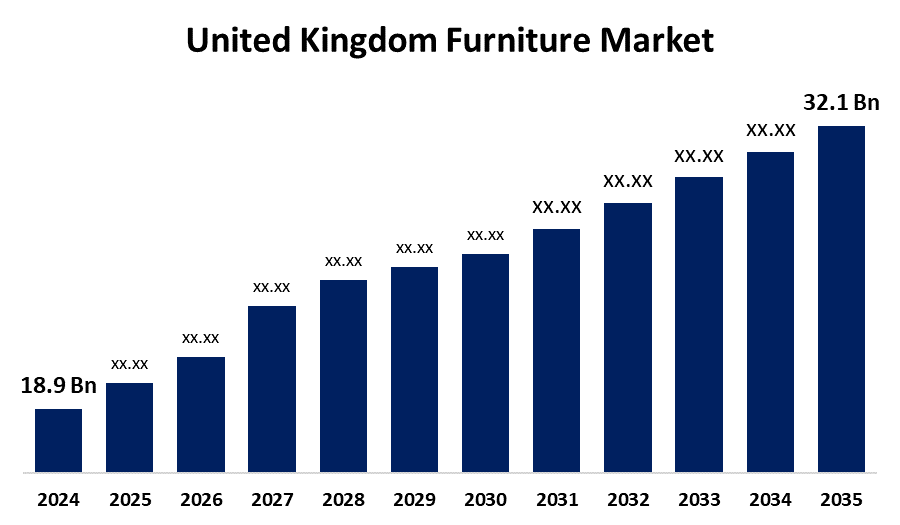

- The United Kingdom Furniture Market Size Was Estimated at USD 18.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.93% from 2025 to 2035

- The United Kingdom Furniture Market Size is Expected to Reach USD 32.1 Billion by 2035

Get more details on this report -

The United Kingdom Furniture Market Size is anticipated to reach USD 32.1 Billion by 2035, Growing at a CAGR of 4.93% from 2025 to 2035. Market Growth is attributed to factors such as rising online purchase platforms, rising urbanization, technological advancements, and changing consumer preferences lead to creating demand for furniture in the United Kingdom.

Market Overview

The furniture sector refers to the world industry that deals with furniture design, production, advertising, and sales for domestic, commercial, and institutional use. It is a fast-evolving sector driven by urbanization, consumerism, and technological progress. As it has a long history of craftsmanship and design, the UK has an advanced pattern of furniture production and utilization. The market has a wide selection of furniture ranging from beds, sofas, dining tables, cabinets, to the rest of the home furnishings. Individuals choose the furniture according to their very own purposes, whether choosing size, color, upholstery, or location. The trend is most favoured among young individuals who want their homes to be their very own. Customisation also allows homeowners to optimize their space, especially for small spaces like small apartments, through specialized furniture like corner sofas or modular shelves. These are some of the differentiating aspects driving UK furniture market growth, with the fact that it caters to a diverse array of consumers ranging from low-budget shoppers to premium connoisseurs, designers, and bespoke consumers.

Online shopping and e-commerce have been dominant factors in the UK furniture industry. Online furniture shopping has increased in usage, due to offering consumers convenience and variety through ease of access to loads of products. Companies such as IKEA, DFS, and Wayfair have good online presence, leading to the high usage of furniture online.

Major players are focusing mainly on future opportunities such as E-commerce and digital transformation, customization, personalization and sustainability, and green activities. The policies of the UK government towards the furniture sector are aimed at product safety, care for the environment, and encouraging green purchasing practices. The main legislation is the Furniture and Furnishings (Fire Safety) Regulations, which regulate that upholstered furniture and furniture composites should have certain fire-resistance levels and should be so marked. The General Product Safety Regulations 2005, which place a general obligation to deliver safe products, including furniture, to consumers, is also relevant.

Report Coverage

This research report categorizes the market for United Kingdom furniture market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom furniture market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom furniture market.

