United Kingdom Drone Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed-Wing Drone, Rotary Blade Drone, and Hybrid Drone), By End Use (Commercial, Consumer, and Military), and UK Drone Market Insights, Industry Trend, Forecasts to 2035

Industry: Aerospace & DefenseUnited Kingdom Drone Market Forecasts to 2035

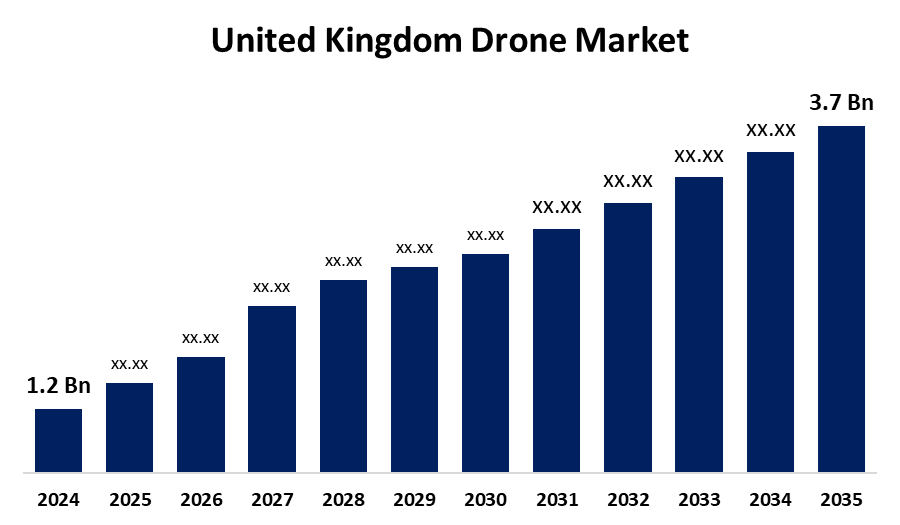

- The United Kingdom Drone Market Size Was Estimated at USD 1.2 Billion in 2024

- The UK Drone Market Size is Expected to Grow at a CAGR of around 10.78% from 2025 to 2035

- The UK Drone Market Size is Expected to Reach USD 3.7 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The UK Drone Market Size is anticipated to Reach USD 3.7 Billion by 2035, Growing at a CAGR of 20.58% from 2025 to 2035. The market is driven by the expanding applications in the construction and infrastructure sectors, the growing demand for drone delivery services in e-commerce and logistics, the growing use of drones in agriculture for crop monitoring and management, and technological advancements in drone navigation and automation systems.

Market Overview

The UK Drone Market Size includes all aspects of drone manufacturing, together with their arrangement and distribution. The market includes both commercial and recreational drone applications, while it increasingly prioritizes aerial photography alongside drone delivery services and data collection across multiple industrial sectors. A drone functions as a hovering robot that operates through remote control and autonomous flight plans that utilize software and GPS, and onboard sensors. The main applications of drones consist of surveillance and search and rescue, but their capabilities extend to weather monitoring and videography, as well as agricultural monitoring and delivery services, and traffic surveillance. The increasing need for drone deliveries, particularly in e-commerce and logistics, is propelling the UK drone market's rapid expansion. Companies like Amazon and UPS are using drones to improve last-mile delivery in crowded metropolitan areas as more UK households shop online and make weekly purchases. Drones offer faster, more efficient, and cost-effective deliveries.

The UK drone market is expanding due to increased use in agricultural and public safety. Farmers employ drones for real-time crop monitoring and effective resource management, reducing wastage by up to 50%. Emergency services use drones for surveillance, rescue, and hazard assessment, improving safety and operational efficiency. Coupled with ongoing technological advancements, these trends are driving strong growth in the UK drone market.

Report Coverage

This research report categorizes the market for the UK drone market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom drone market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom drone market.

United Kingdom Drone Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 10.78% |

| 2035 Value Projection: | USD 3.7 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End Use |

| Companies covered:: | Boeing, Hexagon Geosystems, Yuneec, AeroVironment, Teledyne FLIR, Grahams Drones, senseFly, Parrot, Northrop Grumman, Raytheon, Flyability, 3D Robotics, DJI, Lockheed Martin, Delair, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drone market in the United Kingdom is growing rapidly because DEFRA drives innovation, which boosts agricultural productivity by using precision farming techniques. Drones help monitor crops and estimate yields and manage resources, particularly in areas such as East Anglia and the Midlands. The UK Civil Aviation Authority has made improvements to its regulations, which speed up certification processes, thus making it easier for new commercial drone operators to enter the market. The implementation of AI together with machine learning has transformed drone capabilities for navigation and data analysis, and automation processes, while tech companies and academic institutions maintain support for ongoing innovation.

Restraining Factors

The drone market in the UK faces strict airspace regulations, together with privacy concerns and low acceptance by the general public. The market faces additional barriers because of expensive initial costs combined with technical issues such as short battery duration and the possibility of incorrect usage leading to accidents. Commercial drones face potential delays in their widespread adoption because of legal restrictions and their reliance on weather conditions. These factors hamper the UK drone market during the forecast period.

Market Segmentation

The United Kingdom drone market share is classified into type and end use.

- The fixed-wing drone segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom drone market is segmented by type into fixed-wing drone, rotary blade drone, and hybrid drone. Among these, the fixed-wing drone segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Fixed-wing drones demonstrate outstanding flight endurance, which establishes their essential role for conducting long-distance operations in surveillance and agricultural monitoring, and disaster response.

- The military segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom drone market is segmented by end use into commercial, consumer, and military. Among these, the military segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The armed forces across various nations utilize military drones primarily for identifying targets and conducting surveillance missions and intelligence operations, and combat missions. Nations direct their funds toward building and purchasing sophisticated drone systems because of their rising focus on improving border protection and counterterrorism efforts, and military strength.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom drone market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Boeing

- Hexagon Geosystems

- Yuneec

- AeroVironment

- Teledyne FLIR

- Grahams Drones

- senseFly

- Parrot

- Northrop Grumman

- Raytheon

- Flyability

- 3D Robotics

- DJI

- Lockheed Martin

- Delair

- Others

Recent Developments:

- In August 2024, Orkney I-Port, has been confirmed that the city's first commercial drone postal service, would continue to run until February 2026. The partnership was formed in August 2023 by London-based Skysports, a leading drone firm, and Royal Mail.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom drone market based on the below-mentioned segments:

United Kingdom Drone Market, By Type

- Fixed-Wing Drone

- Rotary Blade Drone

- Hybrid Drone

United Kingdom Drone Market, By End Use

- Commercial

- Consumer

- Military

Need help to buy this report?