United Kingdom Countertops Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Granite, Solid Surface, Engineered Quartz, Laminate, Marble, and Others), By Application (Kitchen, Bathroom, and Others), and UK Countertops Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Countertops Market Size Forecasts to 2035

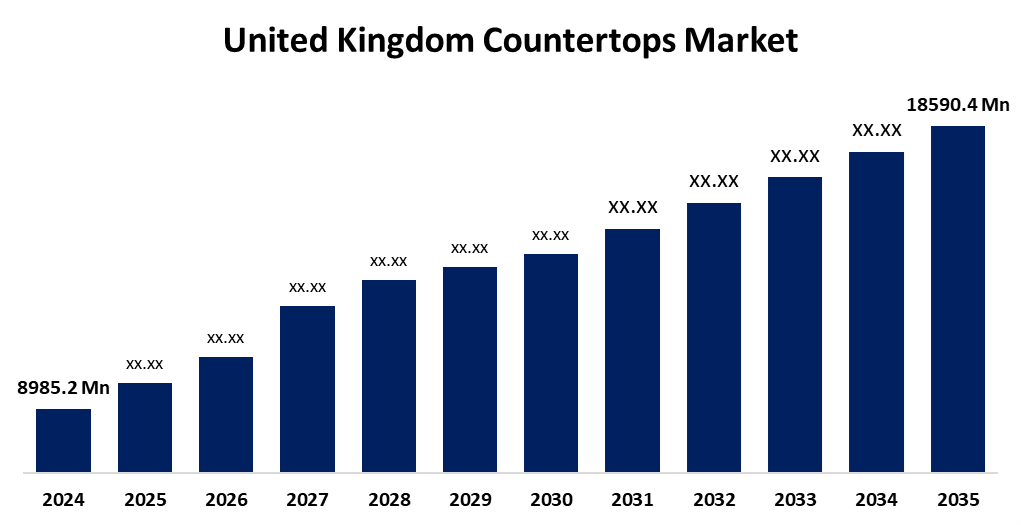

- The United Kingdom Countertops Market Size Was Estimated at USD 8985.2 Million in 2024

- The UK Countertops Market Size is Expected to Grow at a CAGR of around 6.83% from 2025 to 2035

- The UK Countertops Market Size is Expected to Reach USD 18590.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Countertops Market Size is anticipated to reach USD 18590.4 million by 2035, growing at a CAGR of 6.83% from 2025 to 2035. The market is expanding in large part due to the growing popularity of modular kitchens, fashionable bathroom toiletry shelves, and the growing usage of decorative materials. Demand is also being increased by the explosion of smart city projects. The UK countertop market share is also being significantly shaped by the expansion of the commercial and hospitality sectors.

Market Overview

The UK countertops market refers to raised flat surfaces that are utilised as workstations in restrooms, kitchens, and laboratories. Originally, simple concrete platforms have now developed into adaptable, multifunctional surfaces that are installed above cabinets. Their extensive usefulness fuels robust demand in the UK. Countertops are essential in a variety of environments, such as workrooms, restrooms, labs, and retail establishments. Their functionality enables broad use, and they are built from a variety of materials to satisfy specifications, including longevity, aesthetics, and appliance integration. The market is expanding due to the growing demand for large kitchens, many restrooms, food enterprises, and hotel rooms. More investments in home renovations, especially modular kitchens, are now possible due to bank loans and mortgage refinances, which have improved consumer access to credit. The residential market is still the largest purchaser of countertops, and a trend expected to continue. The most recent advancements in countertop surfaces include materials such as granite that are affordable and very aesthetically pleasing, and as a result of those innovations in materials. All of these factors combined will continue to generate excellent and consistent growth in the UK countertop market.

Report Coverage

This research report categorizes the market for the UK countertops market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom countertops market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom countertops market.

United Kingdom Countertops Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 8985.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.83% |

| 2035 Value Projection: | USD 18590.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Imperial Worktops, Howden Joinery Group plc, Wren Kitchens Ltd, Bushboard, Cosentino (Dekton & Silestone), Caesarstone, CRL Stone, Cambria, Nobia Holdings, Athena Surfaces, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The market for countertops is expanding as more people renovate their kitchens, particularly in light of open-concept designs and longer homeownership. Because of its strength, low care requirements, and visual attractiveness, engineered quartz is becoming more and more popular. Accessibility has increased as a result of retail development and integrated showroom-fabrication models in the UK. Demand for non-porous, antibacterial surfaces like quartz and acrylics has also increased as a result of post-pandemic cleanliness concerns, especially in kitchens and medical facilities. Regional variations in consumer preferences and technological advancements continue to influence material selections and sales channels.

Restraining Factors

The countertop industry can be limited by the costs associated with premium materials and installation, which may scare away price-conscious consumers. Also, health concerns over silica dust when fabricating quartz have led to more stringent regulations that may be more complicated to produce. These factors hamper the countertops market during the forecast period.

Market Segmentation

The United Kingdom countertops market share is classified into product type and application.

- The granite segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom countertops market is segmented by product type into granite, solid surface, engineered quartz, laminate, marble, and others. Among these, the granite segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Granite countertops are getting more popular due to their impressive durability, classic style, and ability to substantially increase the value of both residential and commercial properties. Because of its durability with heat, scratches, and stains, granite is among the popular materials for bathrooms and kitchens where surfaces are regularly exposed to high traffic.

- The kitchen segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom countertops market is segmented by application into kitchen, bathroom, and others. Among these, the kitchen segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. kitchen counters are continuing to grow in popularity. Due to enhancing durability, usability, and aesthetics. Countertops are an important element within residential and commercial environments, as contemporary kitchen designs rely heavily on spacious, functional surfaces for food preparation, cooking, and hosting. The popularity of contemporary open kitchen designs, along with the demand for formal and sustainable materials in kitchen spaces, have driven demand for high-quality and durable countertops.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom countertops market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Imperial Worktops

- Howden Joinery Group plc

- Wren Kitchens Ltd

- Bushboard

- Cosentino (Dekton & Silestone)

- Caesarstone

- CRL Stone

- Cambria

- Nobia Holdings

- Athena Surfaces

- Others

Recent Developments:

- In February 2022, Howdens, a leading trade kitchen supplier, acquired Sheridan Fabricators, a UK supplier of premium kitchen worktops. This acquisition supports Howdens' expansion into higher-priced kitchen segments and increases its manufacturing capacity.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom countertops market based on the below-mentioned segments:

United Kingdom Countertops Market, By Type

- Granite

- Solid Surface

- Engineered Quartz

- Laminate

- Marble

- Others

United Kingdom Countertops Market, By Application

- Kitchen

- Bathroom

- Others

Need help to buy this report?