United Kingdom Electrical Bus Market Size, Share, and COVID-19 Impact Analysis, By Propulsion Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Battery Type (Lithium Nickel Manganese Cobalt Oxide, Lithium Iron Phosphate), and United Kingdom Electrical Bus Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationUnited Kingdom Electrical Bus Market Insights Forecasts to 2035

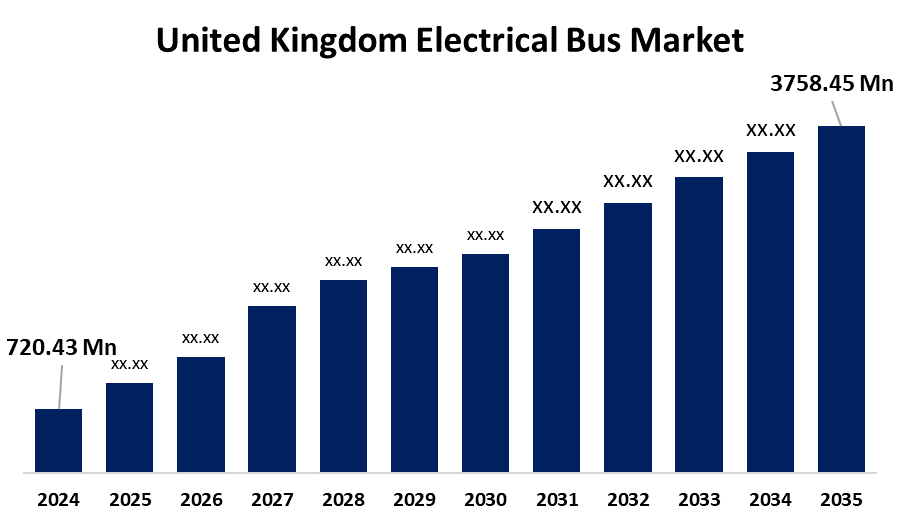

- The United Kingdom Electrical Bus Market Size was estimated at USD 720.43 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 16.20% from 2025 to 2035

- The United Kingdom Electrical Bus Market Size is Expected to Reach USD 3758.45 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Electrical Bus Market Size is anticipated to reach USD 3758.45 Million by 2035, growing at a CAGR of 16.20% from 2025 to 2035. The country's supporting government laws, technological developments that assure effectiveness and enhanced performance, and public awareness of environmental pollution are some of the main factors propelling the market's expansion.

Market Overview

The United Kingdom electrical bus market refers to the business focused on the production and utilization of electric buses for public transportation. The electric bus industry aims to revolutionize urban public transportation by providing affordable, environmentally friendly, and sustainable alternatives. Given the increasing urbanization of the nation and the resulting demand for clean, reliable, and efficient public transportation systems, electric buses are an essential part of the UK's future mobility. Additionally, advancements in charging infrastructure, along with a greater emphasis on sustainability and reducing urban air pollution, have expedited the introduction of electric buses. Besides, the government supports the market growth, such as the UK government has announced a £37.8 million investment to support the rollout of 319 zero-emission buses across England. This funding is part of the Zero Emission Bus Regional Area (ZEBRA 2) programme and is expected to be matched by private investment, bringing additional financial support to the initiative.

Report Coverage

This research report categorizes the market for the United Kingdom electrical bus market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom electrical bus market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom electrical bus market.

United Kingdom Electrical Bus Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 720.43 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 16.20% |

| 2035 Value Projection: | USD 3758.45 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 202 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Propulsion Type (Battery Electric Vehicle, Plug-in Hybrid Electric Vehicle, Fuel Cell Electric Vehicle), By Battery Type (Lithium Nickel Manganese Cobalt Oxide, Lithium Iron Phosphate) |

| Companies covered:: | Alexander Dennis, Wrightbus, Switch Mobility, Abellio London, ZEEbus, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the United Kingdom electrical bus is driven by the incorporation of smart technology into electric buses, such as predictive maintenance systems, fleet management software, and real-time tracking. This trend is also supported by the growth of charging infrastructure, as more cities install fast-charging stations to accommodate electric buses. The future of electric buses in the UK becomes brighter with ongoing innovation, as they emerge as a key element of the region's sustainable transportation strategy.

Restraining Factors

The market's expansion could be hampered by elements like high upfront expenses and intricate charging infrastructure. Electric buses are substantially more expensive up front than traditional buses. This is mostly because electric buses employ more sophisticated and costly technology, and the infrastructure needed for charging them requires more funding.

Market Segmentation

The United Kingdom electrical bus market share is classified into propulsion type and battery type.

- The battery electric vehicle segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom electrical bus market is segmented by propulsion type into battery electric vehicle, plug-in hybrid electric vehicle, and fuel cell electric vehicle. Among these, the battery electric vehicle segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. The reason for the growth is that, when compared to traditional diesel or CNG buses, BEVs have significantly lower operating and maintenance costs. Throughout a vehicle's lifecycle, electric motors are more efficient and require less maintenance since they have fewer moving parts, and electricity is less expensive than fossil fuels.

- The lithium iron phosphate segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom electrical bus market is segmented by battery type into lithium nickel manganese cobalt oxide, and lithium iron phosphate. Among these, the lithium iron phosphate segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because the main element is the abundance of raw materials, such as iron and phosphate, needed to make lithium-iron-phosphate batteries. Large vehicles like buses are safer when using LFP batteries since they are less likely to overheat and are thermally stable. In addition, they are more cost-effective due to the absence of the expensive cobalt and have a longer cycle life than other batteries.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom electrical bus market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alexander Dennis

- Wrightbus

- Switch Mobility

- Abellio London

- ZEEbus

- Others

Recent Developments:

- In January 2025, Wrightbus unveiled two new battery-electric single-deck buses, available in 6m and 9m variants. These buses were part of Wrightbus' new Rightech brand, developed in partnership with Chinese manufacturer King Long. The buses were designed to provide affordable, zero-emission transport across the UK, Ireland, and Europe. The company aimed to accelerate fleet decarbonization while maintaining its commitment to high-quality UK-based engineering.

- In October 2024, Heliox and First Bus expanded their partnership to develop five new electric bus charging depots across the UK, backed by an £89 million investment from First Bus and £16 million in government funding through the ZEBRA 2 programme.

- In October 2021, NFI Group announced that BYD ADL electric buses, operated by First Bus in the UK, had been selected as the official COP26 delegate shuttle service. A fleet of 22 BYD ADL Enviro200EV zero-emission buses provided transport for delegates between Glasgow city centre and the blue and green zones at the event campus.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom electrical bus market based on the below-mentioned segments:

United Kingdom Electrical Bus Market, By Propulsion Type

- Battery Electric Vehicle

- Plug-in Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

United Kingdom Electrical Bus Market, By Battery Type

- Lithium Nickel Manganese Cobalt Oxide

- Lithium Iron Phosphate

Need help to buy this report?