United Kingdom Electric Vehicle Charging Infrastructure Market Size, Share, and COVID-19 Impact Analysis, By Charger Type (Slow Charger and Fast Charger), By Connector Type (CHAdeMO, CCS, and Others), By Application (Commercial and Residential), and UK Electric Vehicle Charging Infrastructure Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Electric Vehicle Charging Infrastructure Market Size Forecasts to 2035

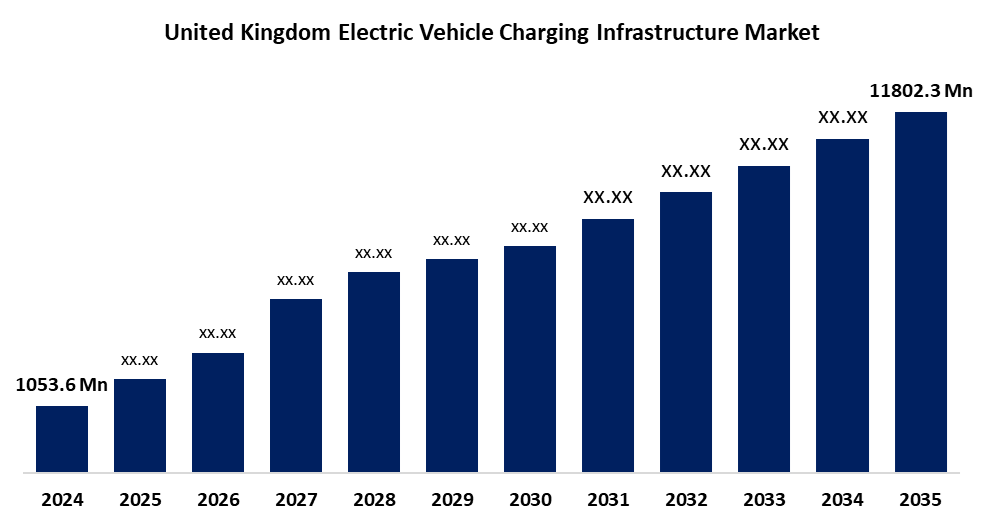

- The United Kingdom Electric Vehicle Charging Infrastructure Market Size Was Estimated at USD 1053.6 Million in 2024

- The UK Electric Vehicle Charging Infrastructure Market Size is Expected to Grow at a CAGR of around 24.56% from 2025 to 2035

- The UK Electric Vehicle Charging Infrastructure Market Size is Expected to Reach USD 11802.3 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Electric Vehicle Charging Infrastructure Market Size is anticipated to reach USD 11802.3 million by 2035, growing at a CAGR of 24.56% from 2025 to 2035. Growth factors for market expansion in the UK are rising carbon pollution concerns and the expanding use of electric cars (EVs).

Market Overview

The UK electric vehicle charging infrastructure market refers to the system of charging stations and related technologies that make it easy and comfortable for EV owners to recharge their vehicles. Private companies and local authorities are being encouraged to extend charging networks by rising consumer demand. Innovations in smart charging systems, integration with renewable energy sources, and rapid charging are important potential. Increased public-private partnerships and stakeholder collaboration are speeding up infrastructure construction throughout the UK. These developments promote an ecosystem of charging that is accessible, sustainable, and easy to use. Improving coverage, increasing efficiency, and facilitating the wider shift to renewable energy and electric vehicles continue to be the major priorities as the sector develops.

In July 2018, the UK government passed the Automated and Electric Vehicles (AEV) Act, which gives the UK government expanded powers to guarantee fast-track development of EVCI on motorways and fuel station locations. Government regulations, tax exemptions and incentives, and improved public environmental awareness are creating greater motivation for rapid EV adoption, thus increasing the need for charging infrastructure. Improvements in battery technology and lowering lithium-ion battery costs are increasing the vehicle range and decreasing charging times to attract more customers. As EV popularity rises, the UK's efforts to support the industry are expanding.

Report Coverage

This research report categorizes the market for the UK electric vehicle charging infrastructure market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom electric vehicle charging infrastructure market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom electric vehicle charging infrastructure market.

United Kingdom Electric Vehicle Charging Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1053.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 24.56% |

| 2035 Value Projection: | USD 11802.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 169 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Charger Type, By Connector Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Fastned, Shell, Engie, TotalEnergies, ZapMap, Ionity, Tesla, Osprey Charging, EDF Energy, Gridserve, Pod Point, Allego, ChargePoint, BP, Connected Kerb, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Strong government funding and program support, an increased consumer interest in environmentally conscious means of transportation, and the climate consciousness driving EV adoption are the major drivers of the UK EV charging infrastructure market. Advancements in fast charging technologies led by companies like Tesla and BP Pulse are further improving the convenience and efficiency of charging vehicles. Growth potential is also supplemented by an established manufacturer that also provides electrified offerings, thus creating demand for more infrastructure and growing the market.

Restraining Factors

The challenges facing the UK EV charging infrastructure market include grid capacity, cost of installation and maintenance and limited electric vehicle re-chargers in rural areas. Moreover, regulatory complexity and slow acceptance by certain consumer sectors could hinder the development of new infrastructure and make an impact in market growth by delaying the deployment of widespread EV infrastructure. These factors hamper the electric vehicle charging infrastructure market during the forecast period.

Market Segmentation

The United Kingdom electric vehicle charging infrastructure market share is classified into charger type, connector type, and application.

- The fast charger segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom electric vehicle charging infrastructure market is segmented by charger type into slow charger and fast charger. Among these, the fast charger segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growth in the number of public charging station installations is due to the various efforts made by governments to expedite the installation of public fast-charging infrastructure. While most businesses deployed Level 2 AC charging stations that can charge an EV fully, or installed Level 3 DC fast chargers that can charge an EV fully in 30-120 minutes.

- The CCS segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom electric vehicle charging infrastructure market is segmented by connector type into CHAdeMO, CCS, and others. Among these, the CCS segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. CCS charging sockets typically integrate AC and DC facilities, sharing the same communication pins. Due to this, the CCS charging socket is more compact than a GB/T or CHAdeMO DC socket, combined with an AC socket. It has become the choice standard for convenient and effective EV charging across the country as it is used by most EVs, offers faster charging, and is accepted by most manufacturers.

- The commercial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom electric vehicle charging infrastructure market is segmented by application into commercial and residential. Among these, the commercial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The initiatives and financial commitments made by governments and automakers to increase public EVCI are the reason for this segment's leading share. Additionally, since depending only on home or overnight charging would not be sufficient for long-distance travel, it is imperative to create supporting infrastructure for EV charging at public sites.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom electric vehicle charging infrastructure market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fastned

- Shell

- Engie

- TotalEnergies

- ZapMap

- Ionity

- Tesla

- Osprey Charging

- EDF Energy

- Gridserve

- Pod Point

- Allego

- ChargePoint

- BP

- Connected Kerb

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom electric vehicle charging infrastructure market based on the below-mentioned segments:

United Kingdom Electric Vehicle Charging Infrastructure Market, By Charger Type

- Slow Charger

- Fast Charger

United Kingdom Electric Vehicle Charging Infrastructure Market, By Connector Type

- CHAdeMO

- CCS

- Others

United Kingdom Electric Vehicle Charging Infrastructure Market, By Application

- Commercial

- Residential

Need help to buy this report?