United Kingdom Esports Market Size, Share, and COVID-19 Impact Analysis, By Revenue Stream (Sponsorship, Media Rights, Merchandise and Tickets, Publisher Fees, Digital Platforms, and Streaming), By Genres (Player vs. Player (PVP), First Person Shooter, Sports Games, Real-Time Strategy, Multiplayer Online Battle Arena, and Fighting), and UK Esports Market Insights, Industry Trend, Forecasts to 2035

Industry: Electronics, ICT & MediaUnited Kingdom Esports Market Size Forecasts to 2035

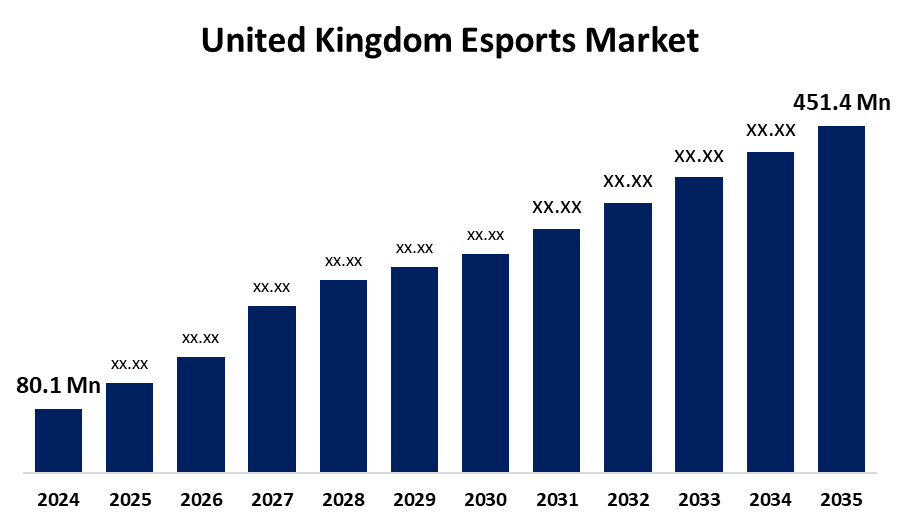

- The United Kingdom Esports Market Size Was Estimated at USD 80.1 Million in 2024

- The UK Esports Market Size is Expected to Grow at a CAGR of around 17.02% from 2025 to 2035

- The UK Esports Market Size is Expected to Reach USD 451.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Esports Market Size is anticipated to reach USD 451.4 Million by 2035, growing at a CAGR of 17.02% from 2025 to 2035. The UK Esports Market is primarily driven by rising internet penetration, major advances in gaming technology, the growing popularity of live-streaming platforms, and favourable investments from sponsors and marketers.

Market Overview

The UK refers to esports, or electronic sports markets, organized, competitive video game play in which professional players and teams compete for awards and recognition. The esports market is a dynamic and rapidly growing industry that includes competitive gaming tournaments, game broadcasting, sponsorship, and more. The growing popularity of competitive gaming among young viewers is one of the main elements driving the UK esports Market development. Esports events and an increasing number of tournaments have created a solid infrastructure that attracts participants and audience. Major UK cities like Manchester and London are becoming hubs for live esports events, which are standing out in the community. In addition, steps towards playing online and remotely during recent international tournaments have increased interest in esports in a widespread demographic. The UK esports has begun to recognize the capacity of the esports market in terms of brands and lucrative research opportunities. They can promote the loyalty of the brand among young customers by focusing on their emotional fan base through imaginative sponsorship arrangements. In addition, educational institutions are interested in rapidly starting esports programs, which pave the way for new initiatives targeted at developing talent and upgrading abilities. Recent trends indicate that gaming companies and traditional sports organizations are rapidly collaborating to tap into the attractive esports sector. The partnership with the famous sports teams and the affected is bridging the gap between esports and traditional Games, causing a more inclusive fan experience. Furthermore, the UK government understands the necessity of regulatory frameworks to support the expansion of e-sports, which could result in increased funding and legitimacy for the business. With community involvement and technological improvements playing critical roles in the future of e-sports in the UK, the industry's growth prospects remain promising as it evolves.

