United Kingdom Drug Screening Market Size, Share, and COVID-19 Impact Analysis, By Sample Type (Urine and Oral Fluid), By Drug Type (Alcohol and Cannabis (Marijuana)), and United Kingdom Drug Screening Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Drug Screening Market Insights Forecasts to 2035

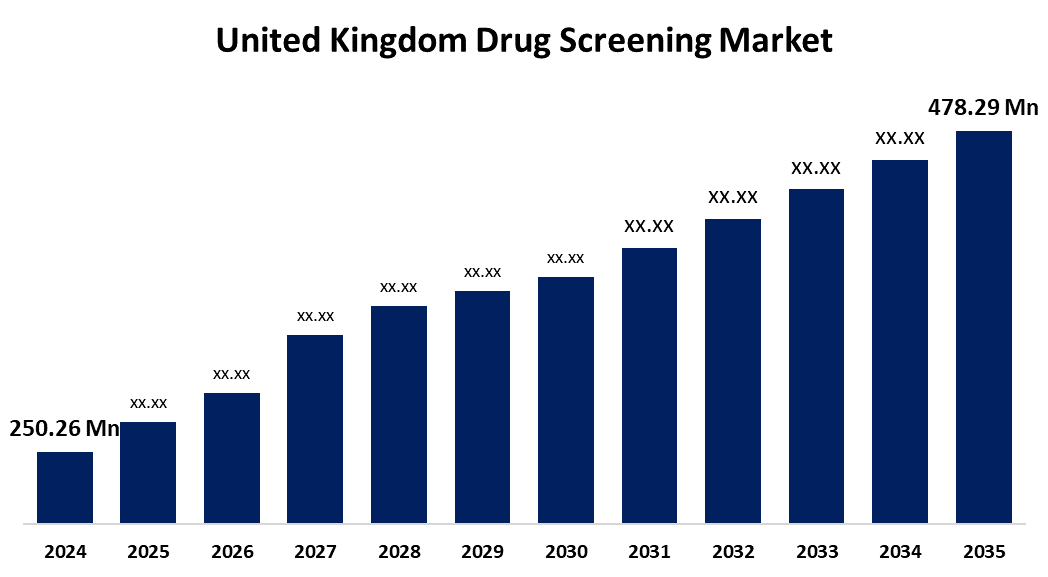

- The United Kingdom Drug Screening Market Size was estimated at USD 250.26 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.07% from 2025 to 2035

- The United Kingdom Drug Screening Market Size is Expected to Reach USD 478.29 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Drug Screening Market Size is Anticipated to reach USD 478.29 Million By 2035, Growing at a CAGR of 6.07% from 2025 to 2035. The increased government attempts to prevent drug use, greater public health awareness, and the extensive use of screening in the fields of criminal justice, sports, and employment, which encourages early identification and guarantees safety compliance.

Market Overview

The United Kingdom drug screening market refers to the industry involved with detecting the presence of drugs or their metabolites in biological samples, such as blood, urine, or saliva. It supports initiatives to prevent substance misuse and guarantee adherence to safety and legal requirements, and it is essential to law enforcement, workplace safety, sports integrity, and healthcare diagnostics. There is potential for creative diagnostic solutions due to the growing demand for rapid and exact testing technology. Market expansion is further supported by expansion in industries including criminal justice, sports groups, and rehabilitation facilities. Furthermore, the development of point-of-care testing and the increase in government programs encouraging drug-free settings open up new opportunities for market participants to provide accessible, reasonably priced, and effective drug screening goods and services. Advanced rapid testing kits, portable point-of-care instruments, and immunoassays with great sensitivity. Accuracy and speed are improved by combining AI and digital reporting. Saliva and breath analysis are two non-invasive sample techniques that are becoming more popular because they are more convenient for users and have a wider range of screening applications.

Report Coverage

This research report categorizes the market for the United Kingdom drug screening market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom Drug screening market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom drug screening market.

United Kingdom Drug Screening Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 250.26 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.07% |

| 2035 Value Projection: | USD 478.29 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Sample Type, By Drug Type and COVID-19 Impact Analysis |

| Companies covered:: | Danimer Scientific, PolyFerm Canada, RWDC Industries, Abbott Laboratories, Thermo Fisher Scientific Inc., Alere Inc., Siemens Healthineers, Randox Laboratories Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing awareness of occupational safety and strict laws requiring frequent drug testing in all sectors of the economy. Growing worries regarding substance addiction, particularly in the transportation and healthcare industries, increase the need for trustworthy screening methods. Technological innovations that increase efficiency and accuracy, such fast-testing kits and more accurate detection techniques, promote broader adoption. The market's expansion is further supported by the growing emphasis on employee wellness initiatives and preventive healthcare. Increased drug testing in rehabilitation and criminal justice facilities also helps to maintain demand. The market for drug screening in the UK is growing as a result of these combined causes.

Restraining Factors

The high expenses of complex testing tool and worries about data security and privacy. Widespread use may also be hampered by uneven regulatory frameworks and the possibility of false positives. Market expansion and implementation are also hampered by low awareness in some industries.

Market Segmentation

The United Kingdom drug screening market share is classified into sample type and drug type.

- The urine segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom drug screening market is segmented by sample type into urine and oral fluid. Among these, the urine segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to its exceptional accuracy in detecting a variety of chemicals and its non-invasive, economical collection. Consistent demand and market expansion are driven by its established testing standards and convenience of usage.

- The alcohol segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom drug screening market is segmented by drug type into alcohol and cannabis (marijuana). Among these, the alcohol segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of widespread use, stringent laws and employment policies, and growing awareness of alcohol misuse. Strong testing procedures and rising monitoring needs in the medical, rehabilitation, and law enforcement fields fuel the market's steady expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom drug screening market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Danimer Scientific

- PolyFerm Canada

- RWDC Industries

- Abbott Laboratories

- Thermo Fisher Scientific Inc.

- Alere Inc.

- Siemens Healthineers

- Randox Laboratories Ltd

- Others.

Recent Developments:

- In December 2023, Quest Diagnostics introduced a new 88-compound test panel for psychoactive substances to detect a broader range of substances in workplace settings.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom drug screening market based on the below-mentioned segments

United Kingdom Drug Screening Market, By Sample Type

- Urine

- Oral Fluid

United Kingdom Drug Screening Market, By Drug Type

- Alcohol

- Cannabis (Marijuana)

Need help to buy this report?