United Kingdom Food Spreads Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Fruit-based Spreads and Honey), By Consumer Segment (Household Consumers and Industrial Users), and United Kingdom Food Spreads Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Food Spreads Market Insights Forecasts to 2035

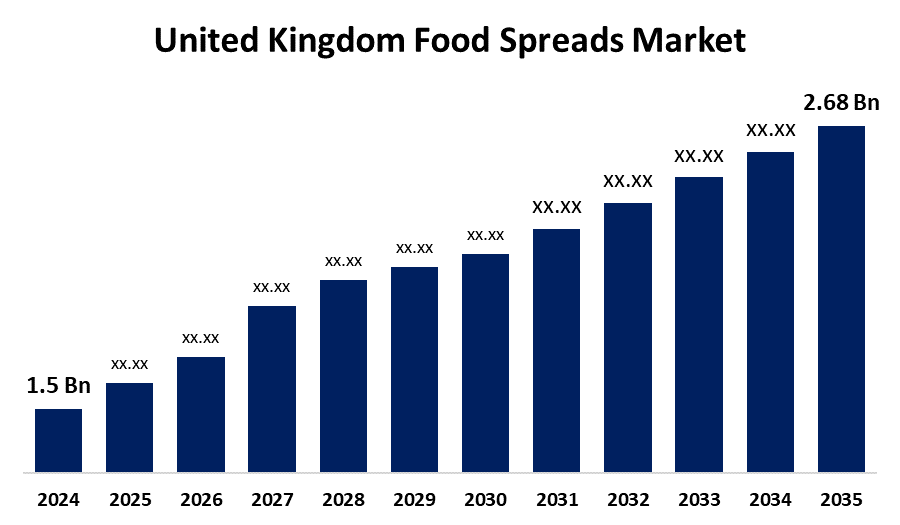

- The United Kingdom Food Spreads Market Size Was Estimated at USD 1.5 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.42% from 2025 to 2035

- The United Kingdom Food Spreads Market Size is Expected to Reach USD 2.68 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Food Spreads Market Size is anticipated to reach USD 2.68 Billion by 2035, growing at a CAGR of 5.42% from 2025 to 2035. The increasing demand from consumers for rapid and wholesome breakfast options, a growing inclination toward natural and organic ingredients, and innovative flavor and packaging that suits time-pressed and health-conscious lives.

Market Overview

The United Kingdom food spreads market refers to the industry focused on the manufacturing, marketing, and distribution of spreadable food items, including dairy-based spreads, jams, jellies, nut butters, marmalades, honey, and chocolate spreads. Consumer demand for diversity, health-conscious options, and innovative flavors shapes the market for these items, which are frequently utilized for daily meals and snacks. Increasing need for low-sugar, organic, and healthful substitutes. There is also potential for innovation given the growing customer demand for plant-based and allergy-free spreads. Convenient single-serve packaging and high-end, artisanal products are also becoming more and more popular, allowing firms to reach a wider audience and accommodate changing lifestyles. The development of organic, plant-based, and fortified spreads that include extra health advantages, such as superfoods and probiotics. In order to satisfy consumer demand for more varied, eco-friendly, and healthful spread options, brands are experimenting with novel tastes, sustainable packaging, and sugar-reduction strategies.

Report Coverage

This research report categorizes the market for the United Kingdom food spreads market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom food spreads market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom food spreads market.

United Kingdom Food Spreads Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.5 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.42% |

| 2035 Value Projection: | USD 2.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 277 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Product Type and By Consumer Segment |

| Companies covered:: | Stute Foods, Nestle SA, The J.M. Smucker Company, Fabulous, Unilever Plc, Ferrero International SA, Bonne Maman, Upfield Holdings B V, British Corner Shop, Hain Celestial Group, Sioux Honey Association Co-op, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing consumer health consciousness is driving up demand for low-sugar, natural, and organic spread options. The popularity of ready-to-eat spreads has increased due to consumers' growing need for rapid breakfast and snack options. Innovation in dairy-free and nut-based spreads is also being aided by increased awareness of plant-based diets and vegan lifestyles. Packaging innovations that improve convenience and shelf life, such as resealable and single-serve alternatives, also contribute to the market. Additionally, a wider range of consumers is being drawn in, and sustained market growth is being supported by product diversification with distinctive flavors and health-promoting ingredients like omega-3s and superfoods.

Restraining Factors

The medical concerns relating to conventional spreads' excessive fat and sugar content. The demand for traditional spread goods is also decreased by regulatory limitations, high raw material costs, and fierce competition from plant-based or healthier substitutes.

Market Segmentation

The United Kingdom food spreads market share is classified into product type and consumer segment.

- The honey segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom food spreads market is segmented by product type into fruit-based spreads and honey. Among these, the honey segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing consumer demand for natural sweeteners, luxurious artisanal and single-origin blends, environmentally friendly beekeeping methods, adaptable applications, and increased accessibility via sales via the internet. In the food spreads market in the UK, it continues to be the largest segment.

- The household consumers segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom food spreads market is segmented by consumer segment into household consumers and industrial users. Among these, the household consumers segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because increasing demand for meals prepared at home and desire in rapid wholesome meal options. Leading firms' effective advertising efforts increase brand loyalty, and the UK food spreads industry continues to grow due to steady consumption trends and changing dietary preferences.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom food spreads market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stute Foods

- Nestle SA

- The J.M. Smucker Company

- Fabulous

- Unilever Plc

- Ferrero International SA

- Bonne Maman

- Upfield Holdings B V

- British Corner Shop

- Hain Celestial Group

- Sioux Honey Association Co-op

- Others.

Recent Developments:

- In July 2021, Unilever announced a £75 million expansion of its spread production facility in Port Sunlight, England, emphasizing its commitment to innovation and meeting the growing demand for diverse spread options.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom food spreads market based on the below-mentioned segments:

United Kingdom Food Spreads Market, By Product Type

- Fruit-based Spreads

- Honey

United Kingdom Food Spreads Market, By Consumer Segment

- Household Consumers

- Industrial Users

Need help to buy this report?