United Kingdom Crowdfunding Market Size, Share, and COVID-19 Impact Analysis, By Type (Equity-based Crowdfunding, Debt-based Crowdfunding), By Application (Food & Beverage, Technology, Media, Real Estate, Healthcare, and Others), and UK Crowdfunding Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited Kingdom Crowdfunding Market Size Forecasts to 2035

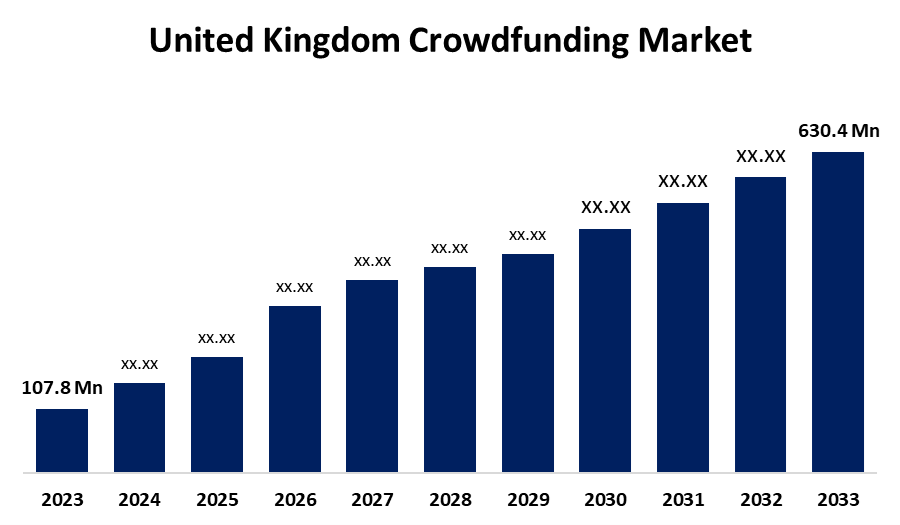

- The United Kingdom Crowdfunding Market Size Was Estimated at USD 107.8 Million in 2024

- The UK Crowdfunding Market Size is Expected to Grow at a CAGR of around 17.42% from 2025 to 2035

- The UK Crowdfunding Market Size is Expected to Reach USD 630.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Crowdfunding Market Size is anticipated to reach USD 630.4 Million by 2035, growing at a CAGR of 17.42% from 2025 to 2035. The market is mostly driven by the growing focus on specialised industries like technology and renewable energy, the growing acceptance of equity crowdfunding, which makes startup investment more accessible, and the quick integration of contemporary technologies like blockchain and artificial intelligence (AI) to improve platform security and efficiency.

Market Overview

The UK crowdfunding Market Size refers to a technique for raising money for a specific project or cause is crowdfunding, which involves asking a large number of people and companies to make tiny, usually short-term, financial contributions. Because it is done online through social networks, groups can easily share a project or cause on their social media platforms. The market is growing as crowdfunding platforms increasingly utilize AI, Blockchain, and machine learning technologies to address investor concerns. Crowdfunding platforms utilize AI-based tools to assist users in starting and running online campaigns, anticipate investor behaviour, create content, spot fraud, show ads to intended audiences, and validate campaigners' identities. Furthermore, crowdfunding platforms are beginning to test AI-powered chatbots to help campaigners rapidly close transactions and start campaigns. Over the forecast period, it is believed that this technology utilization would present an opportunity for market players to experience growth at profitable margins.

In the UK, several crowdfunding platform providers are concentrating on growing their footprints to assist new businesses in obtaining capital from investors. Additionally, government organisations are eager to assist with the creation of products linked to crowdfunding platforms, which will help the sector expand. The largest private market investment platform in the UK, Crowdcube, purchased the secondary liquidity platform Semper. With a rise in secondary share offerings over the last 18 months, Crowdcube has helped 1300 businesses raise over £1 billion in total. Through the Semper acquisition, Crowdcube hopes to establish the biggest private market investment platform in Europe, providing industry-leading secondary liquidity solutions for businesses, workers, and investors.

Report Coverage

This research report categorizes the market for the UK crowdfunding market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom crowdfunding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom crowdfunding market.

United Kingdom Crowdfunding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 107.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 17.42% |

| 2035 Value Projection: | USD 630.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 163 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Crowdcube, Seedrs, Funding Circle, ThinCats, Zopa, Crowdfunder UK, Spacehive, JustGiving, Kowabunga, Capital Cell, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growth of online platforms that give investors more access, increased demand driven by searching for diverse investment opportunities, and underlying government support in protective legislation that provides greater market stability. Innovation through technology, such as AI, blockchain, and smartphone apps, improves platform security and efficiency. There is greater transparency, awareness, and growth of online communities that support philanthropic efforts and common values, which are leading to the increasing popularity of crowdfunding for social impact projects.

Restraining Factors

Regulatory complexity is a major barrier to the crowdfunding business since it can raise compliance costs and restrict access for startups. Furthermore, investor risks like project failure and fraud erode trust. Investor participation is further hampered by limited liquidity and challenges with secondary trading. Last but not least, in certain areas, a lack of knowledge and technological obstacles impede wider market acceptance. These factors hamper the crowdfunding market during the forecast period.

Market Segmentation

The United Kingdom crowdfunding market share is classified into type and application.

- The debt-based crowdfunding segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom crowdfunding market is segmented by type into equity-based crowdfunding, debt-based crowdfunding. Among these, the debt-based crowdfunding segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. New enterprises are moving towards debt-based crowdfunding quickly, a crucial catalyst of growth in the market, due to the simplicity of raising money faster than a traditional bank. Simply put, new businesses can access more affordable capital while avoiding the complexities associated with traditional banks. Arguably, even more valuable for investors, debt-based crowdfunding provides a higher interest rate for projects usually funded in monthly payments.

- The food & beverage segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom crowdfunding market is segmented by application into food & beverage, technology, media, real estate, healthcare, and others. Among these, the food & beverage segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Food and beverage businesses are popular candidates for crowdfunding campaigns because they provide consumers with sustainable practices, health-conscious products, or inventive culinary experiences. Food-related initiatives are particularly well-suited for crowdfunding platforms due to their comparatively inexpensive startup costs and the quick customer feedback loop.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom crowdfunding market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Crowdcube

- Seedrs

- Funding Circle

- ThinCats

- Zopa

- Crowdfunder UK

- Spacehive

- JustGiving

- Kowabunga

- Capital Cell

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom crowdfunding market based on the below-mentioned segments:

United Kingdom Crowdfunding Market, By Type

- Equity-based Crowdfunding

- Debt-based Crowdfunding

United Kingdom Crowdfunding Market, By Application

- Food & Beverage

- Technology

- Media

- Real Estate

- Healthcare

- Others

Need help to buy this report?