United Kingdom Dairy Market Size, Share, and COVID-19 Impact Analysis, By Product (Butter, Cheese, Cream, Dairy Desserts, Milk, Sour Milk Drinks, and Yogurt), By Distribution Channel (Off-Trade and On-Trade), and United Kingdom Dairy Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Dairy Market Insights Forecasts to 2035

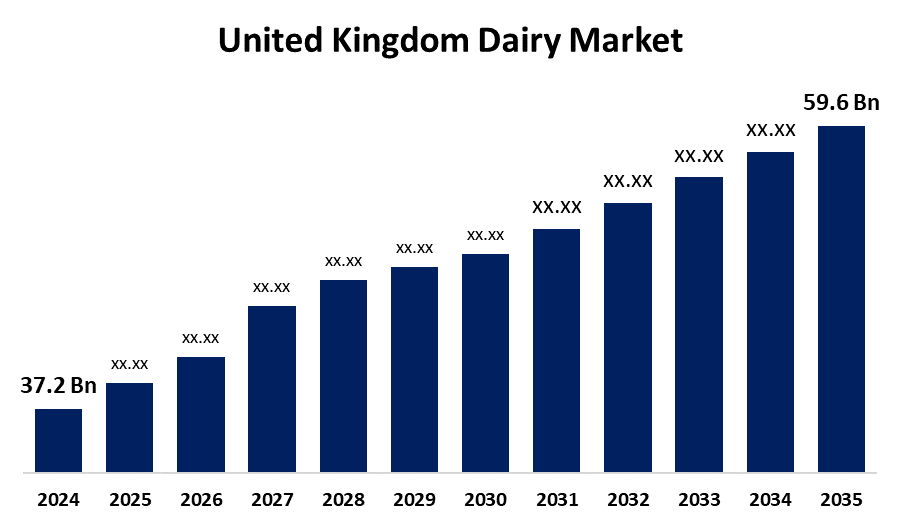

- The United Kingdom Dairy Market Size Was Estimated at USD 37.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.38% from 2025 to 2035

- The United Kingdom Dairy Market Size is Expected to Reach USD 59.6 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Dairy Market Size is Anticipated to reach USD 59.6 Billion By 2035, Growing at a CAGR of 4.38% from 2025 to 2035. The increasing customer demand for functional and organic dairy products, growing health consciousness, new dairy substitutes, growing retail channels, and encouraging government regulations that encourage high-quality and sustainable dairy production procedures.

Market Overview

The United Kingdom dairy market refers to the industry involved in the manufacturing, processing, marketing, and distribution of dairy products in the United Kingdom, including milk, cheese, butter, yogurt, and cream. It meets the needs of both domestic and international markets by combining traditional dairy farming with contemporary processing facilities. The market has adjusted to trends like organic, substitutes made from plants, and health-focused products while upholding strict standards for quality, safety, and environmental responsibility. This development is driven by changing consumer tastes, technology breakthroughs, and sustainability programs. Increasing interest in plant-based and lactose-free substitutes, increased demand for organic and health-conscious products, and advancements in environmentally friendly packaging. Opportunities for growth are also presented by growing export potential, retail's digital transformation, and higher R&D spending, particularly for companies that prioritize impacts on the environment, quality, and transparency. Development of plant-based and lactose-free substitutes, innovative dairy processing techniques, environmentally friendly options for packaging, and functional goods that are high in probiotics. In order to improve product quality, sustainability, and customer satisfaction, businesses are also utilizing AI and IoT for supply chain efficiency and precision farming.

Report Coverage

This research report categorizes the market for the United Kingdom dairy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom dairy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom dairy market.

United Kingdom Dairy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 37.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.38% |

| 2035 Value Projection: | USD 59.6 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Arla Foods, Bel Group, Dale Farm Cooperative Limited, Danone SA, Glanbia PLC, Kingcott Dairy, Muller Group, Ornua Co-Operative Limited, Saputo Inc, Unilever PLC, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing consumer awareness of nutrition and health is driving up demand for low-fat, organic, and functional dairy products. Growth in the market is further supported by the growing popularity of diets high in protein, particularly among those who are concerned regarding their fitness. Efficiency and product quality are enhanced by technological developments in dairy production and processing. The growth of e-commerce and retail platforms has also improved product accessibility. Government programs that support high standards for food safety and sustainable farming methods are also essential. The market's continuous development and expansion are facilitated by shifting dietary choices, such as the need for plant-based and lactose-free dairy substitutes.

Restraining Factors

The changing costs for raw milk, environmental issues with greenhouse gas emissions from dairy production, and growing competition from plant-based substitutes. Furthermore, shifting consumer tastes, unpredictability in the economy, and possible trade disruptions following Brexit could impede market stability and expansion in the years that lie ahead.

Market Segmentation

The United Kingdom dairy market share is classified into product and distribution channel.

- The milk segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom dairy market is segmented by product into butter, cheese, cream, dairy desserts, milk, sour milk drinks, and yogurt. Among these, the milk segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed increasing health consciousness, the popularity of Greek yogurt and plant-based substitutes, and the growing demand for high-protein, probiotic-rich, and functional dairy products are all contributing factors to innovation and a wider range of customer options across product categories.

- The off-trade segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom dairy market is segmented by distribution channel into off-trade and on-trade. Among these, the off-trade segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of increasing consumer appetite for high-end, artisanal dairy products in cafés and restaurants, specialty coffee culture, and out-of-home dining trends, all of which contribute to the on-trade segment's growth and the off-trade segment's strong retail performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom dairy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arla Foods

- Bel Group

- Dale Farm Cooperative Limited

- Danone SA

- Glanbia PLC

- Kingcott Dairy

- Muller Group

- Ornua Co-Operative Limited

- Saputo Inc

- Unilever PLC

- Others.

Recent Developments:

- In October 2024, Trewithen Dairy introduced "Regen Milk," produced using regenerative farming practices. Available in 640 Tesco stores, this milk is sourced from farms employing rotational grazing and natural fertilization methods, reflecting a growing consumer demand for environmentally responsible products.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom dairy market based on the below-mentioned segments

United Kingdom Dairy Market, By Product

- Butter

- Cheese

- Cream

- Dairy Desserts

- Milk

- Sour Milk Drinks

- Yogurt

United Kingdom Dairy Market, By Distribution Channel

- Off-Trade

- On-Trade

Need help to buy this report?