United Kingdom Digital Payment Market Size, Share, and COVID-19 Impact Analysis, By Mode of Payment (Bank Cards, Digital Currencies, Digital Wallets, Net Banking, Point of Sales, and Others), By Organization Size (Small Medium Enterprise, Large Enterprise), and UK Digital Payment Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyUnited Kingdom Digital Payment Market Forecasts to 2035

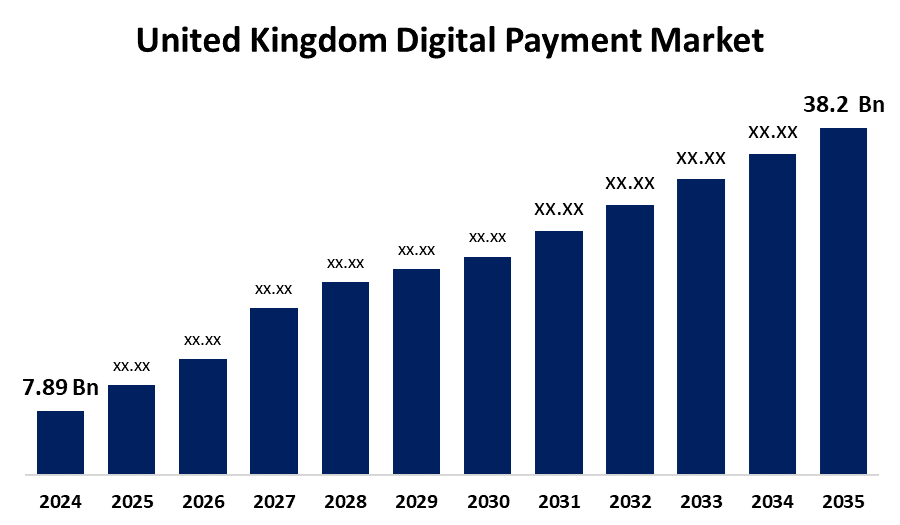

- The United Kingdom Digital Payment Market Size Was Estimated at USD 7.89 Billion in 2024

- The UK Digital Payment Market Size is Expected to Grow at a CAGR of around 15.42% from 2025 to 2035

- The UK Digital Payment Market Size is Expected to Reach USD 38.2 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Digital Payment Market is anticipated to reach USD 38.2 billion by 2035, growing at a CAGR of 15.42% from 2025 to 2035. A significant factor propelling the digital payment industry is the growing use of digital payments for online purchases because of their convenience and shorter transaction times. Additionally, the market for digital payments is expanding at a faster rate due to the growing popularity of smartphones and fast internet connectivity, the growing demand of customers for digital payments, and the widespread use of this payment method by retailers.

Market Overview

The UK digital payment market refers to the use of electronic platforms like mobile devices and the internet to securely transfer money, replacing cash and traditional banking. Common methods include card payments, online transfers, and cryptocurrencies. Their adoption is driven by smartphone use, internet access, and e-commerce growth. Digital payments offer convenience, speed, and security, transforming financial transactions and supporting a connected, evolving UK economy. The growing consumer demand for contactless and mobile payment capabilities. With this rising demand, more retailers and service providers are integrating digital payment technology. Adoption of digital payments is also being pushed by governments to develop a cashless economy. The market presents opportunities to cater to different age groups, with younger users preferring digital wallets and older individuals gradually shifting from traditional payments. Fintech companies are driving innovation through offerings like subscriptions, micro-payments, and peer-to-peer transfers, a trend boosted by the COVID-19 pandemic and increased online shopping. As digital payments become more widespread, traditional banks are pressured to modernize their services. Prioritizing data security and privacy is essential for maintaining consumer confidence and supporting continued growth in the UK’s digital payments market.

Report Coverage

This research report categorizes the market for the UK digital payment market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom digital payment market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom digital payment market.

United Kingdom Digital Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7.89 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 15.42% |

| 2035 Value Projection: | USD 38.2 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 109 |

| Segments covered: | By Mode, By Organization and COVID-19 Impact Analysis |

| Companies covered:: | Barclays, Adyen, TransferWise, Apple Pay, American Express, Square, PayPal, Stripe, Visa, Google Pay, Worldpay, Revolut, Mastercard, Klarna, HSBC, Others, and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Contactless payments have increased significantly as a result of changing consumer preference induced by COVID-19 and in response to COVID-19, propelling growth in the UK digital payment market. Programmes from governments, such as the Faster Payments Service, enhance the ecosystem for payments, support rapid payment to merchants, and stimulate acceptance. The rapid expansion of electronic commerce has also spurred growth in electronic transactions, which requires merchants to develop a competent and strategic digital payment system. The three drivers of consumer preference, enabling legislation, and e-commerce expansion combine to create the main forces driving growth.

Restraining Factors

The concerns regarding data security and privacy are currently an impediment to the UK digital payments sector because they affect customer trust. Similarly, the development of digital payments nationally could be constrained by technology barriers for older consumers, regulatory compliance issues, and potential breaks in digital infrastructure. These factors hamper the digital payment market during the forecast period.

Market Segmentation

The United Kingdom digital payment market share is classified into mode of payment and organization size.

- The point of sales digital payment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom digital payment market is segmented by mode of payment into bank cards, digital currencies, digital wallets, net banking, point of sales, and others. Among these, the point of sales segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Point-of-sale systems are utilized in retail locations to process transactions. Point-of-sale systems allow companies to offer fast checkout alternatives, offer a unique customer experience, and accept various forms of payment. There is a growth of cloud-based point-of-sale systems among retailers throughout the UK in order to increase efficiency and improve customer satisfaction.

- The large enterprise segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom digital payment market is segmented by organization size into small medium enterprise, large enterprise. Among these, the large enterprise segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

Digital payment services are fast becoming an essential means for large retailers to allow customers to make purchases and maintain social distancing. Stores are using digital payment services like e-wallets, smart banking cards, and point-of-sale systems to speed up the checkout process.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom digital payment market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Barclays

- Adyen

- TransferWise

- Apple Pay

- American Express

- Square

- PayPal

- Stripe

- Visa

- Google Pay

- Worldpay

- Revolut

- Mastercard

- Klarna

- HSBC

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom digital payment market based on the below-mentioned segments:

United Kingdom Digital Payment Market, By Mode of Payment

- Bank Cards

- Digital Currencies

- Digital Wallets

- Net Banking

- Point of Sales

- Others

United Kingdom Digital Payment Market, By Organization Size

- Small Medium Enterprise

- Large Enterprise

Need help to buy this report?