United Kingdom Frozen Dessert Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Ice Cream, Yogurts, Cakes, and Others), By Category (Conventional, Sugar-Free), and UK Frozen Dessert Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Frozen Dessert Market Forecasts to 2035

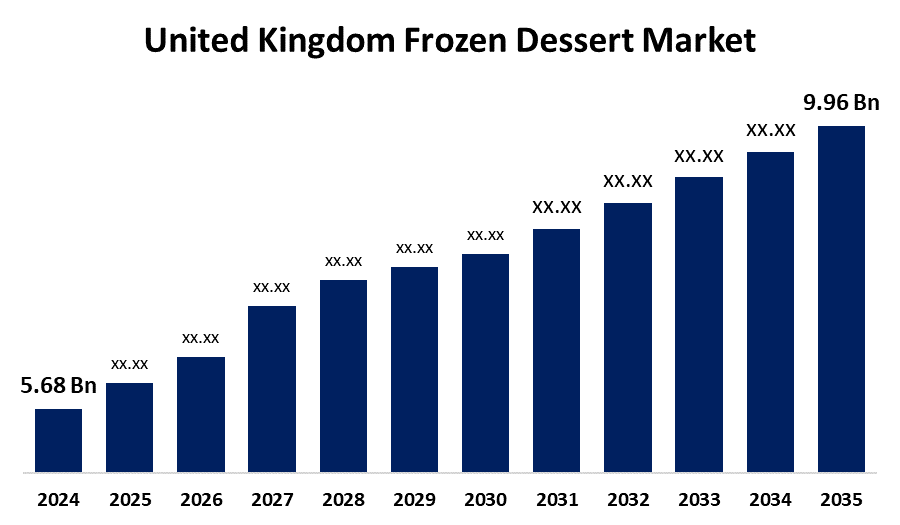

- The United Kingdom Frozen Dessert Market Size Was Estimated at USD 5.68 Billion in 2024

- The UK Frozen Dessert Market Size is Expected to Grow at a CAGR of around 5.24% from 2025 to 2035

- The UK Frozen Dessert Market Size is Expected to Reach USD 9.96 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The UK Frozen Dessert Market Size is anticipated to reach USD 9.96 Billion by 2035, growing at a CAGR of 5.24% from 2025 to 2035. Growing demand for convenient, premium, and health-conscious dessert options is driving the UK frozen dessert market. Increased online shopping, seasonal consumption, and interest in artisanal, plant-based products also contribute to market growth.

Market Overview

The UK frozen dessert market includes the sector that produces and distributes a range of cold, sugary delicacies that are eaten frozen. Frozen desserts are made with dairy products, semi-solids, freezing liquids, vegetable fats, and a mixture of dry fruits. To help with healthier digestion, consumers like to have frozen dessert goods after meals. The market is growing as a result of changing consumer tastes and preferences, changes in income, changes in the weather, and the launch of new flavour items. As health-conscious consumers look for non-dairy, low-fat, and low-sugar solutions, manufacturers are coming up with new flavours and premium ingredients. Sustainability considerations are also influencing packaging and sourcing tactics, while advancements in freezing and production technologies enhance product quality. The market's expansion is further aided by the simplicity of incorporating frozen desserts into a range of drinks and desserts or using them as standalone treats. Consumers are consuming more meals prepared with natural ingredients as a result of increased health and nutritional concerns caused by obesity and diabetes. In response to the growing customer demand for fat- and sugar-free frozen desserts, major firms have invested much in research and development to produce products with natural ingredients and flavours.

Manufacturers were further encouraged by consumers' willingness to spend extra for frozen desserts improved with natural ingredients and their growing disposable income. The demand for convenience, superior quality, and health-conscious options is propelling the UK frozen dessert market's rapid evolution. Customers want single-serve formats, genuine flavours, and online accessibility in artisanal products. By providing upscale, gourmet delights, businesses can profit from this trend and encourage investment and innovation.

Report Coverage

This research report categorizes the market for the UK frozen dessert market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom frozen dessert market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom frozen dessert market.

United Kingdom Frozen Dessert Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.68 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.24% |

| 2035 Value Projection: | USD 9.96 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 267 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Product Type and By Category |

| Companies covered:: | Wall’s, Paddle Pop, Dairy Crest, Nestle, Ben and Jerry’s, Friskies, Haagen-Dazs, Lotte Confectionery, Breyers, Sundae Times, Mars, Movenpick, Unilever, General Mills, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for high-end, artisanal items made with natural ingredients and fewer additives is fuelling the UK frozen dessert market's rapid expansion. Growing health consciousness is reflected increase in demand for branded and organic products. The growth of internet retail, as evidenced by an increase in online food sales, has made a variety of frozen dessert options more accessible and supported niche and creative brands. The demand for low-sugar, dairy-free, and functional choices is being driven by health trends and government sugar-reduction programs. Furthermore, sales are boosted by occasion-based and seasonal consumption, especially during the summer and holidays, which encourages manufacturers to introduce limited-edition flavours and take advantage of celebratory consumer behaviour.

Restraining Factors

The frozen dessert market in the UK is hindered by several factors. The main ones are health issues with the high sugar and fat content, which make people look for healthier substitutes or cut back on their intake of conventional frozen treats. Challenges are also presented by the emergence of new competitors and competition from substitute items. Further impeding market expansion are rising prices and the belief that frozen meals are not as good as fresh ones. These factors hamper the frozen dessert market during the forecast period.

Market Segmentation

The United Kingdom Frozen Dessert Market Share is classified into product type and category

- The ice cream segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom frozen dessert market is segmented by product type into ice cream, yogurts, cakes, and others. Among these, the ice cream segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Demand for the ice cream class is predicted to rise significantly as a result of shifting consumer preferences towards decadent desserts, flavour profile advancements, and growing acceptance of premium-grade light products. Due to its global acceptance, the ice cream category today controls a large portion of the frozen dessert market.

- The conventional segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom frozen dessert market is segmented by category into conventional, sugar-free. Among these, the conventional segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The Conventional sector, which is distinguished by its rich flavours and textures, is still in the lead since traditional dessert enthusiasts find it to be very appealing. Due to the ease of marketing standard frozen desserts, the fact that consumers are accustomed to classic flavours, and the constant need for rich, decadent-tasting sweets, the conventional segment will hold the largest share.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom frozen dessert market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Wall's

- Paddle Pop

- Dairy Crest

- Nestle

- Ben and Jerry's

- Friskies

- Haagen-Dazs

- Lotte Confectionery

- Breyers

- Sundae Times

- Mars

- Movenpick

- Unilever

- General Mills

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom frozen dessert market based on the below-mentioned segments:

United Kingdom Frozen Dessert Market, By Product Type

- Ice Cream

- Yogurts

- Cakes

- Others

United Kingdom Frozen Dessert Market, By Category

- Conventional

- Sugar-Free

Need help to buy this report?