United Kingdom Debt Collection Software Market Size, Share, and COVID-19 Impact Analysis, By Component (Software, Services), By Deployment (On-premise, Cloud), By End-User (Financial Institutions, Collection Agencies, Healthcare, Government, Telecom & Utilities, Others), and United Kingdom Debt Collection Software Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Debt Collection Software Market Insights Forecasts to 2035

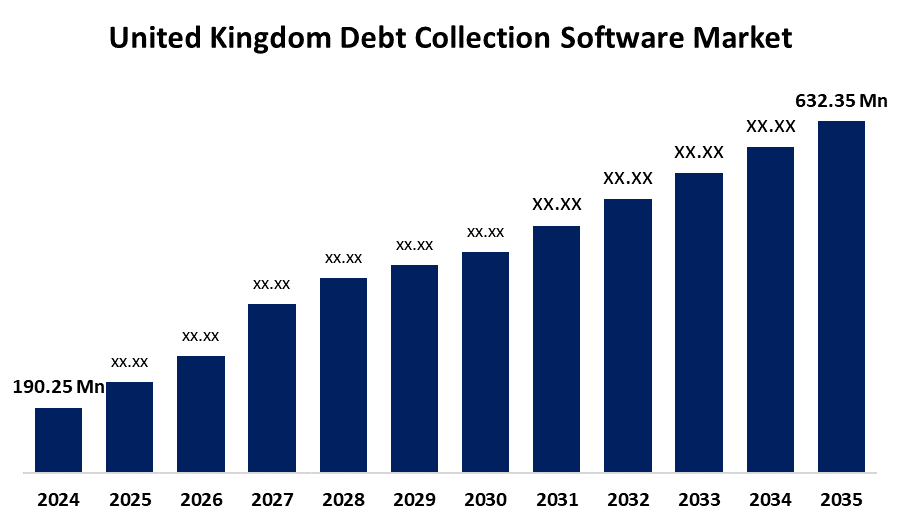

- The United Kingdom Debt Collection Software Market Size was Estimated at USD 190.25 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.54% from 2025 to 2035

- The United Kingdom Debt Collection Software Market Size is Expected to Reach USD 632.35 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Debt Collection Software Market Size is anticipated to reach USD 632.35 Million by 2035, growing at a CAGR of 11.54% from 2025 to 2035. Companies are combining secure data management, mobile-friendly interfaces, and predictive analytics to improve recovery effectiveness, lower operating expenses, and guarantee transparency in debt collection procedures, which boosts the market growth.

Market Overview

The United Kingdom debt collection software market is described as a business that supports the financial and banking sector by offering software solutions with the integration of sophisticated technology for the application, and acts as an alternative solution. The main purpose is to provide seamless transactions for all sectors of banking segments. In addition to anticipating and prioritizing debt recovery, it is a computerized tool for tracking and following up with debtors. The debt collection software is a set of steps for collecting debt, starting with the loan application process and ending with the loan settlement with paid debt. The financial account that contains the debt details is shared with the debt collection software, which is frequently installed on third-party systems. We call this kind of firm a debt collection agency. The account is either sold to a collection agency or transferred to one if the borrower is unable to repay the debt. Agency management, callback scheduling, automated alerts, client management, compliance management, commission management, and contact management are all included in the debt collection program. Moreover, the government is encouraging steps which propelled the market across the country, like the Credit Services Association (CSA), the UK trade body for the debt collection and debt purchase sector, has called on the government to improve its debt collection practices to better support service users and enhance collection revenues.

Report Coverage

This research report categorizes the market for the United Kingdom debt collection software market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom debt collection software market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom debt collection software market.

United Kingdom Debt Collection Software Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 190.25 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 11.54% |

| 2035 Value Projection: | USD 632.35 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 255 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Component, By Deployment and By End-User |

| Companies covered:: | EXUS, DebtView, Dash Billing, STA International, Frontline Collections, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom debt collection software is driven by the increasing automation and substantial need for debt collection software. Moreover, driving industry expansion is the outsourcing of debt recovery to knowledgeable debt collection firms. Furthermore, the growing demand for self-service payment methods to expedite the collection process may also have an impact on market expansion. Furthermore, it is anticipated that the growth potential of the market will be aided by the acceleration of digital tactics to extend collection services more quickly. The growing demand for cross-border debt collection has made Britain a very attractive sector. Software that can manage intricate international regulations and enable effective debt collection across borders is essential as cross-border trade grows.

Restraining Factors

The market expansion faces some challenges that reduce its steady growth, like software maintenance expenses rising as a result of both the need to keep the program updated and enhancements made to bring new functionality. Also, debt collection software requires a lot of data to be entered, it can take years to deploy correctly. The expected return on investment from this product is delayed because software deployment issues with an organization's IT infrastructure can be expensive and time-consuming.

Market Segmentation

The United Kingdom debt collection software market share is classified into component, deployment, and end user.

- The software segment accounted for the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom debt collection software market is differentiated by component into software, and services. Among these, the software segment accounted for the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. The segment's growth is being driven by payment processing, case administration, automated workflows, reporting and analytics, and compliance management are among the software's primary features. Additionally, it offers other features that help customers with automation and debt recovery, like skip tracing, credit reporting, negotiation tools, chatbots, AI-powered communication, document management, team collaboration tools, and connectors with pre-existing software.

- The on-premise segment held the largest share in 2024 and is predicted to grow at a substantial CAGR over the forecast period.

The United Kingdom debt collection software market is segmented by deployment into on-premise, and cloud. Among these, the on-premise segment held the largest share in 2024 and is predicted to grow at a substantial CAGR over the forecast period. This is because on-premise solutions give businesses the most privacy, control, and customisation possible. Companies can customize the program to fit their unique team structure, compliance needs, and collection procedures. By using this method, companies may apply their security policies and keep total control over their critical data, resulting in increased security.

- The financial institutions segment dominated the market in 2024 and is anticipated to grow at a notable CAGR during the forecast period.

The United Kingdom debt collection software market is divided by end-user into financial institutions, collection agencies, healthcare, government, telecom & utilities, and others. Among these, the financial institutions segment dominated the market in 2024 and is anticipated to grow at a notable CAGR during the forecast period. The segment's rise is being driven by the growing requirement for fraud detection, deal with sensitive financial data financial institutions is especially susceptible to fraud. Moreover, advanced functionality like device and IP address checks, multiple account correlations, and suspicious behavior monitoring is available. These characteristics aid in spotting odd transactions, dubious login attempts, and activity that varies geographically.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom debt collection software market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- EXUS

- DebtView

- Dash Billing

- STA International

- Frontline Collections

- Others

Recent Developments:

- In June 2023, EXUS provides a debt collection and recovery software designed to manage credit risk throughout the entire lifecycle of accounts. The platform helps businesses streamline collections, improve loan recovery rates, and ensure compliance with financial regulations.

- In May 2022, Australian-founded fintech InDebted officially launched in the UK, aiming to transform the consumer debt recovery experience with a digital-first approach. Research conducted by Opinium found that 64% of UK adults who had interacted with traditional debt collectors had described the experience as "stressful", with this figure rising to 74% among 18-34-year-olds.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom debt collection software market based on the below-mentioned segments:

United Kingdom Debt Collection Software Market, By Component

- Software

- Services

United Kingdom Debt Collection Software Market, By Deployment

- On-premise

- Cloud

United Kingdom Debt Collection Software Market, By End-User

- Financial Institutions

- Collection Agencies

- Healthcare

- Government

- Telecom & Utilities

- Others

Need help to buy this report?