United Kingdom Emulsion Polymer Market Size, Share, and COVID-19 Impact Analysis, By Type (Vinyl acetate polymers, Styrene-butadiene latex, Acrylics, Polyurethane dispersions, and Others), By Application (Paints & Coatings, Adhesives & Sealants, Paper & Paperboard and Others) and UK Emulsion Polymer Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Emulsion Polymer Market Forecasts to 2035

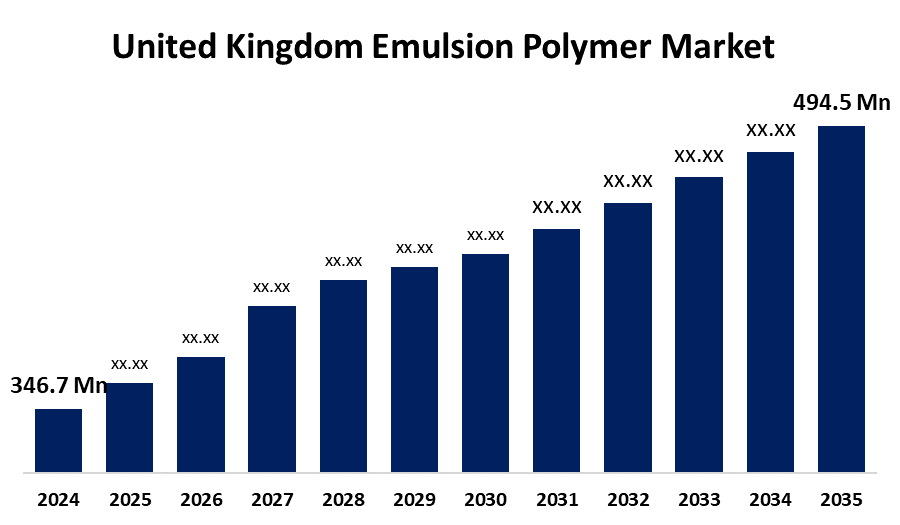

- The United Kingdom Emulsion Polymer Market Size Was Estimated at USD 346.7 Million in 2024

- The UK Emulsion Polymer Market Size is Expected to Grow at a CAGR of around 3.28% from 2025 to 2035

- The UK Emulsion Polymer Market Size is Expected to Reach USD 494.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Emulsion Polymer Market is anticipated to reach USD 494.5 million by 2035, growing at a CAGR of 3.28% from 2025 to 2035. The UK emulsion polymer market is growing due to rising demand in construction, automotive, and packaging industries for eco-friendly and high-performance materials. Stringent environmental regulations also drive the shift toward water-based polymers over solvent-based alternatives.

Market Overview

The UK emulsion polymer market refers to polymer particle dispersions in water that are colloidal and usually stabilised by surfactants. They are made via emulsion polymerisation and create latex solutions using initiators such as potassium persulfate. High molecular weight and quick polymerisation rates are two important benefits. They improve colour quality, heat resistance, and self-repairing qualities and are widely utilised in paints and coatings, which fuels high industry demand. As the market prioritises sustainability and improved product performance, the market for polymer emulsions is expanding. With the added benefit of being environmentally friendly, this adaptable emulsion provides solutions that meet shifting consumer demands and legal requirements, which will fuel market expansion in the years to come. The UK's adoption of water-based and low-VOC polymer emulsions is being accelerated by strict environmental rules aimed at achieving net-zero emissions. It will help reduce carbon emissions, which will support national sustainability. Furthermore, this need is further fuelled by the growing number of green buildings and advancements in packaging. With such ability to make coatings, adhesives, and laminates perform better but cause less damage to the environment, they are important for meeting all regulatory requirements in the industry, along with the industrial needs for sustainable high-performance materials in different industries. In the polymer industry, the North East of England Process Industry Cluster (NEPIC) is essential for promoting creativity and co-operation. In line with the industry's move towards environmentally friendly solutions, NEPIC, which has over 600 partner organisations, promotes efforts in sustainable energy, carbon reduction, and the development of bio-based products.

Report Coverage

This research report categorizes the market for the UK emulsion polymer market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom emulsion polymer market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom emulsion polymer market.

United Kingdom Emulsion Polymer Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 346.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.28% |

| 2035 Value Projection: | USD 494.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Arkema S.A., Celanese Corporation, BASF, Dow Inc., Synthomer Plc, DIC Corporation, Wacker Chemie AG, 3M, Trinseo, Lubrizol, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for polymer emulsions in the UK is expanding as a result of rising consumer demand for water-based, low-VOC products that support the Clean Air Strategy. These environmentally friendly emulsions are frequently found in adhesives, paints, and varnishes for both commercial and domestic use. They contribute to green building objectives in construction by providing energy efficiency and durability. Their biodegradable and recyclable qualities improve sustainability and strength for the packaging sector. Polymer emulsions enhance fabric performance, product longevity, and fuel efficiency in textiles and automobiles. Because of these many uses, polymer emulsions are crucial in a variety of UK industries, satisfying both consumer and regulatory expectations for sustainability.

Restraining Factors

Limitations on the UK polymer emulsion industry include shifting raw material prices, particularly for petrochemical-based inputs, which impact manufacturing costs. Operational complexity may rise in response to strict environmental rules and compliance requirements. Furthermore, competition from solvent-based goods and the availability of substitute green materials could impede market expansion. Widespread use is further hampered by low awareness and uptake in smaller industries. These factors can hamper the UK Emulsion Polymer market during the forecast period.

Market Segmentation

The United Kingdom emulsion polymer market share is classified into type and application.

- The acrylics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom emulsion polymer market is segmented by type into vinyl acetate polymers, styrene-butadiene latex, acrylics, polyurethane dispersions, and others. Among these, the acrylics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing demand for products from the superabsorbent polymer and adhesive, and sealant industries. The demand for acrylic polymers is expected to be further supported by an increase in building and construction activities in developing countries. The market is anticipated to expand due to the growing use of acrylic polymers in water treatment. In the upcoming years, vinyl acetate is expected to grow significantly, mostly due to an increased base of applications in the manufacturing of wood, paper, cloth, and adhesives.

- The paints & coatings segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom emulsion polymer market is segmented by application into paints & coatings, adhesives & sealants, paper & paperboard, and others. Among these, the paints & coatings segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Consumers' growing emphasis on quality and aesthetics is anticipated to fuel demand for high-end paints and technologically sophisticated coatings. Customers' increasing desire for odourless and low-VOC products is driving growth in the paints and coatings market. The existence of stringent environmental laws and policies that promotes eco-friendly items.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom emulsion polymer market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arkema S.A.

- Celanese Corporation

- BASF

- Dow Inc.

- Synthomer Plc

- DIC Corporation

- Wacker Chemie AG

- 3M

- Trinseo

- Lubrizol

- Others

Recent Developments:

- In March 2025, BASF introduced EPS Engineered Polymer Solutions will showcase its portfolio of innovative water-based acrylic polymers for the industrial, construction and architectural coatings industries including UK.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom emulsion polymer market based on the below-mentioned segments:

United Kingdom Emulsion Polymer Market, By Type

- Vinyl acetate polymers

- Styrene-butadiene latex

- Acrylics

- Polyurethane dispersions

- Others

United Kingdom Emulsion Polymer Market, By Application

- Paints & Coatings

- Adhesives & Sealants

- Paper & Paperboard

- Others

Need help to buy this report?