United Kingdom Food Preservatives Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural and Synthetic), By Application (Beverage, Dairy & Frozen Product, Bakery, and Meat), and United Kingdom Food Preservatives Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Food Preservatives Market Insights Forecasts to 2035

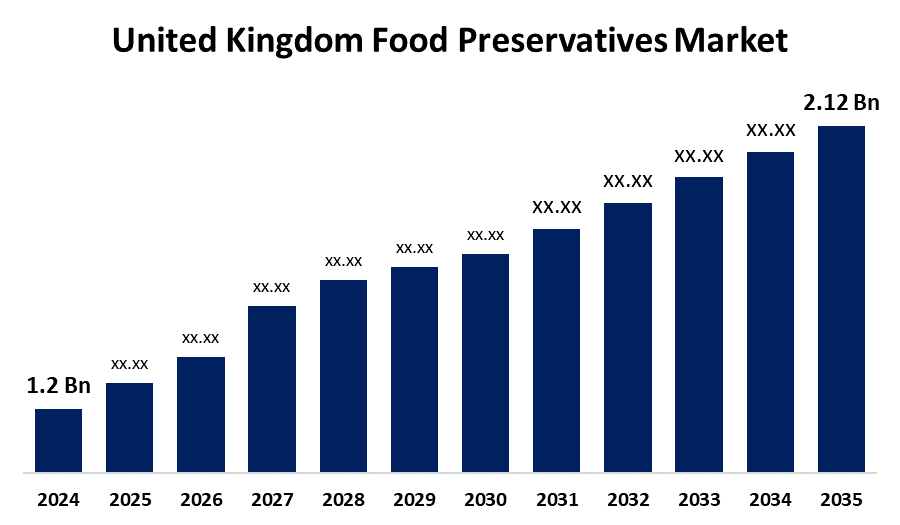

- The United Kingdom Food Preservatives Market Size Was Estimated at USD 1.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.31% from 2025 to 2035

- The United Kingdom Food Preservatives Market Size is Expected to Reach USD 2.12 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Food Preservatives Market Size is Anticipated to reach USD 2.12 Billion By 2035, Growing at a CAGR of 5.31% from 2025 to 2035. The growing consumer awareness of food safety, the necessity of extending shelf life, and the need for packaged and processed goods. The demand for preserved food products is further increased by urbanization and hectic schedules.

Market Overview

The United Kingdom food preservatives market refers to the industry involved in the manufacturing, distribution, and application of natural or chemical additives to food goods in order to preserve quality, increase shelf life, and stop spoiling. By preventing oxidation, microbial development, and other food deterioration processes, these preservatives assist manufacturers and customers ensure food safety and extended preservation. The growing consumer awareness of food safety, an increased focus on minimizing food waste, and a growth in the demand for packaged and processed meals. The move to clean-label and natural preservatives gives producers an opportunity to be creative and satisfy consumers who are concerned concerning their health. Furthermore, growing food product exports and improvements in preservation technologies expand potential markets across a range of industries. The development of plant-based and natural preservatives to fulfill clean-label requirements. In response to consumer demand for healthier food options, businesses are investigating fermentation-derived chemicals, bio-preservation, and antimicrobial peptides to extend shelf life while preserving nutritional content, safety, and flavor.

Report Coverage

This research report categorizes the market for the United Kingdom food preservatives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom food preservatives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom food preservatives market.

United Kingdom Food Preservatives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.31% |

| 2035 Value Projection: | USD 2.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Cargill Incorporated, Corbion N.V., Tate & Lyle PLC, Kerry Group plc, Koninklijke DSM N.V, DSM, IFF, Kemin Industries, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market is expanding as a result of growing consumer awareness of food safety, shelf-life extension, and microbial contamination prevention. In accordance with health-conscious tendencies, the move toward clean-label and organic products also promotes the creation of natural preservatives. The availability and diversity of preserved food products are being improved by the growing retail and e-commerce industries as well as developments in food technology. Growing R&D expenditures and regulatory backing for the safe use of additives are further factors supporting market expansion.

Restraining Factors

The consumer concerns regarding artificial preservatives' effects on health. Strict labeling laws and government regulations, in addition to consumer demand for organic and clean-label foods, restrict the use of artificial additives and force manufacturers to provide safe, natural alternatives.

Market Segmentation

The United Kingdom Food Preservatives Market share is classified into type and application.

- The natural segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom food preservatives market is segmented by type into natural and synthetic. Among these, the natural segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to enhanced health understanding and an increased need for clean-label items. Consumers are choosing foods with fewer artificial ingredients, which is consistent with healthy lifestyles and perceived safety, leading to a rise in the usage of plant-based and organic preservatives.

- The beverage segment accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom food preservatives market is segmented by application into beverage, dairy & frozen product, bakery, and meat. Among these, the beverage segment accounted for the highest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the increased demand for packaged and ready-to-drink beverages with a lengthy shelf life. Preservatives are necessary because consumers demand ease, flavor stability, and product safety. The market for beverage preservatives is expected to increase steadily due to this need in addition to advancements in flavored and functional drinks.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom food preservatives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill Incorporated

- Corbion N.V.

- Tate & Lyle PLC

- Kerry Group plc

- Koninklijke DSM N.V

- DSM

- IFF

- Kemin Industries

- Others.

Recent Developments:

- In July 2022, Kemin Industries launched RUBINITE GC Dry, a natural alternative to sodium nitrite used as a curing agent in processed meats. This product provides microbiological safety and stability without synthetic additives.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom food preservatives market based on the below-mentioned segments

United Kingdom Food Preservatives Market, By Type

- Natural

- Synthetic

United Kingdom Food Preservatives Market, By Application

- Beverage

- Dairy & Frozen Product

- Bakery

- Meat

Need help to buy this report?