United Kingdom Continuous Glucose Monitoring Market Size, Share, and COVID-19 Impact Analysis, By Component (Sensors and Durables), By End-User (Home Settings and Hospitals & Clinics), and United Kingdom Continuous Glucose Monitoring Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Continuous Glucose Monitoring Market Insights Forecasts to 2035

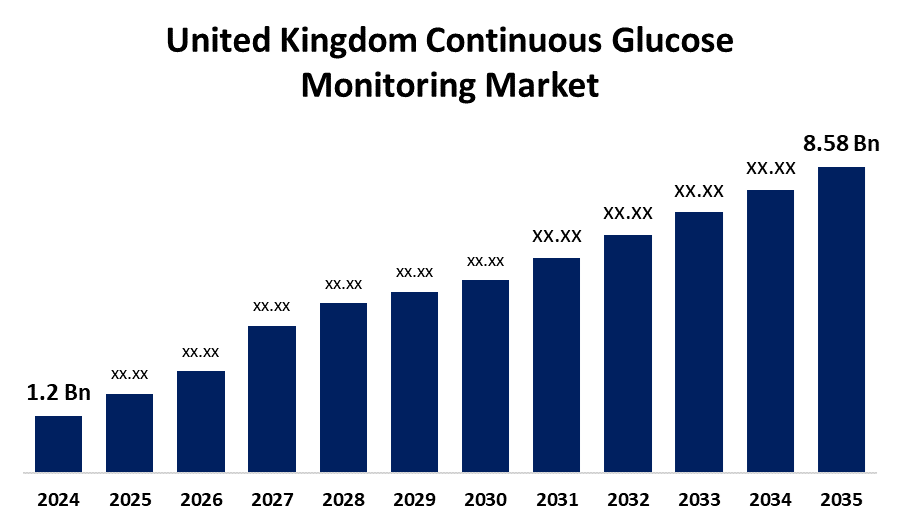

- The United Kingdom Continuous Glucose Monitoring Market Size was estimated at 1.2 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 19.58% from 2025 to 2035

- The United Kingdom Continuous Glucose Monitoring Market Size is Expected to Reach USD 8.58 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Milk Protein Market is anticipated to reach USD 8.58 billion by 2035, growing at a CAGR of 19.58% from 2025 to 2035. The increasing consumer interest in sports and clinical nutrition, growing health consciousness, and rising demand for high-protein meals. Furthermore, innovation in functional meals made from dairy continues to significantly accelerate market expansion.

Market Overview

The United Kingdom continuous glucose monitoring market refers to the industry includes the industry devoted to offering individuals who have diabetes real-time glucose monitoring solutions. Wearable sensors make up CGM systems, which continuously measure the amount of glucose in the interstitial fluid and send the data to specialized monitors or cellphones. With the help of this technology, users can constantly keep an eye on glucose patterns, get notifications when their blood sugar levels are low or high, and make educated choices regarding when to administer insulin and modify their lifestyle. The rising prevalence of diabetes, technical developments, and supportive healthcare policies encouraging the use of CGM devices are all contributing to the expansion of the UK CGM industry. rising rates of diabetes, greater awareness of preventative health care, and growing use of wearable medical technology. The market potential for CGM device manufacturers and service providers is further increased by government measures encouraging digital healthcare and integration with smartphones and telemedicine platforms. Real-time data sharing through mobile apps, non-invasive glucose measurement, longer sensor life, and sensor downsizing. Personalized diabetes management is further improved by integration with AI-driven analytics, which also improves patient outcomes and insights for healthcare providers.

Report Coverage

This research report categorizes the market for the United Kingdom continuous glucose monitoring market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom's continuous glucose monitoring market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom continuous glucose monitoring market.

United Kingdom Continuous Glucose Monitoring Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 19.58% |

| 2035 Value Projection: | USD 8.58 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 135 |

| Segments covered: | By Component, By End-User and COVID-19 Impact Analysis |

| Companies covered:: | Abbott Laboratories (Freestyle Libre), Dexcom, Medtronic, Roche Diagnostics, Senseonics and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for real-time glucose monitoring to enhance patient outcomes and the prevalence of diabetes, particularly Type 1 and Type 2. The adoption of CGM has accelerated due to a move toward preventative healthcare and increased understanding of diabetes management. Demand has been further increased by technological developments in wearable technology, such as longer sensor lifespans, more accuracy, and smartphone integration. Furthermore, the National Health Service's (NHS) strong support, advantageous reimbursement practices, and the growing usage of digital health platforms all play an important part in the UK's broad adoption and expansion of CGM systems.

Restraining Factors

The high equipment prices, the requirement for frequent sensor replacement, and restricted reimbursement coverage for specific patient classifications. Wider use may also be hampered by issues with device calibration and data accuracy, particularly among older populations.

Market Segmentation

The United Kingdom continuous glucose monitoring market share is classified into component and end user.

- The sensors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom continuous glucose monitoring market is segmented by component into sensors and durables. Among these, the sensors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing incidences of diabetes, NHS support for CGM coverage, and developments in sensor technology that provide longer wear times, higher accuracy, and real-time monitoring, all of which improve diabetes treatment and patient lifestyle management.

- The home settings segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom continuous glucose monitoring market is segmented by end-user into home settings and hospitals and clinics. Among these, the home settings segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the increasing need for flexibility, convenience, and self-managed healthcare. CGM devices are becoming more widely available and attractive for at-home diabetes control because of NHS assistance, raised awareness, and user-friendly mobile-integrated remedies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom continuous glucose monitoring market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories (Freestyle Libre)

- Dexcom

- Medtronic

- Roche Diagnostics

- Senseonics

- Others

Recent Developments:

- In January 2024, Medtronic announced the CE Mark approval for its MiniMed 780G system, featuring the newly approved Simplera Sync sensor. This sensor boasts a simplified two-step insertion process and is 50% smaller than previous versions, enhancing user experience. The system is expected to launch across Europe in spring 2024, with general commercial availability commencing in summer 2024.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom continuous glucose monitoring market based on the below-mentioned segments:

United Kingdom Continuous Glucose Monitoring Market, By Component

- Sensors

- Durables

United Kingdom Continuous Glucose Monitoring Market, By End-User

- Home Settings

- Hospitals & Clinics

Need help to buy this report?