United Kingdom Feminine Hygiene Products Market Size, Share, and COVID-19 Impact Analysis, By Type (Sanitary Napkins, Tampons, Panty Liners, Menstrual Cups, and Others), By Nature (Reusable and Disposable), and United Kingdom Feminine Hygiene Products Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Feminine Hygiene Products Market Insights Forecasts to 2035

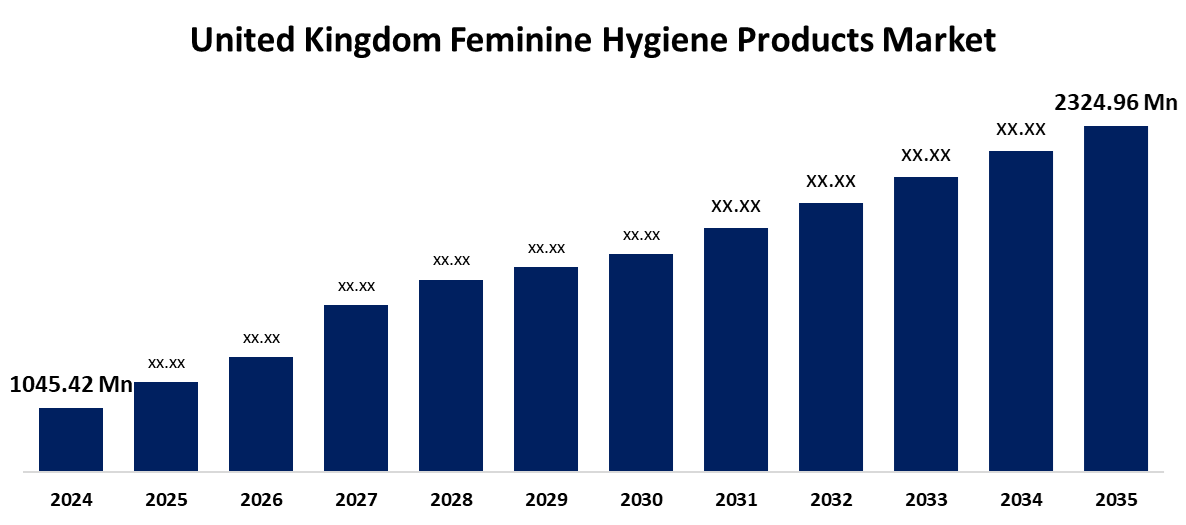

- The United Kingdom Feminine Hygiene Products Market Size Was Estimated at USD 1045.42 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.54% from 2025 to 2035

- The United Kingdom Feminine Hygiene Products Market Size is Expected to Reach USD 2324.96 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United Kingdom Feminine Hygiene Products Market Size is anticipated to reach USD 2324.96 Million by 2035, Growing at a CAGR of 7.54% from 2025 to 2035. The increased demand for sustainable and organic products, higher female employment participation, rising disposable incomes, and increasing awareness of menstruation health all of which are in accordance with customers' preferences for environmentally friendly and health-conscious products.

Market Overview

The United Kingdom Feminine Hygiene Products Market Size refers to the industry includes a number of personal care products made for assisting women with vaginal hygiene, menstruation health, and general intimate care. This includes menstruation cups, tampons, sanitary pads, wipes, intimate washes, and panty liners. Growing awareness, an increasing focus on women's health, rising disposable income, and the trend for organic, biodegradable, and environmentally friendly hygiene products are some of the drivers driving the industry. The increasing demand for organic and sustainable products, expanding knowledge of menstruation health, and rising female employment rates. More possibilities for discreet purchases and wider product accessibility are made possible by growing e-commerce platforms. The industry is also growing as a result of government and non-profit programs that encourage young girls to learn regarding menstruation and hygiene. Long-term value and consumer interest are also generated by innovative reusable items, including menstrual cups. The development of reusable menstruation cups, biodegradable sanitary pads, and chemical-free organic tampons. Modern consumers are able to experience greater convenience, sustainability, and individualized menstruation care with the emergence of smart hygiene products with improved absorption technology and app connectivity.

Report Coverage

This research report categorizes the market size for the United Kingdom feminine hygiene products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom feminine hygiene products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom feminine hygiene products market.

United Kingdom Feminine Hygiene Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1045.42 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.54% |

| 2035 Value Projection: | USD 2324.96 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Nature |

| Companies covered:: | Essity Aktiebolag, Kao Corporation, Daio Paper Corporation, Unicharm Corporation, Premier FMCG, Ontex, Hengan International Group Company Ltd, Drylock Technologies, Natracare LLC, First Quality Enterprises Inc, and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Increasing awareness of menstrual health and cleanliness, aided by government programs and educational campaigns that assist women's health. The need for practical and superior hygiene products has also increased as a result of women's increased employment and discretionary income. The trend toward organic and biodegradable products is being driven by the growing number of environmentally conscious consumers. Additionally, new product designs that accommodate shifting lifestyle preferences include reusable menstrual cups, ultra-thin pads, and leak-proof underwear. Expanding e-commerce further improves accessibility and provides brands access to a larger countrywide consumer base.

Restraining Factors

The high price of sustainable and high-end items, rendering them inaccessible for those with modest incomes. Furthermore, in some communities, cultural taboos and ignorance impede candid conversations and acceptance, which limits the uptake of products and market penetration in specific populations.

Market Segmentation

The United Kingdom feminine hygiene products market share is classified into type and nature.

- The sanitary napkins segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom feminine hygiene products market is segmented by type into sanitary napkins, tampons, panty liners, menstrual cups, and others. Among these, the sanitary napkins segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing demand for organic and sustainable products, expanding understanding of menstrual health, and growing e-commerce platforms that improve product accessibility. Government programs that encourage menstrual hygiene and education also aid in the growth of the business.

- The disposable segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom feminine hygiene products market is segmented by nature into reusable and disposable. Among these, the disposable segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its straightforward and convenient, appealing to customers looking for hassle-free solutions. These goods, which include tampons, sanitary napkins, and panty liners, are easily accessible due to their widespread availability across a variety of retailers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom feminine hygiene products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Essity Aktiebolag

- Kao Corporation

- Daio Paper Corporation

- Unicharm Corporation

- Premier FMCG

- Ontex

- Hengan International Group Company Ltd

- Drylock Technologies

- Natracare LLC

- First Quality Enterprises, Inc

- Others.

Recent Developments:

- In May 2023, Puma introduced a line of leak-free period underwear and activewear. Designed to provide comfort and protection during physical activities, these garments aim to reduce reliance on disposable products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom feminine hygiene products market based on the below-mentioned segments:

United Kingdom Feminine Hygiene Products Market, By Type

- Sanitary Napkins

- Tampons

- Panty Liners

- Menstrual Cups

- Others

United Kingdom Feminine Hygiene Products Market, By Nature

- Reusable

- Disposable

Need help to buy this report?