United Kingdom Defense Market Size, Share, and COVID-19 Impact Analysis, By Type (Fixed-Wing Aircraft, Rotorcraft, Ground Vehicles, Naval Vessels, C4ISR, Weapons and Ammunition, Protection and Training Equipment, Unmanned Systems), By Armed Forces (Army, Navy, Air Force), and United Kingdom Defense Market Insights, Industry Trend, Forecasts to 2035.

Industry: Aerospace & DefenseUnited Kingdom Defense Market Insights Forecasts to 2035

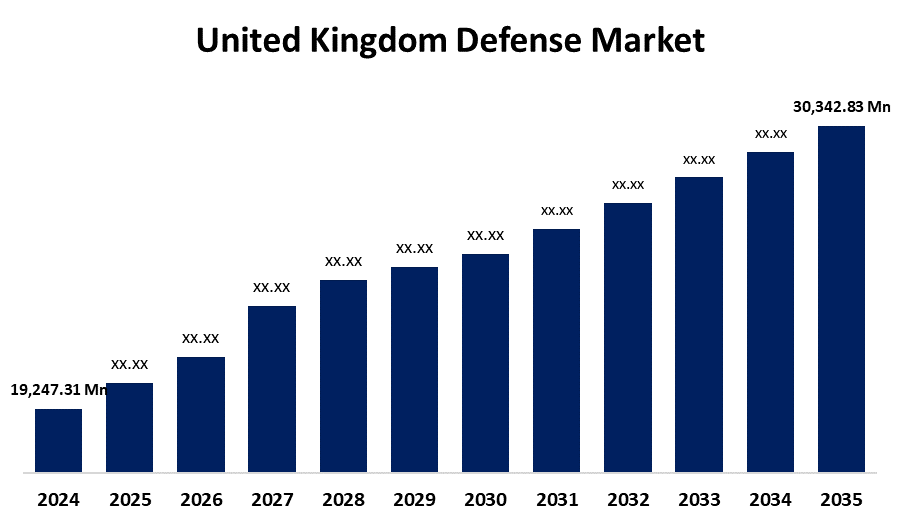

- The United Kingdom Defense Market Size was estimated at USD 19,247.31 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.22% from 2025 to 2035

- The United Kingdom Defense Market Size is Expected to Reach USD 30,342.83 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Defense Market Size is Anticipated to reach USD 30,342.83 Million By 2035, Growing at a CAGR of 4.22% from 2025 to 2035. The market is propelled by rising international disputes, and developments in military technology. Furthermore, international defense cooperation, NATO commitments, and the requirement for strong cybersecurity measures all contribute to the country's market expansion.

Market Overview

The United Kingdom defense market refers to the industry focused on the production and application of weapons systems, machinery, and associated services. Cybersecurity, intelligence, and surveillance systems are among the many sectors that govern alongside land-, sea-, and air-based weapons systems. The primary customers in this industry are administrations and military agencies, depend on defense items for missions of strategic importance, military readiness, and national security. Major defense contractors, tiers of suppliers, specialist technology companies, and research institutes are all part of this industry, which aims to improve military capabilities. Further, the development news, like recent development, in April 2025, the UK and New Zealand strengthened their defense and security partnership as part of a broader effort to protect national interests and improved global stability. Senior regulatory officers of both countries UK and New Zealand, agreed to rg1 deepen military cooperation. Such development highlights the market development for vendors and consumers as well.

Report Coverage

This research report categorizes the market for the United Kingdom defense market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom defense market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom defense market.

United Kingdom Defense Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19,247.31 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.22% |

| 2035 Value Projection: | USD 30,342.83 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Armed Forces and COVID-19 Impact Analysis |

| Companies covered:: | BAE Systems, Leonardo, Lockheed Martin, Airbus Defence and Space, Thales, MSubs Limited, Smallspark Space Systems, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kngdom defense is influenced by increased substantial investment to ensure national security and strengthen military capabilities. This covers expenditures on cybersecurity, modernization initiatives, and cutting-edge weapons. The government makes significant budgetary investments as a result of its dedication to preserving strong defense capabilities in the face of shifting geopolitical tensions and worldwide threats. The focus on cutting-edge defense capabilities also boosts economic expansion by generating employment and encouraging innovation in the defense industry. The military has adopted AI in large part due to the development of self-driving systems like autonomous ships, unmanned aerial vehicles (UAVs), and unmanned ground vehicles (UGVs). These systems can carry out a variety of activities, including target identification, surveillance, reconnaissance, and combat operations, with little or no assistance from humans.

Restraining Factors

The worldwide political and financial developments in the coming years will have a bearing on military tactics, forcing defense agencies to review existing military patterns while implementing novel strategies, such factor that hampers the market growth.

Market Segmentation

The United Kingdom defense market share is classified into type, and armed forces.

- The unmanned systems segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom defense market is segmented by type into fixed-wing aircraft, rotorcraft, ground vehicles, naval vessels, C4ISR, weapons and ammunition, protection and training equipment, and unmanned systems. Among these, the unmanned systems segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. This is due to unmanned systems are technologies and vehicles that run independently or under remote control without a human present. Moreover, commercial, industrial, and military applications all make significant use of these systems. Further, they are encompassed in Unmanned Aerial Vehicles (UAVs), Unmanned Ground Vehicles (UGVs), Unmanned Surface Vehicles (USVs), Unmanned Surface Vehicles (USVs) so military agencies and vendors got wide market growing opportunities, which boost the segment expansion.

- The navy segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United Kingdom defense market is categorized by armed forces into army, navy, and air force. Among these, the navy segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is because country geography shows they are surrounded by sea, and it has key cities which established at the coastline. This portion focused on maritime vessels, underwater defense systems, and corresponding technological advances. This sector, which includes the following categories that boost the navy segment expansion, such as Naval Combat Vessels, Unmanned Naval Systems, and Naval Infrastructure & Maintenance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom defense market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BAE Systems

- Leonardo

- Lockheed Martin

- Airbus Defence and Space

- Thales

- MSubs Limited

- Smallspark Space Systems

- Others

Recent Developments:

- In May 2025, the British Ministry of Defence (MoD) and QinetiQ launched a £160 million initiative to accelerate the development of next-generation laser weapons. This funding extended the Weapons Sector Research Framework (WSRF), which was originally awarded in July 2020. It focused on directed energy weapons like the DragonFire laser and Radio Frequency Directed Energy Weapon (RFDEW) system.

- In May 2025, Leonardo teamed up with Faculty AI to accelerate the development of next-generation defense technologies. This partnership focused on AI-driven defense capabilities, including Cognitive Intelligent Sensing (CoInS) and Electronic Warfare (EW) systems.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom defense market based on the below-mentioned segments

United Kingdom Defense Market, By Type

- Fixed-Wing Aircraft

- Rotorcraft

- Ground Vehicles

- Naval Vessels

- C4ISR

- Weapons and Ammunition

- Protection and Training Equipment

- Unmanned Systems

United Kingdom Defense Market, By Armed Forces

- Army

- Navy

- Air Force

Need help to buy this report?