The introduction of internet streaming services such as Twitch and YouTube Gaming, as well as social media interactions, has significantly increased esports' fan base. Furthermore, the growing popularity of cloud gaming and mobile gaming technology has made esports more accessible, allowing participants and spectators to join without the need for high-performance hardware. All of these developments, together with advancements in wireless and 5G connectivity, are making the gaming experience more fluid and high-quality, propelling the esports sector forward.

Report Coverage

This research report categorizes the market for the UK esports market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom esports market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom esports market.

United Kingdom Esports Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 80.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.02% |

| 2035 Value Projection: | USD 451.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 147 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Revenue Stream, By Genres and COVID-19 Impact Analysis |

| Companies covered:: | Gfinity, Team Liquid, Excel E-sports, London Spitfire, Riot Games, Misfits Gaming, Team Secret, Fnatic, Dignitas, London Royal Ravens, Virtus.pro, Natus Vincere, Valve Corporation, Activision Blizzard, Epic Games, Others, and key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK e-sports market is rapidly growing, driven by the popularity of online gaming and supported by active gamers. Organizations like UKIE and British esports promote healthy gaming and professional opportunities. Tech giants such as Microsoft and Sony support the market through platforms, investments, and infrastructure. Local and international tournaments attract global attention, boosting tourism and revenue. Government initiatives, including funding for digital skills and gaming technologies, further strengthen the ecosystem, creating a robust environment for the continued expansion of the UK e-sports industry.

Restraining Factors

The UK e-sports market faces challenges such as limited recognition as a formal sport, inconsistent revenue streams, and inadequate infrastructure in rural areas. Health concerns, regulatory uncertainties, and cybersecurity risks also hinder growth. Additionally, limited local talent development pathways often push skilled players abroad, affecting the UK's ability to retain top talent and fully capitalize on market potential. This factor can hamper the UK esports market during the forecast period.

Market Segmentation

The United Kingdom esports market share is classified into revenue stream and genres.

- The sponsorship segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom esports market is segmented by revenue stream into sponsorship, media rights, merchandise and tickets, publisher fees, digital platforms, and streaming. Among these, the sponsorship segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Sponsorship is important, as firms recognise the value of engaging with a youthful and technologically savvy audience through targeted advertising and brand collaborations. Providing significant financial support and increased publicity for both tournaments and participants. Brands are boosting their esports investment to reach a younger, more engaged audience through sponsorships, team affiliations, and in-game marketing. These investments pay for tournaments, player salaries, and advertising campaigns that help the industry develop. With a large viewership and enthusiastic enthusiasts, esports are an excellent platform for advertisers trying to target a tech-savvy clientele.

- The first-person shooter segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom Esports market is segmented by genres into player vs. player (PVP), first-person shooter, sports games, real-time strategy, multiplayer online battle arena, and fighting. Among these, the first-person shooter segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to their quick action, intricate strategy, and wide appeal to both players and fans, first-person shooters (FPS) are the industry leader in esports. Well-known video games like Call of Duty, Counter-Strike, and Overwatch have created professional leagues and enormous, loyal fan communities. brought about the most significant technological advancements in the game's history, along with upcoming updates and new features that will keep it developing for years to come. Additionally, because FPS games are graphically active, they are perfect for live streaming, which brings in a lot of money from sponsorship and advertising.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom esports market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Gfinity

- Team Liquid

- Excel E-sports

- London Spitfire

- Riot Games

- Misfits Gaming

- Team Secret

- Fnatic

- Dignitas

- London Royal Ravens

- Virtus.pro

- Natus Vincere

- Valve Corporation

- Activision Blizzard

- Epic Games

- Others

Recent Developments:

- In October 2023, Gfinity announced a new partnership with a major telecommunications firm to improve gamer experiences through high-speed connectivity.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom esports market based on the below-mentioned segments:

United Kingdom Esports Market, By Revenue Stream

- Sponsorship

- Media Rights

- Merchandise and Tickets

- Publisher Fees

- Digital Platforms

- Streaming

United Kingdom Esports Market, By Genres

- Player vs. Player (PVP)

- First Person Shooter

- Sports Games

- Real-Time Strategy

- Multiplayer Online Battle Arena

- Fighting

Need help to buy this report?