United Kingdom Dietary Supplements Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Vitamin, Combination Dietary Supplement, Herbal Supplement, Fish Oil & Omega Fatty Acid, Protein, and Other), By Form (Tablets, Capsules, Powder, Liquids, and Soft Gels), and UK Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Dietary Supplements Market Size Forecasts to 2035

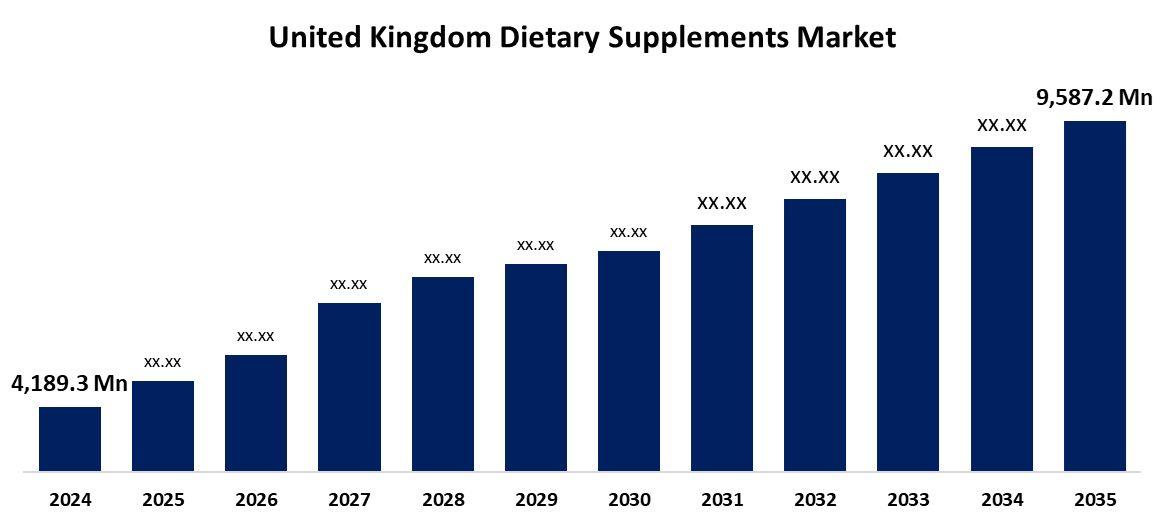

- The United Kingdom Dietary Supplements Market Size Was Estimated at USD 4,189.3 Million in 2024

- The UK Dietary Supplements Market Size is Expected to Grow at a CAGR of around 7.82% from 2025 to 2035

- The UK Dietary Supplements Market Size is Expected to Reach USD 9,587.2 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Dietary Supplements Market Size is anticipated to reach USD 9,587.2 Million by 2035, growing at a CAGR of 7.82% from 2025 to 2035. Growing health consciousness, trends in personalised nutrition, and the expansion of retail and e-commerce channels have all contributed to the growth of the UK dietary supplement market by improving consumer access and increasing demand for easy, focused wellness products.

Market Overview

The UK dietary supplements market is essential for promoting general health, addressing specific wellness needs, including immunity, energy, and ageing, and bridging nutritional deficiencies. Strong demand for dietary supplements is being driven by changes in lifestyle, ageing populations, and rising health consciousness. Supplements are sought after by consumers to enhance well-being, manage chronic ailments, and supplement diets. The market is growing as a result of developments in supplement formulations and the increase in personalised nutrition. Furthermore, increased accessibility due to the growth of online retail channels has made nutritional supplements a crucial component of many UK consumers' everyday health regimens.

Customers' popularity in the organic benefits offered by these supplements. Moreover, consumer knowledge and, consequently, demand for dietary supplements have greatly benefited from availability and thorough educational materials through websites, medical journals, and health professionals. In the UK, especially, probiotics supplements have captured a lot of interest for their potential benefits for digestive health. Growing understanding of the gut-brain connection, as well as the importance of gut health for overall health, has greatly increased demand for dietary supplements that support a healthy gut microbiome. The UK e-commerce growth and increased interest in fitness and health have spurred the demand for dietary supplements and performance enhancers. Companies that are responsive to consumer trends and regulatory conditions can take advantage of the significant opportunities available in the wider dietary supplements market.

Report Coverage

This research report categorizes the market for the UK dietary supplements market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom dietary supplements market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom dietary supplements market.

United Kingdom Dietary Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,189.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.82% |

| 2035 Value Projection: | USD 9,587.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 124 |

| Segments covered: | By Product Type, By Form and COVID-19 Impact Analysis |

| Companies covered:: | GlaxoSmithKline plc, Nestle, Amway, Abbott, Archer Daniels Midland, Myprotein Group, Herbalife, Danone Holdings, Pfizer, Vitabiotics, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK dietary supplement market is growing due to an ageing population and increased health awareness. Almost half of the UK population has long-term health issues that create demand for dietary supplements that help with energy, mental health, and immunity. Dietary supplements for joint, bone, cognitive, and cardiovascular health will continue to grow with the ageing population, expected to make up 27% of the total population in 2072. Chronic disease, specifically arthritis and hypertension, also additive the demand for certain types of products, like glucosamine, omega-3, turmeric, and magnesium. Consumers generally prefer clean-label, plant-based vitamins that support holistic wellness. Health promotion and preventative care stimulate growth and innovation in the area of customised supplement formulations.

Restraining Factors

Authorities such as the FSA and EFSA, which oversee ingredient safety, labelling, and health claims, provide stringent regulatory obstacles to the UK dietary supplement business. Compliance is expensive and difficult, particularly for startups and smaller businesses. Changes made after Brexit increase import and certification requirements, which lead to delays and increased expenses. Adherence is crucial because false health claims put a company at risk of legal action and product removal. These factors hamper the dietary supplements market during the forecast period.

Market Segmentation

The United Kingdom dietary supplements market share is classified into product type and form.

- The combination dietary supplement segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom dietary supplements market is segmented by product type into vitamin, combination dietary supplement, herbal supplement, fish oil & omega fatty acid, protein, and other. Among these, the combination dietary supplement segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The growing customer demand for all-encompassing health support and convenience. These supplements address the needs of people seeking all-encompassing solutions to enhance immunity, vitality, and general well-being by combining several vitamins, minerals, and other nutrients into a single product. Combination supplements enable the treatment of several health issues in a single formulation, saving time and effort as consumer attitudes shift towards preventative healthcare.

- The tablets segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom dietary supplements market is segmented by form into tablets, capsules, powder, liquids, and soft gels. Among these, the tablets segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Convenience, portability, ease of ingestion, and long shelf life are factors contributing to this category's rise. The active components are delivered consistently every serving, due to the accurate and regulated dosages that tablets provide. The most widely used form of dietary supplements at the moment is tablets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom dietary supplements market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GlaxoSmithKline plc

- Nestle

- Amway

- Abbott

- Archer Daniels Midland

- Myprotein Group

- Herbalife

- Danone Holdings

- Pfizer

- Vitabiotics

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom dietary supplements market based on the below-mentioned segments:

United Kingdom Dietary Supplements Market, By Product Type

- Vitamin

- Combination Dietary Supplement

- Herbal Supplement

- Fish Oil & Omega Fatty Acid

- Protein

- Other

United Kingdom Dietary Supplements Market, By Form

- Tablets

- Capsules

- Powder

- Liquids

- Soft Gels

Need help to buy this report?