United Kingdom eSIM Market Size, Share, and COVID-19 Impact Analysis, By Solution (Hardware and Connectivity Services), By Application (Consumer Electronics and M2M), and UK eSIM Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom eSIM Market Forecasts to 2035

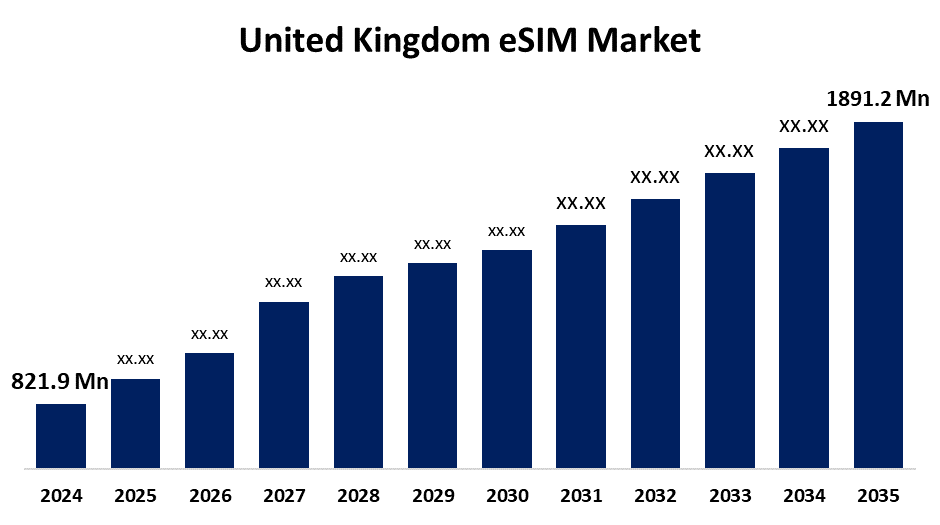

- The United Kingdom eSIM Market Size Was Estimated at USD 821.9 Million in 2024

- The UK eSIM Market Size is Expected to Grow at a CAGR of around 7.87% from 2025 to 2035

- The UK eSIM Market Size is Expected to Reach USD 1891.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK ESIM Market is anticipated to reach USD 1891.2 million by 2035, growing at a CAGR of 7.87% from 2025 to 2035. Early 5G adoption, high smartphone penetration, the existence of telecom companies, and supportive regulations are all factors contributing to this supremacy. The expanding use of IoT in the industrial, automotive, and healthcare sectors benefits the market.

Market Overview

The UK eSIM market refers to an embedded SIM (eSIM) is a built-in, programmable chip in devices like smartphones and smartwatches. It allows users to remotely manage mobile network connections, offering greater flexibility and eliminating the need for physical SIM card swapping. The rise in the adoption of eSIM-compatible devices in the consumer electronics, enterprise, and automotive sectors is now propelling growth in the eSIM market. It is further driven by regulatory impetus through the EU's digital policy and emphasis on data security and data portability. The automotive sector's adoption of eSIM technology is unlocking improved cellular connectivity and connected car services to support next-generation use cases, and a rise in eSIM profile downloads signals growing consumer adoption. The adoption of the GSMA-embedded SIM definition represents a significant step towards the safe and compatible connection of devices on behalf of the vehicle. Technology represents flexibility and an enhanced customer experience with remote SIM provisioning and ease of switching between network providers. The increasing difficulty in managing security across multiple mobile network operators and platforms presents challenges. Vulnerabilities in storing operator credentials and working across multiple virtual environments could still be potential security breaches. These issues might benefit and edge future market growth.

Report Coverage

This research report categorizes the market for the UK eSIM market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom eSIM market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom eSIM market.

United Kingdom eSIM Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 821.9 Million in 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.87% |

| 2035 Value Projection: | USD 1891.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 160 |

| Segments covered: | By Solution, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Deutsche Telekom AG, Gemalto NV, Infineon Technologies AG, NXP Semiconductors N.V., STMicroelectronics, Telefónica, S.A., Sim Local, EE, Tesco Mobile, Giffgaff, Talkmobile, Lyca Mobile, Lebara and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing need for remote SIM provisioning and eSIMs in connected consumer devices, which provide better device designs and faster logistics, is powering the eSIM industry. With its incorporation into sectors such as healthcare, agriculture, and transportation, eSIMs provide secure and flexible connectivity for M2M applications. It also improves efficiency by allowing quick profile switching and connectivity to networks without the need for physical SIM swaps. This transitional change also benefits Mobile Virtual Network Operators (MVNOs) with their use of eSIMs to provide international services, and at the same time, lower costs and complexity related to roaming.

Restraining Factors

Despite the commercial success of the eSIM and the associated connectivity benefits, the eSIM market has low penetration in developing areas due to low awareness, the unavailability of technical expertise, and infrastructural challenges. These factors combine to limit the uptake of the eSIM and the timely UK rollout of the technology. These factors hamper the eSIM market during the forecast period.

Market Segmentation

The United Kingdom eSIM market share is classified into solution and application.

- The connectivity services segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom eSIM market is segmented by solution into hardware and connectivity services. Among these, the connectivity services segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rapid growth in eSIM use for M2M connections, which is expected to thrive as subscription services for network operators, may be the reason for this rapid growth. The connection services that MNOs (mobile network operators) offer enable end users to manage their cellular subscriptions safely and remotely. The automotive industry has recently assembled to approve the GSMA Embedded SIM Specification, paving the way for a new breed of connected vehicles.

- The M2M segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom eSIM market is segmented by application into consumer electronics and M2M. Among these, the M2M segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The M2M industry is driven by the automotive sector for M2M communications, with the key demand drivers in the automobile sector stemming from connected cars. The deployment of eSIM in the automotive sector is expected to improve production efficiencies and support the growth of the connected car market. It is also expected to accelerate the adoption of M2M and IoT technologies by other sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom eSIM market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Deutsche Telekom AG

- Gemalto NV

- Infineon Technologies AG

- NXP Semiconductors N.V.

- STMicroelectronics

- Telefónica, S.A.

- Sim Local

- EE

- Tesco Mobile

- Giffgaff

- Talkmobile

- Lyca Mobile

- Lebara

- Others

Recent Development

- In June 2025, Community Fibre, a UK broadband provider, is preparing to launch eSIM-enabled mobile plans by summer as it enters the MVNO landscape.

- In May 2025, Financial and energy disruptors like Revolut and Octopus are entering the UK mobile market, leveraging strong eSIM offerings.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom eSIM market based on the below-mentioned segments:

United Kingdom ESIM Market, By Solution

- Hardware

- Connectivity Services

United Kingdom ESIM Market, By Application

- Consumer Electronics

- M2M

Need help to buy this report?