United Kingdom Fresh Fish Market Size, Share, and COVID-19 Impact Analysis, By Product (Pelagic Fish, Demersal Fish), By Form (Fresh, Frozen), and United Kingdom Fresh Fish Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Fresh Fish Market Insights Forecasts to 2035

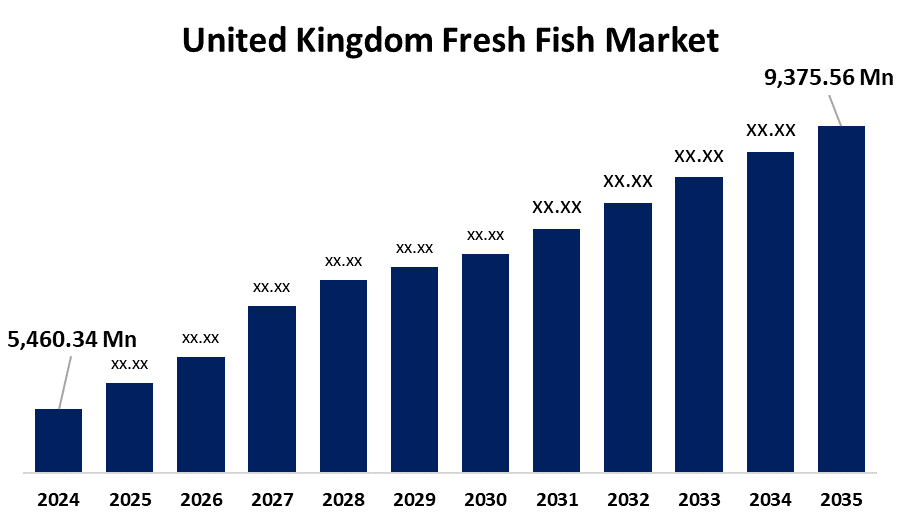

- The United Kingdom Fresh Fish Market Size was estimated at USD 5,460.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.04% from 2025 to 2035

- The United Kingdom Fresh Fish Market Size is Expected to Reach USD 9,375.56 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Fresh Fish Market Size is anticipated to reach USD 9,375.56 Million by 2035, growing at a CAGR of 5.04% from 2025 to 2035. The sector is growing and becoming more competitive locally and internationally, with an evolving UK fish market share situation due to developments in logistics for cold chains and potential for export.

Market Overview

The United Kingdom fresh fish market refers to the business focused on the trade, shipment, and selling of raw seafood and fish that is caught or harvested from rivers, lakes, seas, or aquaculture farms and delivered to market without undergoing extensive processing. The most common ways to purchase fresh fish are whole, filleted, or as other seafood products, including shellfish, steaks, or fillets. The excellent taste, texture, and nutritional value of this kind of fish are prized across the country as a main food ingredient. Fresh fish can have its shelf life prolonged while maintaining its freshness by freezing it, which makes it more accessible for extended periods and easier to transfer between locations. Consumer preferences in the UK's fresh fish industry have changed significantly in recent years, with a noticeable shift towards healthier eating practices. The coastline of the United Kingdom also offers a wealth of marine resources, which promotes a culture of support for regional fisheries and environmentally friendly fishing methods. Fresh fish is always in high demand since seafood is widely acknowledged as an essential part of the traditional British diet, particularly in the form of well-known dishes like fish and chips.

Report Coverage

This research report categorizes the market for the United Kingdom fresh fish market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom fresh fish market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom fresh fish market.

United Kingdom Fresh Fish Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5,460.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.04% |

| 2035 Value Projection: | USD 9,375.56 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 214 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product (Pelagic Fish, Demersal Fish), By Form (Fresh, Frozen) |

| Companies covered:: | Direct Seafoods, South Bank Fresh Fish & Frozen Foods, Pescafish Ltd, Copernus Ltd, A M Seafoods Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom fresh fish is influenced by the country's growing consumer demand, superior aquaculture techniques, and federal support for fishery expansion. Further driving the industry are rising health consciousness and the desire for diets high in protein. The main forces behind the expansion are technological innovation, with the utilization of cutting-edge technologies, such as genetic breeding techniques, automated feeding systems, and water quality monitoring apparatus, for profitability. Farmers and aquaculture producers can estimate market demand and better manage inventories through the application of artificial intelligence (AI) and data analytics. The fresh fish market has also been driven by culinary trends and cultural influences over the years. Fresh seafood dishes are more popular as cuisines mix and change, so there is a higher demand for high-quality seafood. Fresh fish marketplaces are well-positioned to take advantage of consumers' desire to improve their home dining experiences by highlighting freshness and diversity as crucial elements of contemporary cuisine.

Restraining Factors

The market expansion should suffer several problems, such as the increasing environmental concern about habitat destruction and overfishing with unsustainable fishing methods. Moreover, upsetting marine ecosystems and biodiversity due to pollution caused by fishing methods harms coastal habitats, such as wetlands and coral reefs, which serve as vital habitats for fish shelter and reproduction. In addition to the delay in inception due to stringent government laws and international attention sank the market evolutions.

Market Segmentation

The United Kingdom fresh fish market share is classified into product and form.

- The pelagic fish segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United Kingdom fresh fish market is segmented by product into pelagic fish, and demersal fish. Among these, the pelagic fish segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. The growing consumer need for the nutritional advantages of eating fish, especially omega-3 fatty acids found in species like mackerel, sardines, and herring, boosts the pelagic fish segment expansion. Consumers' growing interest in health and wellbeing has increased demand for pelagic fish because they are thought to be healthier substitutes for processed foods and red meat.

- The frozen segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom fresh fish market is classified by form into fresh, and frozen. Among these, the frozen segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is because the growing demand for longer-lasting products that minimize food waste in homes and businesses is one of the main factors driving demand. Fish's texture and nutritional content are preserved by advances in freezing technology, like flash freezing, which makes frozen choices desirable to customers and retailers, and drives the segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom fresh fish market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Direct Seafoods

- South Bank Fresh Fish & Frozen Foods

- Pescafish Ltd

- Copernus Ltd

- A M Seafoods Ltd

- Others

Recent Developments:

- In October 2024, Polish salmon producer Suempol acquired Copernus Ltd, a UK-based fresh fish supplier. This strategic move strengthened Suempol’s presence in the European seafood market and expanded its product range beyond smoked salmon to include species like cod and haddock.

- In April 2024, Trinity Seafoods Ltd was a newly established whitefish processing company in Scotland, formed through a collaboration between Denholm Seafoods, The Don Fishing Company, and Seafood Ecosse. The company focused on processing smaller-sized and underutilized stocks of whitefish, such as haddock, using state-of-the-art automated technology.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom fresh fish market based on the below-mentioned segments:

United Kingdom Fresh Fish Market, By Product

- Pelagic Fish

- Demersal Fish

United Kingdom Fresh Fish Market, By Form

- Fresh

- Frozen

Need help to buy this report?