United Kingdom Diabetes Market Size, Share, and COVID-19 Impact Analysis, By Type (Diabetes Type 1, Diabetes Type 2), By Supporting Product (Insulin Pump Devices, Insulin Syringes, Others), By Monitoring Devices (Self-Monitoring Blood Glucose [Glucometer Devices, Blood Glucose Test Strips, and Lancets], Continuous Glucose Monitoring [Sensors and Transmitters]), and United Kingdom Diabetes Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Diabetes Market Insights Forecasts to 2035

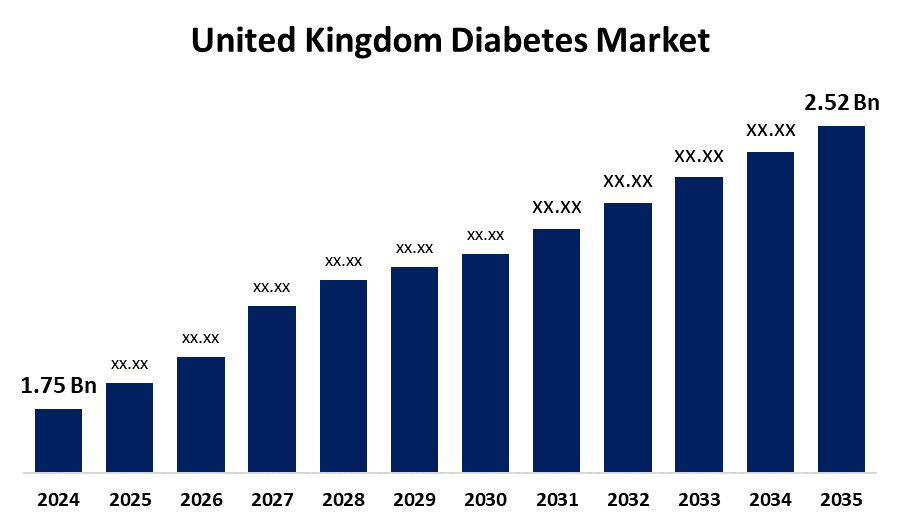

- The United Kingdom Diabetes Market Size was Estimated at USD 1.75 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.37% from 2025 to 2035

- The United Kingdom Diabetes Market Size is Expected to Reach USD 2.52 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Diabetes Market Size is anticipated to reach USD 2.52 Billion by 2035, Growing at a CAGR of 3.37% from 2025 to 2035. The rising incidence of diabetes, and obesity rates are the main factors propelling the market. Further, large firms are focusing on developing cutting-edge products and technical innovation to gain a sizable share of the market.

Market Overview

The United Kingdom diabetes market refers to the business of disease diagnostics, which recognizes its level of tolerance with a focus on the production and application of devices, including insulin pumps, blood glucose meters, continuous glucose monitors (CGMs), and associated accessories, among other medical equipment used to treat and manage diabetes. Diabetes is a condition where high blood sugar levels are caused by several unmodifiable factors. Through the use of diabetes technologies and virtual consultations between patients and healthcare professionals, the pandemic also brought to light prospects for further and continued improvements in the delivery of diabetes treatment. The prevalence of newly diagnosed Type 1 and Type 2 diabetes is on the rise, primarily as a result of poor diet, physical inactivity, and obesity. The rising use of diabetic care products is demonstrated by the sharp rise in the incidence and prevalence of diabetic patients, as well as healthcare costs. There is a rising need for novel medicines for diabetes. According to a recent government survey in May 2021, diabetes diagnoses in the UK have doubled over the last 15 years, with over 4.9 million people currently living with the condition. About 90% of these cases are type 2 diabetes, which is largely influenced by lifestyle factors. Additionally, 13.6 million people are at increased risk of developing type 2 diabetes.

Report Coverage

This research report categorizes the market for the United Kingdom diabetes market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom diabetes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom diabetes market.

United Kingdom Diabetes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.75 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 3.37% |

| 2035 Value Projection: | USD 2.52 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Supporting Product, By Monitoring Devices and COVID-19 Impact Analysis |

| Companies covered:: | AstraZeneca, Boehringer Ingelheim, Novo Nordisk, Sanofi, Eli Lilly and Company, Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for UK diabetes is driven by the rising incidence of diabetes brought on by age, obesity, and bad lifestyle habits. The majority of new cases of diabetes will be type 2 diabetes, driven by changes in dietary risks and obesity rates due to overweight or obesity. The number of diabetes cases is increasing due to smoking, having high cholesterol would increase the prevalence of diabetes and, consequently, the demand for diabetes devices. Further, a primary driver is the growing awareness of diabetes prevention and control, as well as the rise in early detection and diagnosis that fuels the need for treatment. Further, governments and organizations are actively working on projects and providing funds and research and development of diabetic medications, which propel the market growth.

Restraining Factors

The UK diabetes market is being hampered by the rising cost of diabetes care equipment, such as insulin pumps and continuous glucose monitors. The market expansion is being hampered by the stringent regulatory environment regarding these devices.

Market Segmentation

The United Kingdom diabetes market share is classified into type, supporting product, and monitoring devices.

- The diabetes type 2 segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom diabetes market is segmented by type into diabetes type 1, and diabetes type 2. Among these, the diabetes type 2 segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to aging, genetics, and lifestyle choices. The segment expansion is propelled by the increasing number of clinical trials that are being conducted for type 2 diabetes medications.

- The insulin syringes segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

The United Kingdom diabetes market is divided by supporting product into insulin pump devices, insulin syringes, and others. Among these, the insulin syringes segment accounted for the highest share in 2024 and is anticipated to grow at a significant CAGR over the forecast period. This is due to the increased prevalence of chronic diseases like diabetes and obesity, and there is a high demand for insulin syringes. Another significant factor driving the market expansion for insulin syringes is the steadily increasing number of elderly consumers and a growing culture of self-care routines.

- The self-monitoring blood glucose segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom diabetes market is differentiated by monitoring devices into self-monitoring blood glucose [glucometer devices, blood glucose test strips, and lancets], and continuous glucose monitoring [sensors and transmitters]. Among these, the self-monitoring blood glucose [glucometer devices, blood glucose test strips, and lancets] segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because these devices are reasonably priced and accurate in measuring blood glucose levels. Additionally, businesses are introducing affordable, cutting-edge, user-friendly products as a result of technological breakthroughs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom diabetes market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AstraZeneca

- Boehringer Ingelheim

- Novo Nordisk

- Sanofi

- Eli Lilly and Company

- Others

Recent Developments:

- In February 2025, Biocon launched Liraglutide, a drug for diabetes and obesity management, in the UK under the brand names Liraglutide Biocon for diabetes and Biolide for chronic weight management. This follows approval from the UK's Medicines and Healthcare Products Regulatory Agency (MHRA).

- In October 2024, the UK government announced a landmark collaboration with Eli Lilly, the world's largest pharmaceutical company, to boost the life sciences sector with a £279 million investment. This partnership, which was revealed at the International Investment Summit, aimed to accelerate medical innovation, particularly in obesity and diabetes treatment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom diabetes market based on the below-mentioned segments:

United Kingdom Diabetes Market, By Type

- Diabetes Type 1

- Diabetes Type 2

United Kingdom Diabetes Market, By Supporting Product

- Insulin Pump Devices

- Insulin Syringes

- Others

United Kingdom Diabetes Market, By Monitoring Devices

- Self-Monitoring Blood Glucose

- Glucometer Devices

- Blood Glucose Test Strips

- Lancets

- Continuous Glucose Monitoring

- Sensors

- Transmitters

Need help to buy this report?