United Kingdom E-Commerce Apparel Market Size, Share, and COVID-19 Impact Analysis, By Pricing Model (Discounted, Premium), By Platform Type (Third Party Retailer, Company’s Own), and United Kingdom E-Commerce Apparel Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom E-Commerce Apparel Market Insights Forecasts to 2035

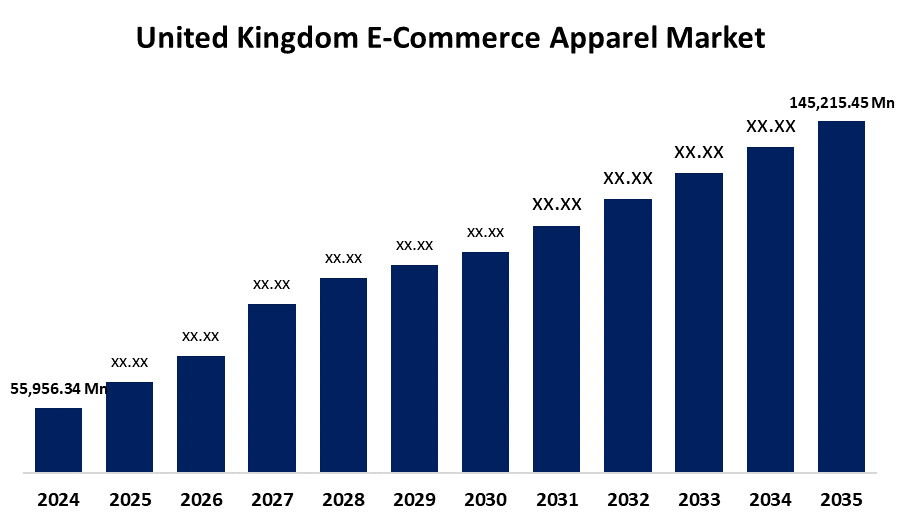

- The United Kingdom E-Commerce Apparel Market Size was Estimated at USD 55,956.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.06% from 2025 to 2035

- The United Kingdom E-Commerce Apparel Market Size is Expected to Reach USD 145,215.45 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom E-Commerce Apparel Market Size is anticipated to reach USD 145,215.45 Million by 2035, growing at a CAGR of 9.06% from 2025 to 2035. The market is growing due to rising smartphone apps, now utilizing AI and understanding the tastes and buying behaviors of their customers. Further, quick fashion models such as e-commerce platforms and social media's widespread use are also opening up new business prospects for firms.

Market Overview

The United Kingdom e-commerce apparel market refers to the industry focused on the selling of clothes, accessories, and shoes online is known as e-commerce apparel. This kind of retail eliminates the need for a conventional brick-and-mortar presence by using the internet to display products, handle transactions, and make it easier for consumers and sellers to exchange goods. The clothing industry has been significantly impacted by the ideas of e-marketplace and e-commerce. In addition to being convenient, shopping from home lets you maintain your favorite brands in your closet. E-commerce companies have seen a surge in clothes sales that have surpassed all other categories, including food and household products. Internet-driven buying and sales trends have significantly increased, according to B2C growth.

Report Coverage

This research report categorizes the market for the United Kingdom e-commerce apparel market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom e-commerce apparel market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom e-commerce apparel market.

United Kingdom E-Commerce Apparel Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 55,956.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 9.06% |

| 2035 Value Projection: | USD 145,215.45 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Pricing Model and By Platform Type |

| Companies covered:: | ASOS, Boohoo, Next, Marks & Spencer, Gymshark, PrettyLittleThing, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom e-commerce apparel is influenced by the increasing demand for clothing products on e-commerce platforms. Further, rising female populations, an increasing number of working women, changing fashion trends, and consumers' excess purchasing power are also associated with the development. The market's ongoing product advancements, as well as rising living standards, will increase demand even further. The growing influence of social media and celebrities is another reason propelling clothing producers to continuously release new patterns and trends. The projected development of the e-commerce apparel sector is nearly impossible to predict due to the development of advanced AI and possibilities for customization.

Restraining Factors

The market expansion could be hampered by several factors, including the growing fluctuation of raw materials, the adoption of eco-friendly practices, and the impact of credit card fraud or identity theft. The inability of consumers to evaluate the size, fit, and feel of clothing when purchasing online is one of the main obstacles facing the e-commerce apparel sector. Since things may not live up to expectations once they are received, this uncertainty often results in higher return rates.

Market Segmentation

The United Kingdom e-commerce apparel market share is classified into pricing model and platform type.

- The premium segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United Kingdom e-commerce apparel market is divided by pricing model into discounted and premium. Among these, the premium segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is because of the ongoing need for unique and superior clothing items. The premium segment catered to a specialized consumer who prioritized exclusivity and quality and was distinguished by its more costly offers.

- The company's own segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom e-commerce apparel market is segmented by platform type into third party retailer and, company's own. Among these, the company's own segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is because Companies often divide their operations into sub-segments, which represent different business areas or product lines. These segments help businesses analyze performance, allocate resources, and report financial results.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom e-commerce apparel market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ASOS

- Boohoo

- Next

- Marks & Spencer

- Gymshark

- PrettyLittleThing

- Others

Recent Developments:

- In May 2025, Saks Fifth Avenue is launching a dedicated storefront on Amazon UK, expanding its global presence. This move builds on a six-year partnership between Saks and Amazon in the US, where Saks already operates a curated luxury space. This expansion highlights how luxury brands are carefully entering mainstream e-commerce, making high-end fashion more accessible to UK shoppers.

- In April 2025, MP Activewear, the clothing line from Myprotein, officially launched in Decathlon stores across the UK. This marks Myprotein’s first major retail partnership, expanding beyond its e-commerce presence. This expansion aligns with Myprotein’s global rebrand, aimed at making fitness apparel more accessible while complementing its sports nutrition products.

- In August 2024, United Legwear & Apparel Co. (ULAC) partnered with Authentic Brands Group to manage Ted Baker’s online operations in the UK and Europe. This move follows ULAC’s recent takeover of Ted Baker’s wholesale, concession shops, and e-commerce operations in the US and Canada.

- In May 2024, Reliance Retail partnered with ASOS, the UK's leading online fashion retailer, to bring its own-brand labels to India. Under this long-term licensing agreement, Reliance Retail will be the exclusive retail partner for ASOS across online and offline channels in India.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom e-commerce apparel market based on the below-mentioned segments:

United Kingdom E-Commerce Apparel Market, By Pricing Model

- Discounted

- Premium

United Kingdom E-Commerce Apparel Market, By Platform Type

- Third Party Retailer

- Company's Own

Need help to buy this report?