United Kingdom Furniture Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 18.9 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 4.93% |

| 2035 Value Projection: | USD 32.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel, and COVID-19 Impact Analysis |

| Companies covered:: | Barker and Stonehouse Ltd, Beyond Furniture, IKEA Limited, John Lewis plc, DFS Furniture plc, Wayfair LLC, Heal’s (1810) Ltd, Dunelm Group PLC, Steve Bristow Stone Masonry Limited, Furniture Village Limited, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Changing lifestyles and consumer expectations primarily influence the UK furniture industry significantly. The market is expanding due to new residential developments and the growing urbanization of some areas. Government agencies are placing bets on housing infrastructure development or refurbishment projects. Trends have diverged significantly over the past years towards employing compact living spaces, city living, and higher demand for sustainable and multi-functional furniture. Now, the vast majority of UK consumers want furniture that not only appears excellent but is also eco-friendly. In addition, consumers are being increasingly aware of the environment while making purchases. Consequently, more consumers are buying furniture made from natural materials like sustainably harvested wood, recyclable plastic, and recyclable wood. Most furniture companies are designing innovative concepts and processes that require less energy and resources to produce their items. Green practices such as carbon footprint reduction and the promotion of circular economy values are now major selling points for companies in the UK furniture industry. Another reason is that the UK furniture market has been driven by increased e-commerce and digitization. With its vast choice, ease of use, and capability to compare prices and designs, online purchasing has emerged as a prominent sales channel for furniture.

Restraining Factors

Both the merchants and manufacturers of furniture have faced supply chain disruption, which is the primary challenge for market growth. The effectiveness of the supply chain has declined due to increased lead times caused by human resource shortages, transport delays, and factory shutdowns. Increased costs have also been imposed on firms and clients. The price of furniture products has risen because labor, transportation, and raw materials have unstable costs. Premium products have been hard to purchase for consumers, and most manufacturers have been unable to maintain their profit margins. Another disadvantage is that consumers are seeking more environmentally friendly and sustainable products, which has kept manufacturers from complying with tough environmental regulations and going green across the supply chain. The challenge for the UK furniture industry is striking a balance between ecological and regulatory demands, while making goods which are affordable to the consumer and would be willing to purchase, constraining market growth over the forecast period.

Market Segmentation

The United Kingdom furniture market share is classified into product type and distribution channel.

- The home furniture segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom furniture market is segmented by product type into home furniture, office furniture & institutional furniture. Among these, the home furniture segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The critical demand for well-designed, functional, and visually appealing furniture that has the ability to adjust to the many needs of homeowners is propelling the expansion of this segment. The British consumer's desire for luxury, sophistication, and high-quality craftsmanship has seen a steady demand for home furnishings. E-commerce expansion and convenience of access to the portal for online shopping, which have enabled buyers to search for a number of furnishings from the comfort of their homes, are fueling market expansion. The UK housing market and frequency of house renovations and moves also guarantee an ongoing demand for furniture within the home. Individuals often buy new furniture to match their interior design tastes when moving or remodeling their homes, which drives segmental growth.

- The online segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom furniture market is segmented by distribution channel into offline and online. Among these, the online segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increased use of online channels, which offer consumers convenience, choice, and competitive prices as customer behavior and technology advance, is fueling the segment's growth. Since internet channels are available 24/7 and enable customers to purchase anytime it is convenient for them, this propels the market growth. This feature appeals to today's time-constrained consumers. A stupendous range of furniture products, from old to new, is available on internet sites and platforms to cater to different tastes and preferences. Also, a factor of prime importance is competitive pricing, enhanced by the fact that online sellers typically have lower overhead than brick-and-mortar outlets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom furniture market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barker and Stonehouse Ltd

- Beyond Furniture

- IKEA Limited

- John Lewis plc

- DFS Furniture plc

- Wayfair LLC

- Heal's (1810) Ltd

- Dunelm Group PLC

- Steve Bristow Stone Masonry Limited

- Furniture Village Limited

- Others

Recent Developments:

- In December 2024, the New lifestyle and furniture brand LIVHOME has selected Racecourse Retail Park in Liverpool as the location for its inaugural UK store. LIVHOME is a new retail format that will shake up the sector, making it simple for consumers to access high-quality furniture that combines comfort and functionality with style. Utilizing its ergonomic expertise, the design team created an inspirational, yet budget-friendly, interior design-led range that takes its lead from British heritage and fashion-conscious European design in order to create a breath of fresh air in a market that has been stale.

- In October 2024, The Cotswold Company, the digitally-driven luxury handcrafted furniture and homeware brand, is planning to launch its 11th UK showroom at 7 High Street, Marlow. Ralph Tucker, Chief Executive Officer of the Cotswold Company, stated: "We are looking forward to introducing The Cotswold Company to Buckinghamshire with our new Marlow store in time for Christmas.". This will provide great opportunities to bring local customers into our high-quality, built-to-last products and encourage more to shop beyond throwaway furniture.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Furniture Market based on the below-mentioned segments:

United Kingdom Furniture Market, By Product Type

- Home Furniture

- Office Furniture

- Institutional Furniture

United Kingdom Furniture Market, By Distribution Channel

- Offline

- Online

Need help to buy this report?