United Kingdom Construction Equipment Market Size, Share, and COVID-19 Impact Analysis, By Product (Earth Moving Machinery, Material Handling Machinery), By Class (Heavy Construction Equipment, Compact Construction Equipment), and United Kingdom Construction Equipment Market Insights, Industry Trend, Forecasts to 2035.

Industry: Construction & ManufacturingUnited Kingdom Construction Equipment Market Insights Forecasts to 2035

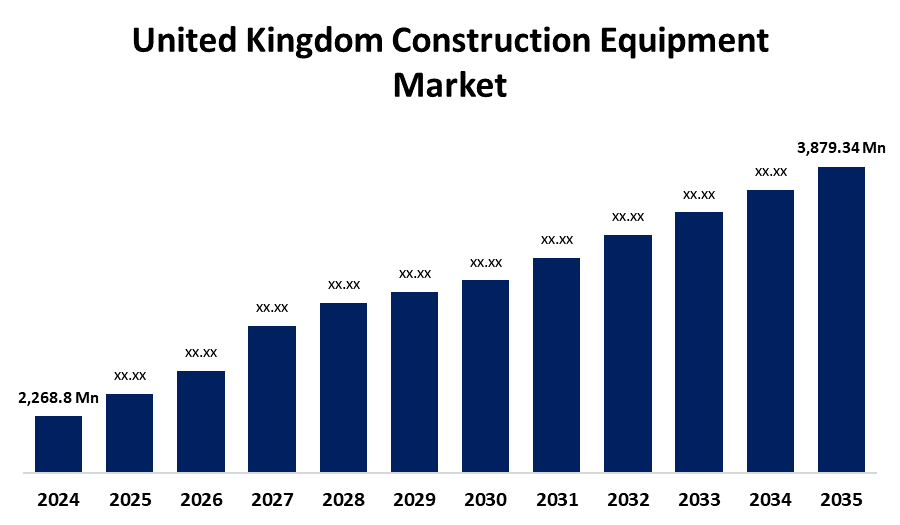

- The United Kingdom Construction Equipment Market Size was estimated at USD 2,268.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.00% from 2025 to 2035

- The United Kingdom Construction Equipment Market Size is Expected to Reach USD 3,879.34 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Construction Equipment Market Size is Anticipated to reach USD 3,879.34 Million By 2035, Growing at a CAGR of 5.00% from 2025 to 2035. The market is expanding due to significant technical breakthroughs, fast urbanization, and a growing focus on innovation and sustainability by major businesses to meet the rising demand for products.

Market Overview

The United Kingdom construction equipment market refers to the industry that manufactures, sells, and services machinery used in construction, mining, and infrastructure projects across the country for daily construction sites. This includes earthmoving equipment (excavators, backhoe loaders, bulldozers), material handling equipment (cranes, forklifts, telescopic handlers), road construction equipment (asphalt pavers, road rollers), and other specialized machinery. Road construction, leveling, digging, drilling, and moving are just a few of the tasks that these tools are utilized for. The market is made up of a variety of industries, including manufacturing, oil and gas, and infrastructure and construction. Moreover, implementing changes that would improve the machines' speed, efficiency, and precision while carrying out a certain duty. Also, the government encourages steps such as UK Export Finance UKEF agreed to support MCA Infrastructures SA, a subsidiary of the M.Couto Alves (MCA) Group, in purchasing mobile construction equipment from Dints International Ltd. The equipment includes excavators, stackers, diggers, generators, cars, trucks, vans, and trailers. MCA Group, which acts as an engineering, procurement, and construction (EPC) contractor, will initially deploy the equipment for a rural electrification programme in the region.

Report Coverage

This research report categorizes the market for the United Kingdom construction equipment market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom construction equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom construction equipment market.

United Kingdom Construction Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,268.8 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 5.00% |

| 2035 Value Projection: | USD 3,879.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Class and COVID-19 Impact Analysis |

| Companies covered:: | Dennis Barnfield Ltd, Conquip Engineering Group, Contractors Equipment Sales Ltd, Howard Plant Sales Ltd, Byfield Services Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing investments in the infrastructure and building industries are contributing to the need for construction equipment. The growing building and construction industry, due to the smart cities program, is driving the need for construction equipment to move concrete, building supplies, and other equipment. Further, increasing demand for residential and commercial real estate as a result of the growing urban population is propelling market expansion. The growing usage of automation and artificial intelligence (AI) in the construction industry is driving up demand as well-known companies integrate state-of-the-art technology into this equipment. The market for construction equipment is also expected to expand as a result of the introduction of fuel-efficient equipment and the development of high-rise building projects.

Restraining Factors

The high expense of purchasing and maintaining construction equipment is one major obstacle. Additionally, the construction sector is cyclical and affected by things like economic downturns and geopolitical instability; the demand for construction equipment may fluctuate, and flexibility in response to changing market conditions.

Market Segmentation

The United Kingdom construction equipment market share is classified into product and class.

- The earth moving machinery segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom construction equipment market is segmented by product into earth moving machinery, and material handling machinery. Among these, the earth moving machinery segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. For operations like excavation, grading, and land clearing all crucial for building roads, bridges, and structures earthmoving machinery like loaders, excavators, and bulldozers is necessary. Roadbuilding tools, such as compactors and asphalt pavers, are essential for building and maintaining transportation networks. The market for construction equipment is expanding as a result of contractors and construction businesses depending on these specialized tools to finish projects quickly.

- The compact construction equipment segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom construction equipment market is segmented by class into heavy construction equipment, and compact construction equipment. Among these, the compact construction equipment segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is due to for compact construction equipment focuses on compact, multipurpose machinery made for urban job locations and confined spaces. These devices are frequently utilized in utility work, landscaping, infrastructure projects, and residential construction.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom construction equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Dennis Barnfield Ltd

- Conquip Engineering Group

- Contractors Equipment Sales Ltd

- Howard Plant Sales Ltd

- Byfield Services Ltd

- Others

Recent Developments:

- In April 2025, Case Construction Equipment launched five new machines, including two compact wheel loaders, two motor graders, and a small articulated loader with a telescopic arm. The 421G compact wheel loader is designed for heavy construction, snow removal, and road maintenance, while the CL36EV electric compact wheel loader offers a low-noise, emissions-free solution for urban projects.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom construction equipment market based on the below-mentioned segments

United Kingdom Construction Equipment Market, By Product

- Earth Moving Machinery

- Material Handling Machinery

United Kingdom Construction Equipment Market, By Class

- Heavy Construction Equipment

- Compact Construction Equipment

Need help to buy this report?