United Kingdom Cryptocurrency Market Size, Share, and COVID-19 Impact Analysis, By Type (Bitcoin (BTC), Litecoin, Ether, Ripple, Ether Classic, and Others), By End-Use (Trading, E-Commerce and Retail, Peer-To-Peer Payment, and Remittance), and United Kingdom Cryptocurrency Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited Kingdom Cryptocurrency Market Insights Forecasts to 2035

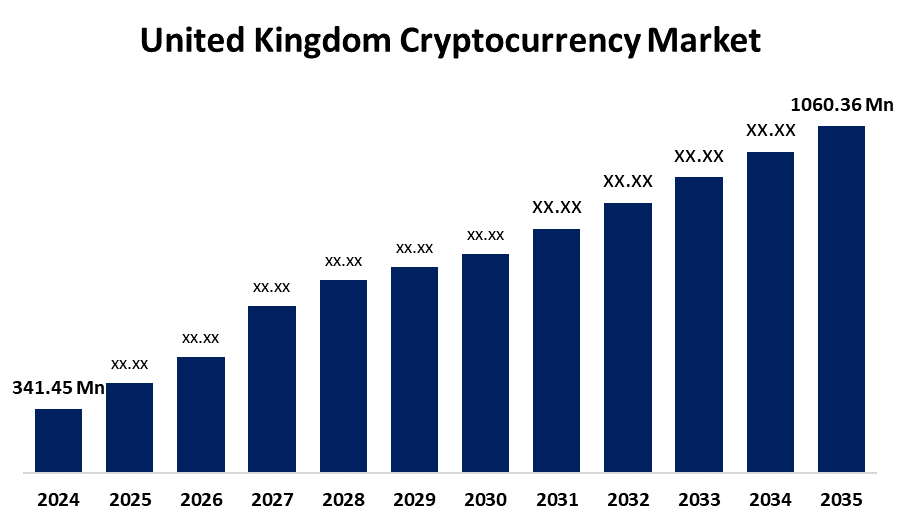

- The United Kingdom Cryptocurrency Market Size was Estimated at USD 341.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.85% from 2025 to 2035

- The United Kingdom Cryptocurrency Market Size is Expected to Reach USD 1060.36 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Cryptocurrency Market Size is anticipated to reach USD 1060.36 Million by 2035, growing at a CAGR of 10.85% from 2025 to 2035. The increasing use and growth of decentralized finance platforms and applications are driving the market and may have an impact on the demand for specific cryptocurrencies.

Market Overview

The United Kingdom cryptocurrency market refers to the industry focused on covering blockchain-based financial services, trade, legislation, and cryptocurrency exchanges. The market is expanding because the UK is at the forefront of proactive legislation to close these gaps and enhance security, and foster a good atmosphere. Furthermore, a major trend in recent years has been the growth of technology companies' contributions to easily accessible trading platforms via computers and cellphones. Businesses and market participants are also advancing it by incorporating cryptocurrencies into their payment systems, which is growing the industry. Moreover, the government encourages and has outstanding rules and laws that might exceed the market expansion. For instance, the UK government has introduced new cryptoasset rules aimed at boosting growth while protecting consumers. These regulations will bring crypto exchanges, dealers, and agents under a clear regulatory framework, ensuring transparency, consumer protection, and operational resilience, similar to traditional financial firms.

Report Coverage

This research report categorizes the market for the United Kingdom cryptocurrency market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cryptocurrency market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom cryptocurrency market.

Driving Factors

The market for United Kingdom cryptocurrency is driven by the increasing need for efficiency and transparency in financial payment systems. This increasing demand is in line with the growing internet penetration, with user-friendly smartphones. In addition, the contribution of technology businesses to easily accessible trading platforms via computers and cellphones has emerged as a major trend in recent years. The market is mostly driven by the rise in customers' interest in cryptocurrencies, with more awareness of the use of cryptocurrencies, which helps them to improve their financial solidity and stability. Moreover, businesses and market participants are also advancing it by incorporating cryptocurrencies into their payment systems, which is growing the industry.

Restraining Factors

However, the market expansion could be constrained by the absence of laws controlling the creation and assessment of these digital assets and reduce the cryptocurrency values. This type of manipulation often involves deceptive tactics that lure novice investors and lead to market losses. Also, there is no monitoring or set of rules; the value of cryptocurrencies can be artificially inflated or deflated, which puts consumers who are not familiar with the complexities of this market at risk and ultimately hurts their investments.

Market Segmentation

The United Kingdom Cryptocurrency Market share is classified into type and end use.

- The Bitcoin (BTC) segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United Kingdom cryptocurrency market is segmented by type into Bitcoin (BTC), Litecoin, Ether, Ripple, Ethereum Classic, and others. Among these, the Bitcoin (BTC) segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. The segment growth is driven by the widely used digital currency. Bitcoin is a virtual currency that serves as an alternative, decentralized payment system. It is anticipated that the introduction of Bitcoin Exchange Traded Funds (ETFs) will increase the number of bitcoin trades in the future.

- The trading segment held the highest share in 2024 and is anticipated to grow at a remarkable CAGR over the forecast period.

The United Kingdom cryptocurrency market is segmented by end use into trading, e-commerce and retail, peer-to-peer payment, and remittance. Among these, the trading segment held a significant share in 2024 and is anticipated to grow at a remarkable CAGR over the forecast period. This is because trading enables users to purchase, sell, check asset balances, and obtain deposit addresses. Further, to facilitate bitcoin trading for their customers, a number of browser technology providers are concentrating on partnering with blockchain technology companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom cryptocurrency market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nayms

- Elliptic

- Coincover

- ShapeShift

- Coinweb Labs

- Scalable Capital

- Others

Recent Developments:

- In June 2025, IG Group officially launched crypto trading, becoming the first UK-listed company to offer this service to retail investors. Customers can now buy, sell, and hold crypto assets directly on IG’s platform, with access to 31 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), XRP (XRP), and various altcoins.

- In April 2025, Mastercard and Kraken joined forces to expand crypto payments across the EU and UK. This partnership allowed Kraken customers to spend their crypto assets at over 150 million merchants that accepted Mastercard. Kraken was set to launch physical and digital debit cards, enabling users to make everyday purchases with cryptocurrencies and stablecoins.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom cryptocurrency market based on the below-mentioned segments:

United Kingdom cryptocurrency Market, By Type

- Bitcoin (BTC)

- Litecoin

- Ether

- Ripple

- Ether Classic

- Others

United Kingdom cryptocurrency Market, By End Use

- Trading

- E-Commerce and Retail

- Peer-To-Peer Payment

- Remittance

Need help to buy this report?