United Kingdom Engineering Plastics Market Size, Share, and COVID-19 Impact Analysis, By Resin Type (Fluoropolymer, Liquid Crystal Polymer, and Polyamide), By Technology (Injection Molding, Extrusion, and Blow Molding), and United Kingdom Engineering Plastics Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsUnited Kingdom Engineering Plastics Market Insights Forecasts to 2035

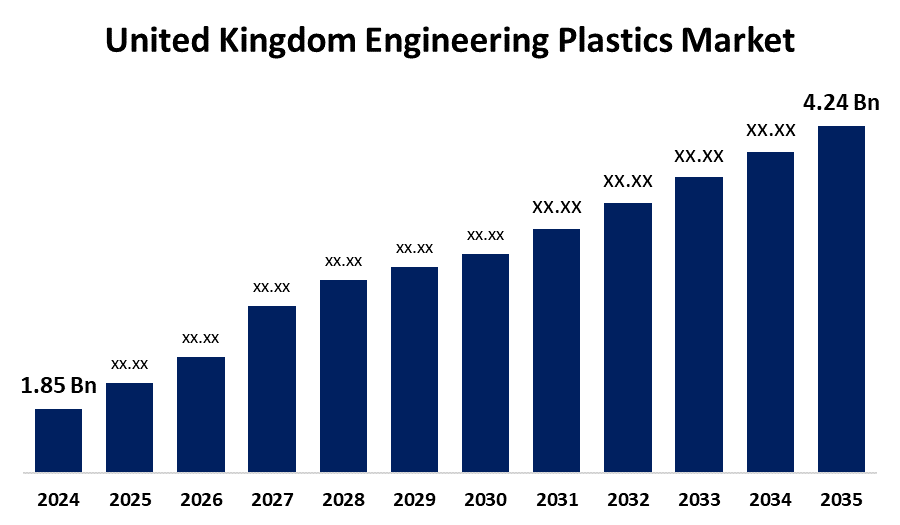

- The United Kingdom Engineering Plastics Market Size Was Estimated at USD 1.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.83% from 2025 to 2035

- The United Kingdom Engineering Plastics Market Size is Expected to Reach USD 4.24 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Engineering Plastics Market Size is Anticipated to reach USD 4.24 Billion By 2035, Growing at a CAGR of 7.83% from 2025 to 2035. The increasing demand from the construction, electronics, and automobile industries. These plastics are perfect for substituted metals and improving performance in high-tech and industrial applications because of their exceptional resilience, lightweight nature, and heat resistance.

Market Overview

The United Kingdom engineering plastics market refers to the industry focused on the manufacturing, marketing, and use of high-performance plastics in demanding engineering environments. These plastics, which include PEEK, polycarbonate, and polyamide, are prized for their strength, chemical stability, heat resistance, and light weight. They provide a strong and effective substitute for conventional materials like metal and glass, and are widely employed in a variety of industries, including automotive, electronics, construction, aerospace, and healthcare. Increasing expenditures on industrial automation, smart manufacturing, and infrastructure. Potential is further increased by the growing need for high-performance, corrosion-resistant materials in electronics, medical devices, and 3D printing applications. The use of engineering plastics over conventional materials is additionally promoted by government programs that support sustainability and energy efficiency, which encourages long-term industry growth and innovation. By applying their Biotransformation technology, companies including Polymateria have created biodegradable plastics that break down without producing microplastics. To prevent ocean pollution, startups, including Fishy Filaments, are recycling used fishing nets into premium nylon for 3D printing.

Report Coverage

This research report categorizes the market for the United Kingdom engineering plastics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom engineering plastics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom engineering plastics market.

United Kingdom Engineering Plastics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.38% |

| 2035 Value Projection: | USD 4.24 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Resin Type, By Technology and COVID-19 Impact Analysis |

| Companies covered:: | AGC Inc, Alfa S.A.B. de C.V., Asahi Kasei Corporation, BASF SE, Celanese Corporation, Covestro AG, Domo Chemicals, INEOS, Mitsubishi Chemical Corporation, Polymer Extrusion Technologies (UK) Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand from important sectors, including construction, electronics, automotive, and aerospace. Lightweight, strong, and high-performing materials are needed in these industries to improve productivity, fuel economy, and product longevity. The use of engineering plastics in place of metal components is also being encouraged by the increased emphasis on sustainability and lowering carbon emissions. Innovation and material customization are further supported by technological developments in polymer blends and composites. The market's steady growth and expansion are also being greatly contributed by the growing need for heat-resistant and structurally sound plastics driven on by the development of electric vehicles and 3D printing applications.

Restraining Factors

The high costs for raw materials, intricate production procedures, and some polymers' limited capacity for recycling. Market expansion is further hampered by environmental concerns and stringent government laws on plastic waste and emissions, particularly for engineering plastics that are petroleum-based or non-biodegradable.

Market Segmentation

The United Kingdom engineering plastics market share is classified into resin type and technology.

- The polyamide segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom engineering plastics market is segmented by resin type into fluoropolymer, liquid crystal polymer, and polyamide. Among these, the polyamide segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to its superior thermal stability, chemical resistance, and mechanical strength. Because of its adaptability, it is widely used in industrial, automotive, and electrical applications where strong, lightweight, and economically priced materials are becoming increasingly desirable.

- The injection molding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom engineering plastics market is segmented by technology into injection molding, extrusion, and blow molding. Among these, the injection molding segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its high level of precision, mass manufacturing cost effectiveness, and capacity to produce intricate parts. It supports a wide range of consumer products, electronics, and automotive applications, generating steady demand across several industries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom engineering plastics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AGC Inc

- Alfa S.A.B. de C.V.

- Asahi Kasei Corporation

- BASF SE

- Celanese Corporation

- Covestro AG

- Domo Chemicals

- INEOS

- Mitsubishi Chemical Corporation

- Polymer Extrusion Technologies (UK) Ltd

- Others

Recent Developments:

- In May 2024, Polyplastics introduced a new polyphenylene sulfide (PPS) resin with enhanced thermal shock resistance. This innovation is designed for improved recyclability, aligning with the UK's emphasis on sustainable materials in the automotive and electronics sectors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom engineering plastics market based on the below-mentioned segments

United Kingdom Engineering Plastics Market, By Resin Type

- Fluoropolymer

- Liquid Crystal Polymer

- Polyamide

United Kingdom Engineering Plastics Market, By Technology

- Injection Molding

- Extrusion

- Blow Molding

Need help to buy this report?