United Kingdom Courier, Express and Parcel (CEP) Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Courier Services and Express Services), By End-user (Business-to-Consumer and Business-to-Business), and United Kingdom Courier, Express, and Parcel (CEP) Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Courier, Express and Parcel (CEP) Market Insights Forecasts to 2035

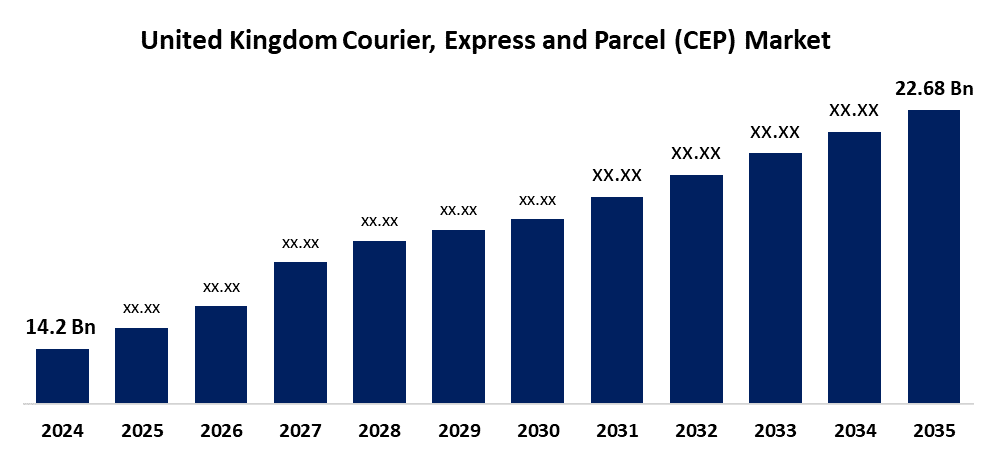

- The United Kingdom Courier, Express and Parcel (CEP) Market Size Was Estimated at USD 14.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.35% from 2025 to 2035

- The United Kingdom Courier, Express, and Parcel (CEP) Market Size is Expected to Reach USD 22.68 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Courier, Express, and Parcel (CEP) Market Size is anticipated to reach USD 22.68 Billion by 2035, growing at a CAGR of 4.35% from 2025 to 2035. The increasing e-commerce, growing customer demand for same-day and next-day delivery, logistics technology innovations, and growing international trade facilitated by effective last-mile delivery alternatives.

Market Overview

The United Kingdom courier, express, and parcel (CEP) market refers to the industry involved with collecting, transferring, and delivering papers, parcels, and shipments within a given time range. The expansion of e-commerce, the demands of company supply chains, and growing customer expectations for dependable and quick delivery options throughout the UK are driving this sector, which supports both domestic and international logistics. Technological developments in monitoring and logistics, the rapid expansion of e-commerce, and the rising demand for same-day and next-day delivery. Innovation, automation, and strategic alliances are made possible by expanding cross-border trade, increasing urbanization, and the demand for effective last-mile delivery services. Long-term growth in the industry has been driven by these trends, which promote investment in environmentally friendly delivery systems and enhanced consumer satisfaction. Deployment of robot deliveries, smart lockers, driverless delivery trucks, and AI-powered route optimization. These technologies enable sustainable logistics, save operating costs, and speed up deliveries all of which are in line with changing consumer demands and environmental objectives.

Report Coverage

This research report categorizes the market for the United Kingdom courier, express, and parcel (CEP) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom courier, express, and parcel (CEP) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom courier, express, and parcel (CEP) market.

United Kingdom Courier, Express and Parcel (CEP) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.35% |

| 2035 Value Projection: | USD 22.68 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 235 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Service Type and By End-user |

| Companies covered:: | Royal Mail Group, DHL International GmbH, Hermes (now Evri), DPD Group, Yodel, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in e-commerce which has been driven by more individuals purchasing via the internet and increasing customer behavior. While digital transformation makes real-time tracking, improved route optimization, and an improved customer experience possible, rapid urbanization and growing logistical infrastructure have boosted last-mile delivery capabilities. The CEP market is a crucial pillar of the UK's digital economy since the growth of SMEs and opportunities for cross-border trade are also increasing the demand for effective and scalable delivery networks.

Restraining Factors

The labor shortages, complicated last-mile delivery logistics, high operating expenses, and strict environmental laws. Intense competition increases pressure on prices and restricts profit margins for smaller logistics providers, while congestion and unsuccessful delivery efforts decrease efficiency.

Market Segmentation

The United Kingdom courier, express, and parcel (CEP) market share is classified into service type and process.

- The courier services segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom courier, express, and parcel (CEP) market is segmented by service type into courier services and express services. Among these, the courier services segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to the increased need for same-day, next-day, and time-sensitive delivery. They are crucial for rapid, high-end, and valuable shipments because of their dependability, specialist handling, and integration with e-commerce and business-to-business requirements.

- The business-to-consumer accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom courier, express, and parcel (CEP) market is segmented by end-user into business-to-consumer and business-to-business. Among these, the business-to-consumer accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is growing demand for prompt, reliable transport, growing consumer preference for useful home deliveries, and increased online purchasing. The demand for same-day and next-day delivery services is increasing as a consequence of e-commerce platforms' constant investments in efficient logistics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom courier, express, and parcel (CEP) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Royal Mail Group

- DHL International GmbH

- Hermes (now Evri)

- DPD Group

- Yodel

- Others.

Recent Developments:

- In April 2025, Emirates introduced Emirates Courier Express, an end-to-end delivery solution designed to offer high-quality express delivery services. The service promises to treat packages with the same care as passengers, aiming to redefine the express delivery experience.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom courier, express, and parcel (CEP) market based on the below-mentioned segments:

United Kingdom Courier, Express, and Parcel (CEP) Market, By Service Type

- Courier Services

- Express Services

United Kingdom Courier, Express, and Parcel (CEP) Market, By End-user

- Business-to-Consumer

- Business-to-Business

Need help to buy this report?