United Kingdom Frozen Dough Market Size, Share, and COVID-19 Impact Analysis, By Product (Bread & Pizza, Biscuits & Cookies, and Others), By Distribution Channel (Supermarket & Hypermarkets, Convenience Stores, Bakery Stores, and Online Food Service), and United Kingdom Frozen Dough Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Frozen Dough Market Size Insights Forecasts to 2035

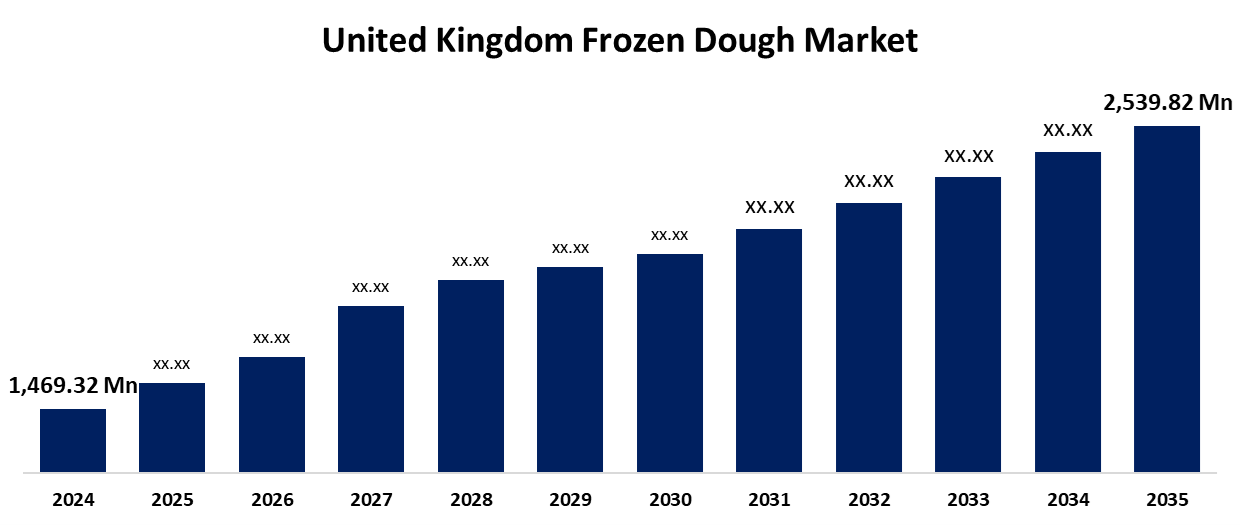

- The United Kingdom Frozen Dough Market Size was Estimated at USD 1,469.32 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.10% from 2025 to 2035

- The United Kingdom Frozen Dough Market Size is Expected to Reach USD 2,539.82 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United Kingdom Frozen Dough Market Size is anticipated to reach USD 2,539.82 Million by 2035, growing at a CAGR of 5.10% from 2025 to 2035. The industry's main driver is the growing demand for baked goods, which raises the need for frozen doughs because they're quick and simple to make, and a hectic lifestyle highlights the need for such food products.

Market Overview

The United Kingdom frozen dough market refers to the subsegment of food and beverage focused on the production and distribution of products made from ready-to-bake dough that are refrigerated to keep them. These goods, which serve both commercial and residential customers, are made with convenience, long shelf life, and reliable quality in mind. They can either be baked right away or given time to proof before baking. There is no need for additional yeast, kneading, or active time when making bread dough. Among the baking industry's fastest-growing segments is this one. The growing consumer interest in convenience foods and a demand for freshly baked goods that can be taken out of the freezer and baked right away are the main drivers of this trend. The bread industry is evolving with the times, and although the amount of bread consumed worldwide per person has slightly decreased, there are still plenty of prospects for expansion. Similarly, because it doesn't require substantial preparation to bake goods, frozen dough saves commercial bakeries time and labor. The versatility of frozen doughs allows them to be used to make a variety of foods, including rolls, cookies, and more, which has led to a surge in demand.

Report Coverage

This research report categorizes the market for the United Kingdom frozen dough market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom frozen dough market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom frozen dough market.

United Kingdom Frozen Dough Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,469.32 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.10% |

| 2035 Value Projection: | USD 2,539.82 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Massarellas Dough, Bradleys Foods, Pan Artisan, Speciality Breads, Molino Fresco Ltd, and Other key vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom frozen dough is driven by the customer demand for time-saving and convenient solutions, as busy lives make ready-to-bake items that cut down on preparation time without compromising quality more appealing. Additionally, the availability and consumer exposure of frozen bakery products are growing due to their increased penetration in both retail and foodservice channels. Improvements in freezing technology have helped to allay earlier worries about frozen dough's quality by enhancing its flavor, texture, and shelf life. In addition, the increasing popularity of artisanal goods and home baking is pushing producers to create high-end frozen dough options that appeal to consumers who value quality. An additional factor that is anticipated to impede market expansion is the absence of appropriate storage equipment and cold chain logistics.

Restraining Factors

The market for frozen dough is constrained by several problems, despite its promising growth prospects, such as issues with some customers and artisan bakers, challenges related to storage and logistics, frozen dough necessitates constant cold chain management, which can raise expenses and make distribution more difficult for small and medium-sized end users.

Market Segmentation

The United Kingdom frozen dough market share is classified into product, and distribution channel.

- The bread & pizza segment accounted for the largest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period.

The United Kingdom frozen dough market is divided by product into bread & pizza, biscuits & cookies, and others. Among these, the bread & pizza segment accounted for the largest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period. This is because of its ease of use, long shelf life, and capacity to produce bakery-quality results with little effort. Frozen bread dough, especially artisan-style loaves, baguettes, and rolls, and more popular in the retail and foodservice industries. Meanwhile, growing consumer interest in making real, restaurant-style pizzas at home is driving the frozen pizza dough market. Sourdough, gluten-free, and stone-baked bases are in high demand.

- The convenience stores segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The United Kingdom frozen dough market is segmented by distribution channel into supermarket & hypermarkets, convenience stores, bakery stores, and online food service. Among these, the convenience stores segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. This is due to the product does not require additional labor or equipment. Additionally, the technology of frozen dough helps to create new market prospects because it allows dining services channels to boost their product offers and expand their distribution region.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom frozen dough market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Massarellas Dough

- Bradleys Foods

- Pan Artisan

- Speciality Breads

- Molino Fresco Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom frozen dough market based on the below-mentioned segments:

United Kingdom Frozen Dough Market, By Product

- Bread

- Biscuits & Cookies

- Pizza

- Others

United Kingdom Frozen Dough Market, By Distribution Channel

- Supermarket & Hypermarkets

- Convenience Stores

- Bakery Stores

- Online Food Service

Need help to buy this report?