United Kingdom Food Colors Market Size, Share, and COVID-19 Impact Analysis, By Type (Natural, Synthetic, Naturally-identical, Caramel, and Others), By Source (Plant and Animal, Chemicals, and Others), By Application (Processed Foods and Beverages), and UK Food Colors Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Food Colors Market Forecasts to 2035

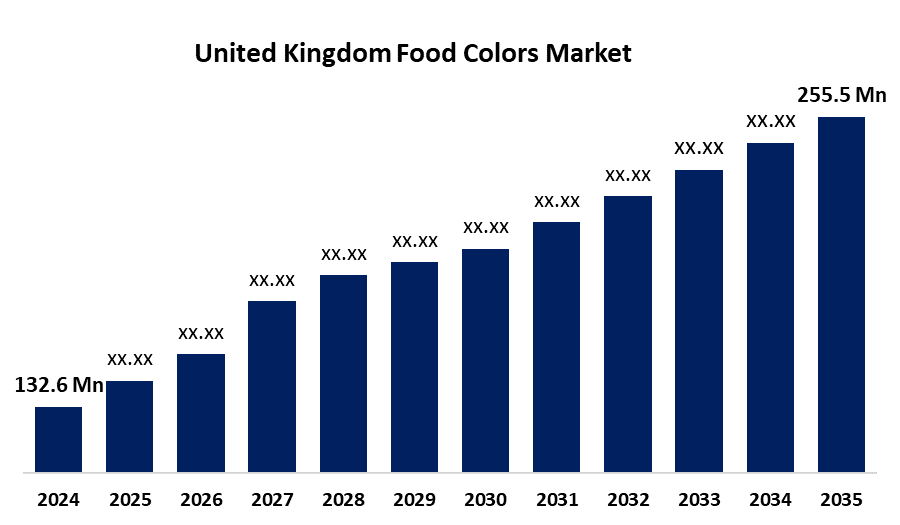

- The United Kingdom Food Colors Market Size Was Estimated at USD 132.6 Million in 2024

- The UK Food Colors Size is Expected to Grow at a CAGR of around 6.14% from 2025 to 2035

- The UK Food Colors Market Size is Expected to Reach USD 255.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Food Colors Market is anticipated to reach USD 255.5 million by 2035, growing at a CAGR of 6.14% from 2025 to 2035. The growing consumer inclination toward natural and organic colors, coupled with the rising demand in the processed and convenience food sectors, advancements in color extraction and stabilization technologies, stricter regulations on synthetic dyes, expansion of food and beverage (F&B) market, and the broadening range of applications for food colors are collectively driving the market.

Market Overview

The United Kingdom food colors market includes colored supply and demand in the market that is used to increase or restore the color of food products and beverages. Food colors are additives used in food and drinks to enhance their appearance and make them more attractive. These colors can be either natural sourced from plants or minerals or synthetic, created through chemical processes. They are widely used in processed foods to create appealing visuals and maintain uniformity between batches. There is a growing trend toward natural food colorants, as more consumers prefer healthier choices. These natural options not only add color but can also offer health benefits, such as the antioxidant properties found in ingredients like beetroot and turmeric. As a result, they contribute both to the visual appeal and the nutritional value of food. Food colorants have a wide range of uses across the food industry. In bakery items, they enhance the appearance of products like cakes and pastries. They are usually used to provide vivid colors to soda and juice in beverages, and to add the eyes catching colors to sweets and chocolate to confectionery products. The market is inspired by the demand for clean label material, as consumers are clearly moving away from products with synthetic additives in favor of those created with natural, chemical free components. This change is clearly the result of consumers being more aware of various health risks that make these artificial chemicals compared to the materials arising from plants. Many food and beverage growers have integrated the production and use of clean-labeled components in their finished food products as a result of this remarkable customer change.

The increase in processed food and intake of beverages has inspired manufacturers to use attractive colors on their products to make them visually appealing to attract more customers and thus, increased the demand for food colors in the UK. Additionally, a change in artificial to natural colors from fruits, vegetables, and spices is a growing trend in the food colors industry.

Report Coverage

This research report categorizes the market for the UK food colors market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom food colors market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK food colors market.

United Kingdom Food Colors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 132.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.14% |

| 2035 Value Projection: | USD 255.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 103 |

| Segments covered: | By Type, By Source, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Koninklijke DSM N.V., BASF SE, Chr. Hansen A/S, Sensient Technologies, Dohler Group, D.D. Williamson & Co, Givaudan (Naturex), Bond of Colours, Biocon Colors, Tate & Lyle, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The growing consumption of processed foods and beverages, especially soft drinks, is driving demand for food colors to enhance product appeal. At the same time, increasing consumer awareness about the health risks of synthetic colors is boosting the popularity of natural, plant-based colorants, creating new growth opportunities in the food colors market. Enhancing product appeal has emerged as a crucial driver in the food colors market. With the rise of social media platforms such as YouTube and Instagram, the visual distinction of products plays a significant role in consumer preference. Color serves as an essential element for manufacturers, as visually attractive products tend to draw more consumers.

Restraining Factors

Synthetic food dye has been associated with carcinogens and allergic reactions. To overcome these concerns, strict rules have been established by international governing bodies. Artificial colors have been found to be harmful carcinogenic substances that can increase the risk of cancer with frequent consumption. U.K. Research conducted by the government found that consuming artificial colors can cause over -activation in children between 8 and 9 years of age. Caffeine, a common ingredient in soft drinks, may also lead to heart-related problems like palpitations. These factors hampered the UK food colors market during forecast period.

Market Segmentation

The United Kingdom food colors market share is classified into by type, source and application.

- The natural segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK food colors market is segmented by type into natural, synthetic, naturally-identical, caramel, and others. Among these, the natural segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This growth is being given fuel by increasing consumer preference for organic and clean label products. An increased awareness about health and concerns on synthetic dyes potentially known to trigger allergic reactions is also contributing to the trend. Additionally, progress in biotechnology supports the expansion of this segment. Their technology aims to change traditional agricultural-based methods with more durable practices, which meet the high demand for natural colors in UK market.

- The plant and animal segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK food colors market is segmented by source into plant and animal, chemicals, and others. Among these, the plant and animal segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Rising consumer awareness about natural colorants is anticipated to drive demand for plant- and animal-based sources. In addition to these, certain microorganisms also serve as natural food colorants by producing compounds like canthaxanthin, astaxanthin, and phycocyanin. These natural pigments are also utilized in the pharmaceutical industry due to their safety for consumption. However, the production and application of these natural color sources tend to be costly, contributing to their high market value.

- The processed foods segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK food colors market is segmented by application into processed foods and beverages. Among these, the processed foods segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Driven by the high demand for ready-to-eat snacks and convenience foods in developed markets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK food colors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- Koninklijke DSM N.V.

- BASF SE

- Chr. Hansen A/S

- Sensient Technologies

- Dohler Group

- D.D. Williamson & Co

- Givaudan (Naturex)

- Bond of Colours

- Biocon Colors

- Tate & Lyle

- Others

Recent Developments:

- In June 2024, The Tate & Lyle company announced a $1.8 billion acquisition of CP Kelco, a specialist in pectin and gums. This move is aimed at expanding its capabilities in natural, clean-label ingredients.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK food colors market based on the below-mentioned segments:

United Kingdom Food Colors Market, By Type

- Natural

- Synthetic

- Naturally-identical

- Caramel

- Others

United Kingdom Food Colors Market, By Source

- Plant and Animal

- Chemicals

- Others

United Kingdom Food Colors Market, By Application

- Processed Foods

- Beverages

Need help to buy this report?