United Kingdom Electrodeposited Copper Foils Market Size, Share, and COVID-19 Impact Analysis, By Material (Ferrous, Non-Ferrous, and Others), By Methodology (Press-and-Sinter, Metal Injection Molding, and Additive Manufacturing), and United Kingdom Electrodeposited Copper Foils Market Insights, Industry Trend, Forecasts to 2035.

Industry: Advanced MaterialsUnited Kingdom Electrodeposited Copper Foils Market Insights Forecasts to 2035

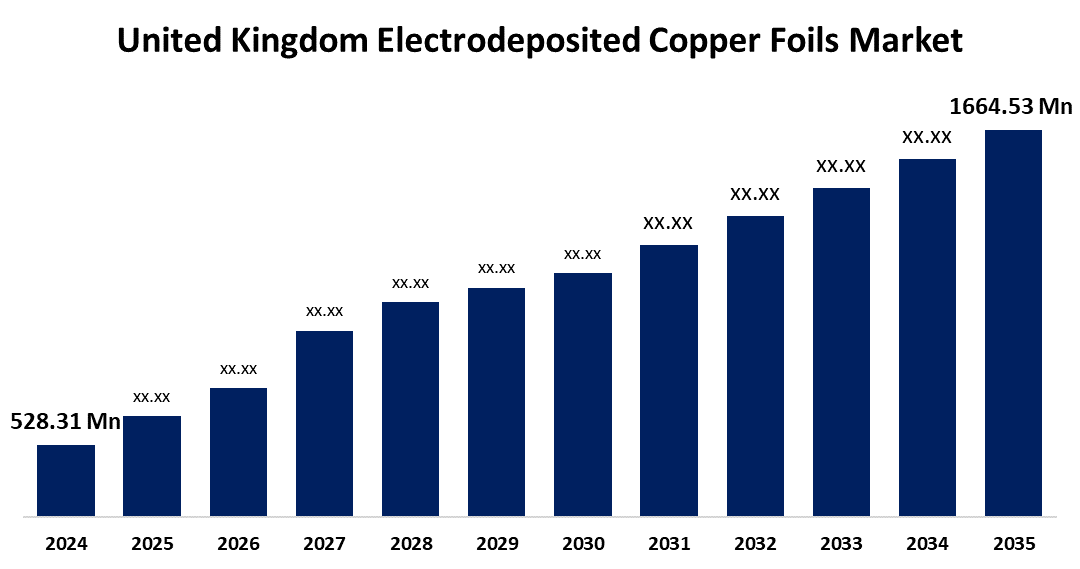

- The United Kingdom Electrodeposited Copper Foils Market Size was estimated at USD 528.31 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.00% from 2025 to 2035

- The United Kingdom Electrodeposited Copper Foils Market Size is Expected to Reach USD 1664.53 Million by 2035

Get more details on this report -

The United Kingdom Electrodeposited Copper Foils Market Size is Anticipated to reach USD 1664.53 Million By 2035, Growing at a CAGR of 11.00% from 2025 to 2035. The extensive use of electric vehicles, which mostly rely on electrodeposited copper foils for their printed circuit boards (PCBs) and battery systems, and the rising need for high-performance electronic devices are the main causes of this rise. Moreover, developments in copper foil technology and the quick development of renewable energy sources are driving market growth.

Market Overview

The market for electrodeposited copper foils in the UK is the industry devoted to the manufacture and use of electrodeposited copper foils, which are thin copper layers made by electrochemical deposition. The leading manufacturer of consumer electronics, semiconductors, and high-end PCBs, all of which rely on electrodeposited copper foils for their superior electrical conductivity and compactness, is still the United Kingdom. The rapid advancement of 5G networks, artificial intelligence (AI), and the Internet of Things (IoT) has led to an increasing need for ultra-thin, high-strength copper foils in flexible printed circuit boards (PCBs) and semiconductor packaging. Microelectronics innovation is increasing the demand for precision-engineered copper foils. The market for electrodeposited copper foils is also being boosted by the growing emphasis on renewable energy sources like solar and wind power. Copper foils find widespread application in solar panel photovoltaic cells and in wind turbine generators and transformers, among other parts.

Report Coverage

This research report categorizes the market for the United Kingdom electrodeposited copper foils market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom electrodeposited copper foils market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom electrodeposited copper foils market.

United Kingdom Electrodeposited Copper Foils Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 528.31 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.00% |

| 2035 Value Projection: | USD 1664.53 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Material, By Methodology and COVID-19 Impact Analysis |

| Companies covered:: | Avocet Electrofoils (AEF), GKN Powder Metallurgy, Sandvik AB, Carpenter Technology Corporation, Miba AG (Owned by Teer Coatings Limited), and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapidly expanding electric vehicle (EV) market is another important factor for market expansion. The production of electric vehicle batteries relies heavily on electrodeposited copper foils because of their superior mechanical strength, conductivity, and thermal management capabilities. Copper foils' exceptional strength and ductility make them perfect for use in the harsh conditions of car batteries, which require materials that can tolerate high temperatures and currents. The market is expanding as a direct result of the increase in demand for copper foils brought on by this spike in EV production.

Restraining Factors

The market for electrodeposited copper foils is hampered by the price volatility of raw materials, particularly copper, a commodity that is traded worldwide. Copper prices are affected by supply chain disruptions, mining output fluctuations, and geopolitical variables, making it difficult for producers to maintain cost effectiveness and stable pricing structures.

Market [rg1] Segmentation

The United Kingdom electrodeposited copper foils market share is classified into material and methodology.

- The non-ferrous segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom electrodeposited copper foils market is segmented by material into ferrous, non-ferrous, and others. Among these, the non-ferrous segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. The dominance of the non-ferrous market is explained by the extensive use of copper-based foils in semiconductors, electric vehicles (EVs), and renewable energy applications. Copper is used in the production of PCBs, lithium-ion batteries, and power transmission components due to its superior electrical conductivity, endurance, and corrosion resistance.

- The press-and-sinter segment held the highest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom electrodeposited copper foils market is segmented by methodology into press-and-sinter, metal injection molding, and additive manufacturing. Among these, the press-and-sinter segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its scalability and affordability in large-scale production. The manufacturing of accurate and lightweight materials by metal injection molding is gaining popularity in the miniaturized electronics and aerospace sectors.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom electrodeposited copper foils market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Avocet Electrofoils (AEF)

- GKN Powder Metallurgy

- Sandvik AB

- Carpenter Technology Corporation

- Miba AG (Owned by Teer Coatings Limited)

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom electrodeposited copper foils market based on the below-mentioned segments

United Kingdom Electrodeposited Copper Foils Market, By Material

- Ferrous

- Non-Ferrous

- Others

United Kingdom Electrodeposited Copper Foils Market, By Methodology

- Press-and-Sinter

- Metal Injection Molding

- Additive Manufacturing

Need help to buy this report?