United Kingdom Cosmetics Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Personal Care Products and Cosmetics/Make-Up Products), By Sales Channel (Specialist Retail Stores, Supermarkets/Hypermarkets, Pharmacies/Drug Stores, Online Retail Channels, and Others), and United Kingdom Cosmetics Market Insights, Industry Trend, Forecasts to 2035.

Industry: Consumer GoodsUnited Kingdom Cosmetics Market Insights Forecasts to 2035

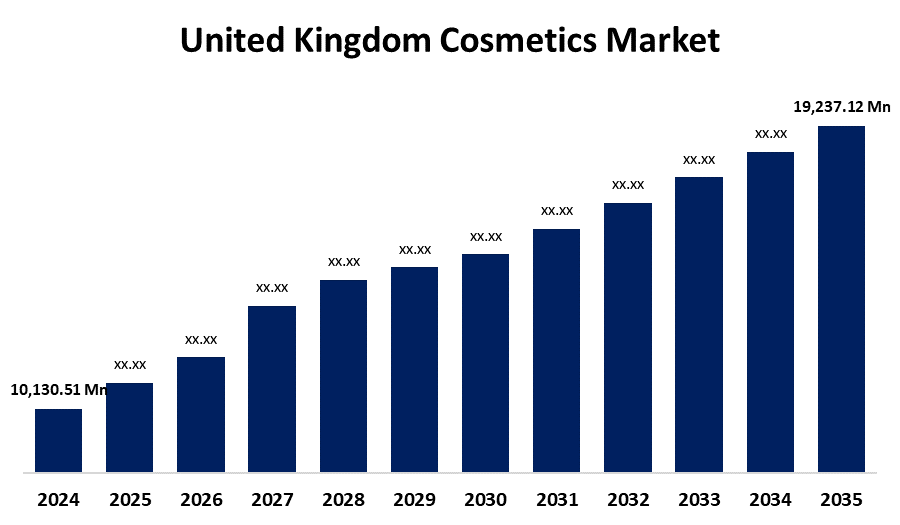

- The United Kingdom Cosmetics Market Size was estimated at USD 10,130.51 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.00% from 2025 to 2035

- The United Kingdom Cosmetics Market Size is Expected to Reach USD 19,237.12 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Cosmetics Market Size is Anticipated to reach USD 19,237.12 Million By 2035, Growing at a CAGR of 6.00% from 2025 to 2035. The growing consumer desire for natural and organic goods, the social media influence, the expansion of e-commerce platforms, and the growing need for personal care are the drivers of this industry.

Market Overview

The UK cosmetics market refers to the business which a sub-portion of the consumer goods industry by focusing on the production and application of products for personal cleanliness, makeup, and styling. Products such as skincare, makeup, hair care, fragrances, and personal hygiene items are all included in this broad category. Also, shifting consumer preferences and growing economic circumstances are having a significant influence on the beauty and personal care business across the UK. The highly influential market trend, such as rising demand for eco-friendly and ethical beauty products, expands the market growth. Using environmentally friendly packaging and sustainable sources for cosmetics and personal hygiene items is another way that businesses are capitalizing on this trend. Furthermore, a strong emphasis on research and development, which addresses the to continuous innovation in product formulation and sustainable packaging, and supports the growth of the cosmetics market expansion. Concurrently, local industry players take part in various events or campaigns to boost the cosmetics business. For instance, UK beauty brands made a significant entrance at Cosmoprof India 2024, which was held in Mumbai in December. A delegation of 17 British beauty companies showcased their innovations, highlighting the UK's billion-dollar beauty industry. The event supported by His Majesty’s Trade Commissioner for South Asia, Harjinder Kang, who emphasized the growing trade collaboration between the UK and India, valued at £42 billion annually.

Report Coverage

This research report categorizes the market for the United Kingdom cosmetics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cosmetics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom cosmetics market.

United Kingdom Cosmetics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 10,130.51 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.00% |

| 2035 Value Projection: | USD 19,237.12 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Product Type, By Sales Channel and COVID-19 Impact Analysis |

| Companies covered:: | Lush, THG, Avon Products, PZ Cussons, TENA Skincare, Weleda, ELEMIS, Notino, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom cosmetics is driven by the digital transformation of the cosmetics business across the UK, which includes the use of augmented reality, artificial intelligence, and customization technologies. Modern technology is being used by beauty businesses to provide customized product recommendations and shopping experiences in terms of virtual try-on capabilities, AI-powered skin analysis, and customized formulation services. Further, social media is a way to introduce a new product with partnership or brand advertising with reputable individuals, which influences product sales and brand discovery, particularly for younger consumers. The desire for natural, organic, and cruelty-free cosmetics is also being driven by rising consumer demand.

Restraining Factors

The strict EU regulations on cosmetic ingredients and safety precautions require market players to make significant compliance efforts, which has a more detrimental impact on cosmetics. Moreover, high market penetration and fierce competition among well-known brands can also create problems with market saturation and pricing pressures, along with a shortage of transparency and responsible sourcing.

Market Segmentation

The United Kingdom cosmetics market share is classified into product type and sales channel.

- The personal care products segment held a significant share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom cosmetics market is divided by product type into personal care products and cosmetics/make-up products. Among these, the personal care products segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This segment development is influenced by the growing prevalence of skin sensitivity problems, and the growing consumer awareness of skin wellness issues is rising. Additionally, the growing focus on natural and organic components in personal care products, and the introduction of novel products that target particular skin conditions have strengthened the segment position of this market growth.

- The pharmacies/drug stores segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom cosmetics market is segmented by sales channel into specialist retail stores, supermarkets/hypermarkets, pharmacies/drug stores, online retail channels, and others. Among these, the pharmacies/drug stores segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. This is because the provision of a comprehensive range of products that cater to the diverse needs of clients is the reason for the segmental expansion. Furthermore, companies in the industry have been purposely looking at the demand in pharmacies, particularly from consumers who are curious about ingredient lists and certain skin conditions, and pharmacies are more genuine and reliable with guidance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom cosmetics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lush

- THG

- Avon Products

- PZ Cussons

- TENA Skincare

- Weleda

- ELEMIS

- Notino

- Others

Recent Developments:

- In April 2025, Aspects Beauty officially launched Gritti Venetia in the UK. This bold fragrance house, deeply rooted in Venetian heritage. Lucca Gritti, the brand, blended rich traditions with modern creativity, drawing inspiration from his ancestor, the 16th-century nobleman Alvise Gritti, and each fragrance is crafted in Italy. This marked an exciting new chapter for fragrance lovers in the UK.

- In April 2024, the University of Manchester, Boots, and No7 Beauty Company renewed their 20-year partnership to drive advancements in skin science. This collaboration had already led to groundbreaking skincare innovations, including the No7 Future Renew range. The renewed partnership continued to focus on skin health, anti-aging solutions, and supporting people through significant skin changes, such as those caused by menopause.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom cosmetics market based on the below-mentioned segments

United Kingdom Cosmetics Market, By Product Type

- Personal Care Products

- Cosmetics/Make-Up Products

United Kingdom Cosmetics Market, By Sales Channel

- Specialist Retail Stores

- Supermarkets/Hypermarkets

- Pharmacies/Drug Stores

- Online Retail Channels

- Others

Need help to buy this report?