United Kingdom Digital X-ray Devices Market Size, Share, and COVID-19 Impact Analysis, By Technology (Computed Radiography and Direct Radiography), By Application (Orthopaedic and Cancer), and United Kingdom Digital X-ray Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Digital X-ray Devices Market Insights Forecasts to 2035

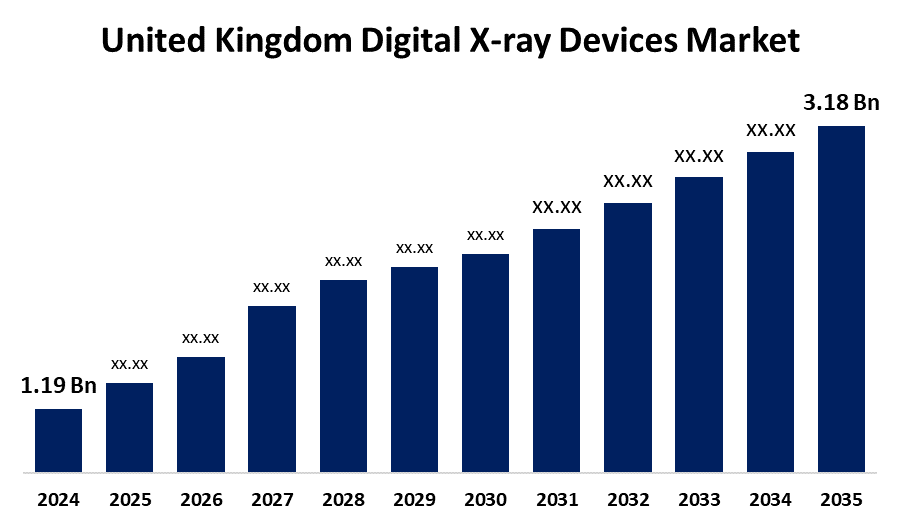

- The United Kingdom Digital X-ray Devices Market Size Was Estimated at USD 1.19 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.35% from 2025 to 2035

- The United Kingdom Digital X-ray Devices Market Size is Expected to Reach USD 3.18 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Digital X-ray Devices Market Size is anticipated to reach USD 3.18 Billion by 2035, growing at a CAGR of 9.35% from 2025 to 2035. The increasing geriatric population, rising chronic illness prevalence, growing need for enhanced diagnostic imaging, and the rapid demand for digital healthcare technologies that provide improved image quality, efficiency, and lower radiation exposure.

Market Overview

The United Kingdom digital X-ray devices market refers to the industry focused on the creation, manufacturing, and marketing of digital radiography equipment for use in medical imaging. Digital X-ray machines, in contrast to conventional film-based systems, use digital detectors to electronically collect and store pictures, allowing for rapid processing, improved image quality, and simpler data exchange. By enhancing patient outcomes and operational effectiveness, this market supports diagnostic applications in hospitals, clinics, and diagnostic centers and is essential to contemporary healthcare. Increasing investments in AI-integrated diagnostic solutions, growing need for portable and mobile imaging devices, and escalating healthcare digitization. The potential for innovation, market expansion, and enhanced patient care nationally is further increased by growing applications in emergency, orthopedic, and dental care, as well as government programs to update healthcare infrastructure. Customizable detectors for patient comfort, AI integration for improved diagnostic accuracy, and portable devices that allow for more rapid more effective imaging in a variety of healthcare environments.

Report Coverage

This research report categorizes the market for the United Kingdom digital X-ray devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom digital X-ray devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom digital X-ray devices market.

United Kingdom Digital X-ray Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.19 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 9.35% |

| 2035 Value Projection: | USD 3.18 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 231 |

| Tables, Charts & Figures: | 113 |

| Segments covered: | By Technology and By Application |

| Companies covered:: | Philips Healthcare, GE Healthcare, Siemens Healthineers, Canon Medical Systems, Fujifilm Holdings Corporation., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising incidence of chronic illnesses, including cancer, heart disease, and arthritis, has increased the need for accurate and timely diagnostic instruments. Advances in technology, such as high-resolution imaging and AI integration, have increased workflow efficiency and diagnosis accuracy. The expansion of the business is further supported by government programs encouraging digital healthcare and higher expenditures on updating medical infrastructure. Furthermore, market expansion is being driven by the aging population, which is more susceptible to bone and joint problems, in addition to the expanding use of portable and mobile X-ray equipment in outpatient and emergency settings.

Restraining Factors

The initial expenditures for sophisticated imaging systems, a shortage of qualified personnel to run and decipher digital diagnostics, and privacy issues with data. Furthermore, widespread integration across all areas and healthcare levels is limited by slower acceptance in smaller healthcare facilities.

Market Segmentation

The United Kingdom digital X-ray devices market share is classified into technology and application.

- The direct radiography segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom digital X-ray devices market is segmented by technology into computed radiography and direct radiography. Among these, the direct radiography segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing demand for shorter wait times for patients, more effective diagnostic workflows, and interaction with hospital information systems. Modern health care institutions find it desirable due to the ease of use, reduced long-term expenditures, and low maintenance requirements.

- The orthopaedic segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom digital X-ray devices market is segmented by application into orthopaedic and cancer. Among these, the orthopaedic segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of increasing rates of musculoskeletal illnesses, joint diseases, and fractures, particularly in the elderly. Demand is further fueled by rising sports and physical activity engagement as well as the requirement for enhanced imaging for surgery planning and post-operative evaluation.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom digital X-ray devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Philips Healthcare

- GE Healthcare

- Siemens Healthineers

- Canon Medical Systems

- Fujifilm Holdings Corporation.

- Others

Recent Developments:

- In January 2024, Carestream Health introduced the DRX-Excel Plus X-ray system, a versatile solution for both fluoroscopy and general radiology. It delivers real-time, high-quality images for a wide range of exams while enhancing workflow efficiency and productivity. The system's advanced features aim to improve user, patient, and administrator experiences.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom digital X-ray devices market based on the below-mentioned segments:

United Kingdom Digital X-ray Devices Market, By Technology

- Computed Radiography

- Direct Radiography

United Kingdom Digital X-ray Devices Market, By Application

- Orthopaedic

- Cancer

Need help to buy this report?