United Kingdom Fixed Connectivity Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Internet Access, Voice Services, Data Services, Managed Services, and Bundled Services), By Technology (Fiber Optic Broadband, DSL, Cable Broadband, Fixed Wireless Access, and Satellite Broadband), and United Kingdom Fixed Connectivity Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyUnited Kingdom Fixed Connectivity Market Insights Forecasts to 2035

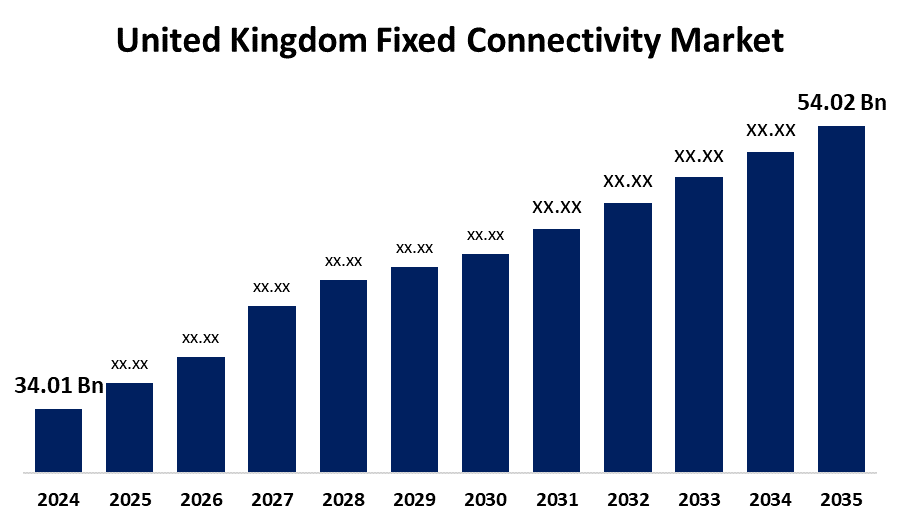

- The United Kingdom Fixed Connectivity Market Size Was Estimated at USD 34.01 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.30% from 2025 to 2035

- The United Kingdom Fixed Connectivity Market Size is Expected to Reach USD 54.02 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Fixed Connectivity Market Size is Anticipated to reach USD 54.02 Billion By 2035, Growing at a CAGR of 4.30% from 2025 to 2035. The increasing acceptance of digital services, the construction of fiber-optic infrastructure, the growing demand for high-speed internet, and the growing trends of online learning and remote work all underscore the need for dependable, stable, and fast connections.

Market Overview

The United Kingdom fixed connectivity market refers to the industry include the infrastructure and services that use tangible media like fiber-optic cables, DSL, and coaxial cables to deliver reliable, fast internet and communication. It meets the connectivity demands of homes, businesses, and industries throughout the United Kingdom. By providing dependable and consistent internet access for consumers and businesses across the country, this market is essential to the advancement of digital transformation, remote work, e-learning, and smart technologies. The increased enterprise demand for safe, lightning-fast connectivity, government-backed investments in digital infrastructure, and expanding fiber-to-the-home (FTTH) networks. Growing digital platform dependence and smart city initiatives also open up new avenues for collaboration and innovation in connection and network optimization services. The full-fiber (FTTP) network rollout, AI integration for network optimization, and SD-WAN technology adoption for enhanced performance. In both urban and rural regions, improvements in low-latency connectivity and green infrastructure solutions are also improving service sustainability, scalability, and efficiency.

Report Coverage

This research report categorizes the market for the United Kingdom fixed connectivity market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom fixed connectivity market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom fixed connectivity market.

United Kingdom Fixed Connectivity Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 34.01 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.30% |

| 2035 Value Projection: | USD 54.02 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Service Type, By Technology and COVID-19 Impact Analysis |

| Companies covered:: | BT Group, Virgin Media, Sky Group, TalkTalk, Vodafone Group, CityFibre, Hyperoptic, Openreach, KCOM Group, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for dependable, lightning-fast internet in the business, industrial, and residential sectors. Strong internet infrastructure is now more important than ever due to the increasing trend toward remote work, online learning, and digital entertainment. Full-fiber deployment is being accelerated by corporate investments in fiber-optic networks and government programs like Project Gigabit. Stable fixed-line connectivity is also necessary for the growth of cloud-based services, IoT devices, and smart homes. For operational efficiency, businesses are also giving low-latency, secure communication links top priority. All of these elements work together to support the UK's fixed connection infrastructure's steady expansion and upgrading.

Restraining Factors

The significant deployment costs for infrastructure, particularly in isolated or rural locations. Network expansion may be delayed by regulatory obstacles, sluggish planning approvals, and interruptions from active building projects. Furthermore, demand in some consumer and business categories may be constrained by competition from mobile broadband alternatives.

Market Segmentation

The United Kingdom fixed connectivity market share is classified into service type and technology.

- The internet access segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom fixed connectivity market is segmented by service type into internet access, voice services, data services, managed services, and bundled services. Among these, the internet access segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to rising demand in homes and companies for dependable, rapid internet. Growing demands for gaming, streaming, and remote work are driving growth, which is bolstered by government full-fiber plans and the widespread deployment of fiber internet.

- The fiber optic broadband segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom fixed connectivity market is segmented by technology into fiber optic broadband, DSL, cable broadband, fixed wireless access, and satellite broadband. Among these, the fiber optic broadband segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it provides the blazingly quick, dependable, and high-capacity internet that is necessary for bandwidth-intensive tasks like gaming, streaming, and remote work. Its dominance is further supported by government funding and the quick growth of fiber networks in cities.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom fixed connectivity market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BT Group

- Virgin Media

- Sky Group

- TalkTalk

- Vodafone Group

- CityFibre

- Hyperoptic

- Openreach

- KCOM Group

- Others.

Recent Developments:

- In May 2025, Carnival Internet UK, has launched, offering ultra-reliable, full-fiber broadband without hidden fees or mid-contract price increases. The service provides speeds ranging from 100Mbps to 900Mbps, with a choice of two different router.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom fixed connectivity market based on the below-mentioned segments

United Kingdom Fixed Connectivity Market, By Service Type

- Internet Access

- Voice Services

- Data Services

- Managed Services

- Bundled Services

United Kingdom Fixed Connectivity Market, By Technology

- Fiber Optic Broadband

- DSL

- Cable Broadband

- Fixed Wireless Access

- Satellite Broadband

Need help to buy this report?