United Kingdom Fresh Processed Meat Product Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fresh Meat, Poultry, Seafood, and Others), By Application (Home Cooking, Foodservice, Ready-to-Eat Meals, Pet Food, and Others), and United Kingdom Fresh Processed Meat Product Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Fresh Processed Meat Product Market Insights Forecasts to 2035

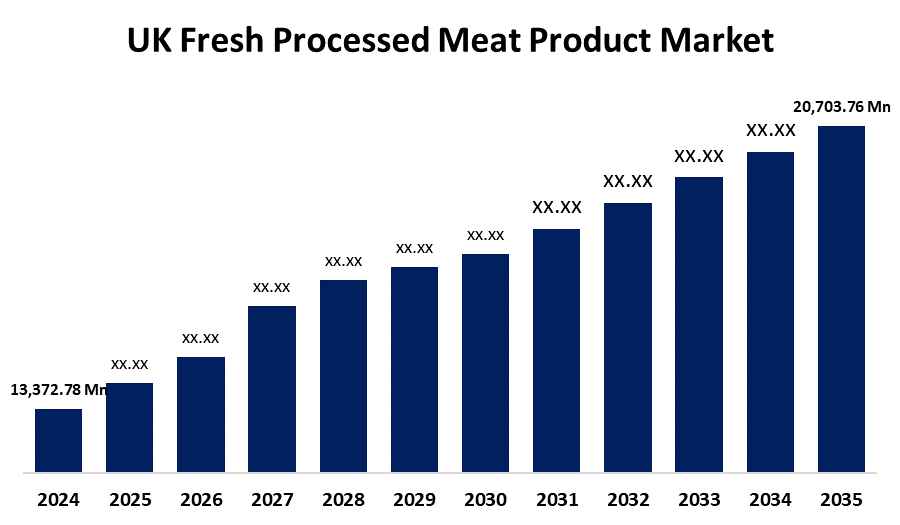

- The United Kingdom Fresh Processed Meat Product Market Size Was Estimated at USD 13,372.78 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.05% from 2025 to 2035

- The United Kingdom Fresh Processed Meat Product Market Size is Expected to Reach USD 20,703.76 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Fresh Processed Meat Product Market Size is anticipated to reach USD 20,703.76 Million by 2035, growing at a CAGR of 4.05% from 2025 to 2035. The increasing urbanization, developing retail channels, growing customer demand for rapid and ready-to-eat foods, and ongoing developments in meat processing technology that improve product flavor and shelf life.

Market Overview

The United Kingdom fresh processed meat product market refers to the industry involved in the production, packaging, and distribution of fresh meat products that have been processed for convenience, flavor, or preservation. This includes goods like marinated meats, bacon, and sausages. These products are not frozen; however, they do go through some little processing, such as curing or seasoning. Consumer interest for premium meat with a long shelf life that is easy to cook is reflected in the market. The increasing demand for protein choices that are convenient to prepare. Low-fat, organic, and preservative-free product innovation is being driven by health-conscious consumers. Premium supermarkets and internet grocery stores are two examples of growing retail channels that aid in market expansion. Additionally, there is potential for differentiation and brand loyalty due to the growing interest in ethically produced and locally sourced meats, especially among consumers who are concerned with quality and the environment. The development healthier alternatives with fewer components of fat, salt, and preservatives. Additionally, businesses are launching new flavors, plant-based blends, and packaging that is environmentally friendly. Technological developments in processing extend shelf life and enhance quality, meeting changing consumer demands for sustainability, convenience, and nutrient content.

Report Coverage

This research report categorizes the market for the United Kingdom fresh processed meat product market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom fresh processed meat product market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom fresh processed meat product market.

United Kingdom Fresh Processed Meat Product Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 13,372.78 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.05% |

| 2035 Value Projection: | USD 20,703.76 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 234 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product Type and By Application |

| Companies covered:: | Westfleisch SCE, JBS, Cargill, The BRF Group (UK Division), Hormel Foods Corporation, Smithfield Foods, Maple Leaf Foods, ConAgra Brands, Oscar Mayer (Kraft Heinz Company), Pilgrim’s Pride Corporation, Perdue Farms (Perdue Foods), and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased consumption of meat as an essential source of protein and increasing awareness of diets high in protein also support market expansion. Additionally, consumers who are concerned about their health are being drawn to new product developments including clean-label meats, organic alternatives, and healthier alternatives. These products have become readily accessible because to growing retail channels including supermarkets and internet sites. Demand is also fueled by shifting lifestyles, more disposable incomes, and a desire for tasty, pre-marinated meats. Consumer purchase decisions are becoming more and more affected by marketing methods that emphasize ethical sources and sustainability.

Restraining Factors

The consumer trust is hampered by illnesses linked to processed meats, such as heart disease and cancer. Market perception is impacted by environmental issues surrounding the production of beef. Particularly for small and mid-sized meat processing businesses, high production costs, supply chain interruptions, and demanding regulatory requirements further impede growth and innovation.

Market Segmentation

The United Kingdom Fresh Processed Meat Product Market share is classified into product type and application.

- The fresh meat segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom fresh processed meat product market is segmented by product type into fresh meat, poultry, seafood, and others. Among these, the fresh meat segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to its use in common meals, a growing need for diets substantial in protein, and consumer preference for foods with minimal processing. Cultural eating customs and growing knowledge of its nutritional benefits are additional elements contributing to its attraction.

- The home cooking segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom fresh processed meat product market is segmented by application into home cooking, foodservice, ready-to-eat meals, pet food, and others. Among these, the home cooking segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by growing as more customers place greater emphasis on dining at home and are seeking fresh, high-quality products. The use of fresh processed meats in home kitchens is also encouraged by cost-effectiveness, health consciousness, and the popularity of online recipes and cooking shows.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom fresh processed meat product market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Westfleisch SCE

- JBS

- Cargill

- The BRF Group (UK Division)

- Hormel Foods Corporation

- Smithfield Foods

- Maple Leaf Foods

- ConAgra Brands

- Oscar Mayer (Kraft Heinz Company)

- Pilgrim’s Pride Corporation

- Perdue Farms (Perdue Foods)

- Others.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom fresh processed meat product market based on the below-mentioned segments:

United Kingdom Fresh Processed Meat Product Market, By Product Type

- Fresh Meat

- Poultry

- Seafood

- Others

United Kingdom Fresh Processed Meat Product Market, By Application

- Home Cooking

- Foodservice

- Ready-to-Eat Meals

- Pet Food

- Others

Need help to buy this report?