United Kingdom Diabetes Drugs Market Size, Share, and COVID-19 Impact Analysis, By Drug Class (Insulin, DPP-4 Inhibitors, GLP-1 Receptor Agonists, SGLT2 Inhibitors, and Others), By Diabetes Types (Type 1, Type 2, Diabetes Type 3, Diabetes Type 4, and Diabetes Type 5), and United Kingdom Diabetes Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Diabetes Drugs Market Insights Forecasts to 2035

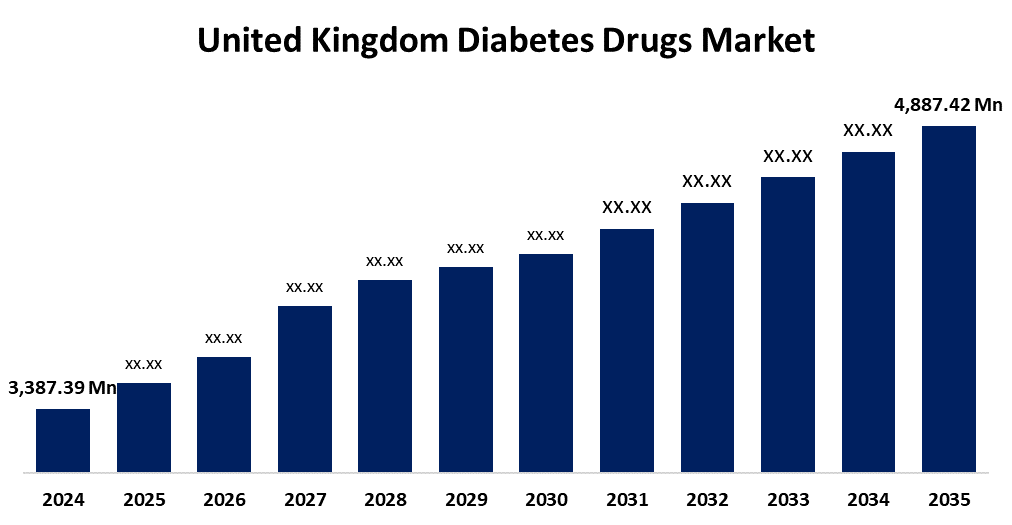

- The United Kingdom Diabetes Drugs Market Size Was Estimated at USD 3,387.39 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.39% from 2025 to 2035

- The United Kingdom Diabetes Drugs Market Size is Expected to Reach USD 4,887.42 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Diabetes Drugs Market Size is anticipated to reach USD 4,887.42 Million by 2035, growing at a CAGR of 3.39% from 2025 to 2035. The increasing rates of obesity, sedentary lifestyles, aging populations, and rising diabetes prevalence. Sustained demand and market growth are further supported by improvements in medication formulations, more awareness, and government programs for better diabetes treatment.

Market Overview

The United Kingdom diabetes drugs market refers to the industry focused on the creation, manufacturing, and marketing of pharmacological therapies for the management and control of diabetes. This covers insulin treatments, oral hypoglycemic medications, and more recent pharmacological classes such as SGLT2 inhibitors and GLP-1 receptor agonists. The market is driven by healthcare regulations, innovation, and increased awareness of diabetes treatment and prevention initiatives, and it caters to the UK's expanding diabetic population. The increased incidence of diabetes, particularly Type 2, as a result of sedentary lifestyles, obesity, and aging. Treatment outcomes are being improved by developments in pharmacological development, such as SGLT2 inhibitors and GLP-1 receptor agonists. Access and adherence are improved by government assistance, raised awareness, and digital health integration. The market potential is also being increased by the increased emphasis on preventive healthcare, which is encouraging early diagnosis and long-term treatment requirements. The development of innovative therapies such SGLT2 inhibitors and GLP-1 receptor agonists, customized treatment regimens, digital health integration, and combination medications that increase effectiveness, boost patient adherence, and lower long-term consequences.

Report Coverage

This research report categorizes the market for the United Kingdom diabetes drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom diabetes drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom diabetes drugs market.

United Kingdom Diabetes Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3,387.39 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.39% |

| 2035 Value Projection: | USD 4,887.42 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 279 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Drug Class and By Diabetes Types |

| Companies covered:: | Novo Nordisk A/S, Sanofi, Merck & Co., Inc, Eli Lilly and Company, AstraZeneca, Takeda Pharmaceutical Company Limited, Boehringer Ingelheim International GmbH, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing incidence of diabetes, particularly Type 2, as a consequence of sedentary lifestyles, aging populations, and rising obesity rates. Demand is also being increased by growing awareness of diabetes management, early diagnosis, and preventative healthcare. Treatment outcomes are being improved by technological developments in drug formulation, such as the creation of more patient-friendly and efficient drugs like SGLT2 inhibitors and GLP-1 receptor agonists. Government programs, better healthcare facilities, and greater availability of cutting-edge treatments all contribute to market expansion. Furthermore, the incorporation of digital health technologies promotes long-term disease control and medication adherence, which supports the market's steady growth.

Restraining Factors

The high treatment expenses, particularly for cutting-edge treatments, which could restrict access. Patient non-compliance, possible adverse pharmacological effects, and strict regulatory permissions all impede market expansion. Effective diabetes treatment and medication adoption are also hampered by low awareness in certain populations.

Market Segmentation

The United Kingdom diabetes drugs market share is classified into drug class and diabetes types.

- The GLP-1 receptor agonists segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom diabetes drugs market is segmented by drug class into insulin, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT2 inhibitors, and others. Among these, the GLP-1 receptor agonists segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed because they promote weight loss, reduce blood sugar, and improve cardiovascular health. Their use in the UK market for diabetes medications is also fueled by improved formulations, more patient adherence, and wider therapeutic uses.

- The type 2 segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom diabetes drugs market is segmented by diabetes types into type 1, type 2, diabetes type 3, diabetes type 4, and diabetes type 5. Among these, the type 2 segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of increasing incidence as a consequence of sedentary lifestyles, obesity, and aging. Improvements in oral and injectable medicines, early diagnosis, more knowledge, and individualized treatment plans all contribute to improved patient outcomes and increased demand in the UK market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom diabetes drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Novo Nordisk A/S

- Sanofi

- Merck & Co., Inc

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Others.

Recent Developments:

- In February 2025, Biocon launched its generic version of liraglutide in the UK under the brand names Liraglutide Biocon for diabetes and Biolide for chronic weight management. This launch, following approval from the Medicines and Healthcare Products Regulatory Agency (MHRA), positions Biocon as the first generics company to obtain approval for GLP-1 peptide in a major regulated market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom diabetes drugs market based on the below-mentioned segments:

United Kingdom Diabetes Drugs Market, By Drug Class

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

- Others

United Kingdom Diabetes Drugs Market, By Diabetes Types

- Type 1

- Type 2

- Diabetes Type 3

- Diabetes Type 4

- Diabetes Type 5

Need help to buy this report?