United Kingdom Enhanced Oil Recovery (EOR) Market Size, Share, and COVID-19 Impact Analysis, By Technology (Thermal, Gas Injection, and Chemical), By Application (Onshore and Offshore), and United Kingdom Enhanced Oil Recovery (EOR) Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerUnited Kingdom Enhanced Oil Recovery (EOR) Market Insights Forecasts to 2035

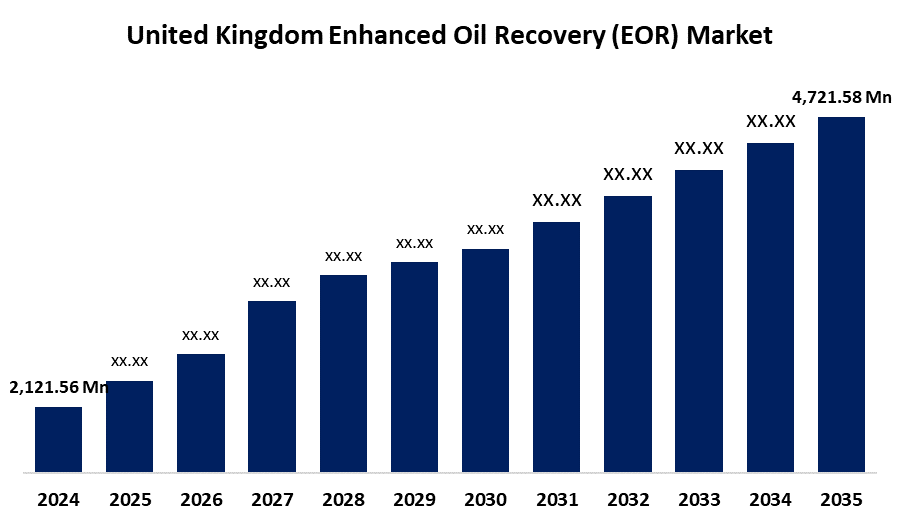

- The United Kingdom Enhanced Oil Recovery (EOR) Market Size Was Estimated at USD 2,121.56 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.54% from 2025 to 2035

- The United Kingdom Enhanced Oil Recovery (EOR) Market Size is Expected to Reach USD 4,721.58 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Enhanced Oil Recovery (EOR) Market Size is anticipated to reach USD 4,721.58 Million by 2035, growing at a CAGR of 7.54% from 2025 to 2035. The increasing government support for energy security and sustainability, aging oil fields, increased investment in improved recovery technology, and growing demand for effective oil extraction all contribute to market expansion.

Market Overview

The United Kingdom enhanced oil recovery (EOR) market refers to the industry involves utilizing sophisticated technologies to extract more oil from existing reservoirs than can be obtained using primary and secondary recovery procedures. Chemical flooding, gas injection, and thermal recovery are instances of EOR technologies that extend the life of existing oil fields and improve oil recovery efficiency. In order to meet the UK's energy needs and handle issues with diminishing production and sustainability, this market is essential. The availability of established oil resources that call for sophisticated recovery techniques. Increased spending on cutting-edge EOR technology, like carbon capture, utilization, and storage (CCUS), offers the possibility of improved oil production as well as environmental advantages. Supportive government initiatives to lower carbon emissions and ensure energy security further propel market expansion by promoting the use of effective and sustainable EOR solutions. The advanced techniques such as thermal heating, chemical flooding, and carbon capture and storage (CCS). These technologies increase the efficiency of oil extraction while lowering their negative effects on the environment, promoting sustainability objectives, and prolonging the productive life of established oil fields with greater accuracy and economy.

Report Coverage

This research report categorizes the market for the United Kingdom enhanced oil recovery (EOR) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom enhanced oil recovery (EOR) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom enhanced oil recovery (EOR) market.

United Kingdom Enhanced Oil Recovery (EOR) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,121.56 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.54% |

| 2035 Value Projection: | USD 4,721.58 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 236 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Technology and By Application |

| Companies covered:: | BP PLC, Eni S.p.A., TotalEnergies SE, Repsol S.A., Statoil ASA (Equinor), Royal Dutch Shell PLC, OMV Group, Wintershall Dea GmbH, MOL Group, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The need to ensure continuous domestic oil production by optimizing extraction from established and deteriorating oil fields. Increasing energy use and volatile crude oil prices drive investment in effective recovery methods. Oil yield is increased and operating expenses are decreased by technological developments in EOR techniques such chemical flooding, gas injection, and thermal recovery. Furthermore, government programs that assist carbon reduction and energy security encourage the use of eco-friendly EOR systems, such as carbon capture, utilization, and storage (CCUS). These elements work together to accelerate up market expansion and the uptake of cutting-edge recovery technology.

Restraining Factors

The difficult reservoir conditions, stringent environmental regulations, and significant operational and technology costs. Rapid market expansion and acceptance of innovative EOR technologies are also constrained by worries regarding carbon emissions, possible environmental hazards, and difficulties obtaining funding for large-scale projects.

Market Segmentation

The United Kingdom enhanced oil recovery (EOR) market share is classified into technology and application.

- The gas injection segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom enhanced oil recovery (EOR) market is segmented by technology into thermal, gas injection, and chemical. Among these, the gas injection segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to growing emphasis on sustainable, carbon-neutral oil production from established offshore and onshore locations, increased use of CO2 injection for enhanced oil recovery and carbon sequestration, and increased expenditures in advanced chemical EOR processes.

- The offshore segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom enhanced oil recovery (EOR) market is segmented by application into onshore and offshore. Among these, the offshore segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the North Sea's oil fields' maturity, which is increasing demand for sophisticated recovery methods like chemical flooding and CO2 injection. These techniques promote sustainable extraction from aged deposits, increase asset life, and optimize production.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom enhanced oil recovery (EOR) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BP PLC

- Eni S.p.A.

- TotalEnergies SE

- Repsol S.A.

- Statoil ASA (Equinor)

- Royal Dutch Shell PLC

- OMV Group

- Wintershall Dea GmbH

- MOL Group

- Others.

Recent Developments:

- In October 2024, ICM announced the deployment of its patented FOT Oil Recovery™ technology at Absolute Energy's facility in Colwich, Kansas. This innovative process improves the separation of solids and liquids from whole stillage, significantly increasing the amount of distillers corn oil available for recovery. The technology also reduces natural gas consumption, enhancing energy efficiency and supporting sustainability goals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom enhanced oil recovery (EOR) market based on the below-mentioned segments:

United Kingdom Enhanced Oil Recovery (EOR) Market, By Technology

- Thermal

- Gas Injection

- Chemical

United Kingdom Enhanced Oil Recovery (EOR) Market, By Application

- Onshore

- Offshore

Need help to buy this report?