United Kingdom Food Additives Market Size, Share, and COVID-19 Impact Analysis, By Product (Flavors & Enhancers, Sweeteners, Enzymes, Emulsifiers, Shelf-life Stabilizers, Fat Replacers, Prebiotics, Probiotics, Dietary Fibers, and Others), By Source (Natural and Synthetic), By Application (Bakery & Confectionery, Beverages, Convenience Foods, Dairy & Frozen Desserts, Spices, Condiments, Sauces & Dressings, and Other Applications), and United Kingdom Food Additives Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited Kingdom Food Additives Market Insights Forecasts to 2033

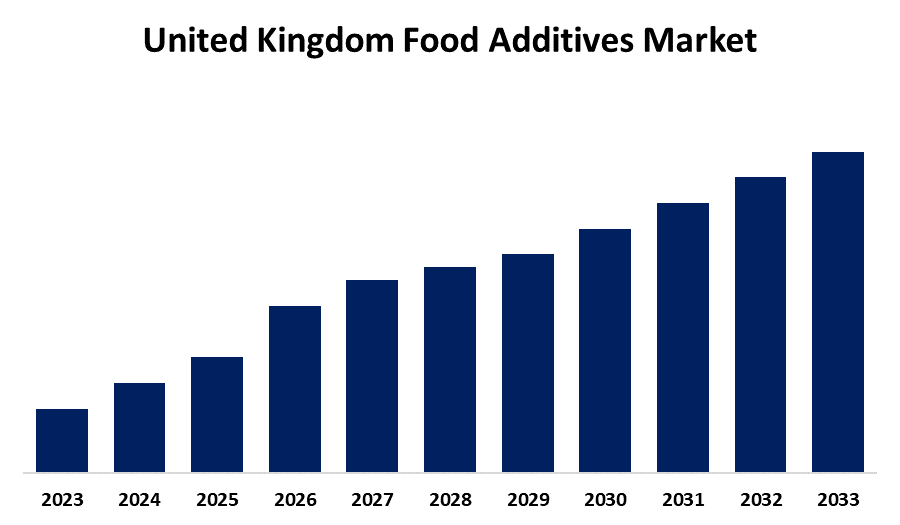

- The United Kingdom Food Additives Market Size is Growing at a CAGR of 3.01% during the forecast period 2023 to 2033

- The United Kingdom Food Additives Market Size is anticipated to hold a significant share by 2033

Get more details on this report -

The United Kingdom Food Additives Market Size is anticipated to hold a significant share by 2033, Growing at a CAGR of 3.01% from 2023 to 2033. The increasing consumer demand for convenient & processed food and the rise of shelf-stable products are driving the growth of the food additives market in the UK.

Market Overview

The food additives market refers to the demand for edible substances added to food for enhancing or modifying various properties such as taste, texture, appearance, and shelf life. Food additives are added to the food during processing or preparation in order to alter its appearance, taste, texture, or other characteristics. They are also used to preserve flavour or enhance taste, appearance, or other sensory qualities of the food. Demand for processed and convenient foods leads to the demand for food additives in order to enhance products' longer shelf life, enhanced taste, and appealing visual attributes. A rise in plant-based food consumption is offering opportunities for innovation in the food additives sector. Plant-based alternatives, especially in categories such as emulsifiers, stabilizers, and protein-based ingredients, are developed by manufacturers. Furthermore, the demand for natural and organic additives, plant-based food additives growth along the growing health consciousness among consumers are escalating the market growth opportunities.

Report Coverage

This research report categorizes the market for the UK food additives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom food additives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK food additives market.

United Kingdom Food Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 3.01% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Product, By Source, By Application |

| Companies covered:: | BASF SE, Cargill Incorporated, DuPont de Nemours Inc., Kerry Group PLC, Ingredion Incorporated, Archer Daniels Midland Company, Tate & Lyle PLC, Corbion NV, Roquette Freres, International Flavors and Fragrances Inc., Givaudan SA, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The shifting consumer inclination towards processed & convenience foods, with the upsurging development of food processing technologies, is contributing to driving the food additives market as these additives aid in enhancing the safety, shelf life, and sensory properties of these food products. The increasing consumer health awareness about food additive chemicals, along with the rising focus on natural and simple ingredients, is propelling the market expansion.

Restraining Factors

The strict regulations associated with the food additives, fluctuation in raw material prices, and consumer demand for natural & clean-label alternatives are challenging the food additives market.

Market Segmentation

The United Kingdom Food Additives Market share is classified into product, source, and application.

- The sweeteners segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom food additives market is segmented by product into flavors & enhancers, sweeteners, enzymes, emulsifiers, shelf-life stabilizers, fat replacers, prebiotics, probiotics, dietary fibers, and others. Among these, the sweeteners segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period. There is an increasing demand for high fructose corn syrup due to the demand for sweet products like confections and soft drinks. The surging preferences for natural and zero-calorie sweeteners, like stevia, along with the rising prevalence of obesity, are contributing to the market growth in the sweeteners segment.

- The natural segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom food additives market is segmented by source into natural and synthetic. Among these, the natural segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period. The source of natural food additives is dietary fibers that are derived from fruit peels. The growing demand for vegan food products and clean-label and healthier food products is propelling the market in the natural segment.

- The bakery & confectionery segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period.

The United Kingdom food additives market is segmented by application into bakery & confectionery, beverages, convenience foods, dairy & frozen desserts, spices, condiments, sauces & dressings, and other applications. Among these, the bakery & confectionery segment dominated the market with the largest revenue share in 2023 and is expected to grow at a significant CAGR during the projected period. Food additives are used in bakery and confectionery production for enhancing the quality, extend shelf life, and improving the sensory characteristics. The increasing use of products such as bread, cakes, biscuits, tortillas, and sugar & chocolate confections is driving the market demand.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. food additives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Cargill Incorporated

- DuPont de Nemours Inc.

- Kerry Group PLC

- Ingredion Incorporated

- Archer Daniels Midland Company

- Tate & Lyle PLC

- Corbion NV

- Roquette Freres

- International Flavors and Fragrances Inc.

- Givaudan SA

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In November 2022, Tate & Lyle PLC announced a new addition to its sweetener portfolio- ERYTESSE Erythritol. ERYTESSE Erythritol can be used in a range of categories, including beverages, dairy, bakery, and confectionery.

Market Segment

This study forecasts revenue at U.K., regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom Food Additives Market based on the below-mentioned segments:

UK Food Additives Market, By Product

- Flavors & Enhancers

- Sweeteners

- Enzymes

- Emulsifiers

- Shelf-life Stabilizers

- Fat Replacers

- Prebiotics

- Probiotics

- Dietary Fibers

- Others

UK Food Additives Market, By Source

- Natural

- Synthetic

UK Food Additives Market, By Application

- Bakery & Confectionery

- Beverages

- Convenience Foods

- Dairy & Frozen Desserts

- Spices

- Condiments

- Sauces & Dressings

- Other Applications

Need help to buy this report?