United Kingdom Decentralized Finance Market Size, Share, and COVID-19 Impact Analysis, By Component (Decentralized Applications (dApps), Smart Contracts, and Blockchain Technology), By Application (Payments, Data & Analytics, Decentralized Exchange, Stablecoins, Assets Tokenization, Prediction Industry, Compliance & Identity, Marketplaces & Liquidity, and Others), and United Kingdom Decentralized Finance Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Decentralized Finance Market Insights Forecasts to 2035

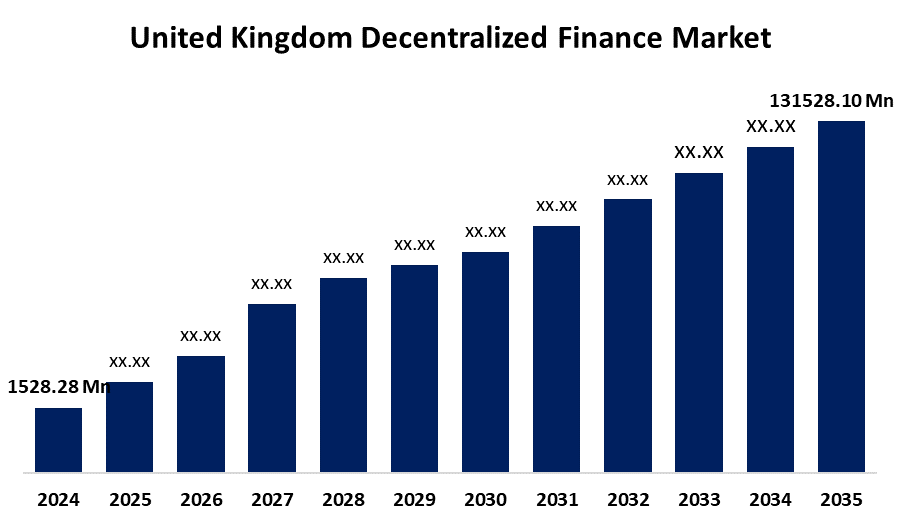

- The United Kingdom Decentralized Finance Market Size was estimated at USD 1528.28 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 49.93% from 2025 to 2035

- The United Kingdom Decentralized Finance Market Size is Expected to Reach USD 131528.10 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Decentralized Finance Market is anticipated to reach USD 131528.10 million by 2035, growing at a CAGR of 49.93% from 2025 to 2035. The market is driven by the growing need for financial transactions to be more efficient, secure, and transparent. Significant developments that are boosting the reliability and acceptance of decentralized finance solutions anywhere include the emergence of smart contracts, the process of tokenization, and advantageous governmental policies.

Market Overview

The UK decentralized finance (DeFi) market is the network of blockchain-based financial services and apps that operate in the country and allow for transparent, permissionless, peer-to-peer transactions without the need for conventional middlemen like banks or brokers. Decentralized lending, borrowing, trading, asset management, and stablecoins are just a few of the services offered in this market. Smart contracts are mainly implemented on public blockchains such as Ethereum. The UK is becoming a major center for DeFi innovation and adoption in the country due to its strong fintech infrastructure, forward-thinking legislative frameworks, and active involvement from institutional and retail investors. The expansion of DeFi platforms has been significantly accelerated by the emergence of e-sports and gaming, as developers are increasingly using DeFi tokens for in-app purchases. Additionally, trading games and collectibles have become popular blockchain genres that enable players to exchange tokens and create their distinct ecosystems. Augur, a DeFi platform that lets users wager on a range of international events, sports, and economic outcomes, is one example. It is anticipated that the development of blockchain-based prediction tools will open up new avenues for the growth of the decentralized finance sector shortly.

Report Coverage

This research report categorizes the market for the United Kingdom decentralized finance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom decentralized finance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom decentralized finance market.

United Kingdom Decentralized Finance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1528.28 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 49.93% |

| 2035 Value Projection: | USD 131528.10 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Component, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Centrifuge, Settle Network, Zumo, Revolut, Archax, Tokeny Solutions, Others. |

| Pitfalls & Challenges: | Covid 19 Impact Challenges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom decentralized finance is driven by substantial investment from well-organized digital financial infrastructures and strong institutional interest. Fintech companies are increasingly integrating DeFi protocols into traditional processes. Research institutes and digital projects funded by the government are also shaping an ecology of competition, which is heightened by the growing experimentation with tokenized assets and on-chain governance. Furthermore, the UK's robust fintech sector, high level of digital literacy, and extensive cryptocurrency use fuel consumer desire for financial services that are more open, effective, and easily accessible. The UK's strategic location as a global financial center also draws partnerships and investment from other countries, which helps DeFi innovate in fields like automated market making, asset tokenization, and decentralized lending.

Restraining Factors

Despite substantial growth market could undergo some barriers like increased monitoring of security threats, like as fraud and smart contract vulnerabilities, high transaction prices and slower processing, lack of basic terminology, and interoperability issues between DeFi protocols and integration issues with the current financial infrastructure.

Market Segmentation

The United Kingdom decentralized finance market share is classified into component and application.

- The smart contracts segment accounted for the largest market share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom decentralized finance market is segmented by component into decentralized applications (dApps), smart contracts, and blockchain technology. Among these, the smart contracts segment accounted for the largest market share in 2024 and is expected to grow at a substantial CAGR over the forecast period. DeFi protocols and apps are built on top of smart contracts. A smart contract can act as a custodian, establishing precise guidelines for who can access these assets, when they can be accessed, and how. Additionally, it accelerates decentralized banking, insurance, lending, and investing activities, where smart contracts are also which is expected to open up new growth prospects for the segment expansion.

- The payments segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom decentralized finance market is segmented by application into payments, data & analytics, decentralized exchange, stablecoins, assets tokenization, prediction industry, compliance & identity, marketplaces & liquidity, and others. Among these, the payments segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is because of its core use case for the DeFi sector and the blockchain ecosystem, and allows users to safely and immediately exchange cryptocurrencies. DeFi payment systems help big banks better serve their wholesale and retail clients and optimize market infrastructure.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom decentralized finance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Centrifuge

- Settle Network

- Zumo

- Revolut

- Archax

- Tokeny Solutions

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom decentralized finance market based on the below-mentioned segments:

United Kingdom Decentralized Finance Market, By Component

- Decentralized Applications (dApps)

- Smart Contracts

- Blockchain Technology

United Kingdom Decentralized Finance Market, By Application

- Payments

- Data & Analytics

- Decentralized Exchange

- Stablecoins

- Assets Tokenization

- Prediction Industry

- Compliance & Identity

- Marketplaces & Liquidity

- Others

Need help to buy this report?