United Kingdom Compound Feeds Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Ruminants and Poultry), By Ingredient (Cereals, Oilseeds, and Protein Sources), and United Kingdom Compound Feeds Market Insights, Industry Trend, Forecasts to 2035.

Industry: AgricultureUnited Kingdom Compound Feeds Market Insights Forecasts to 2035

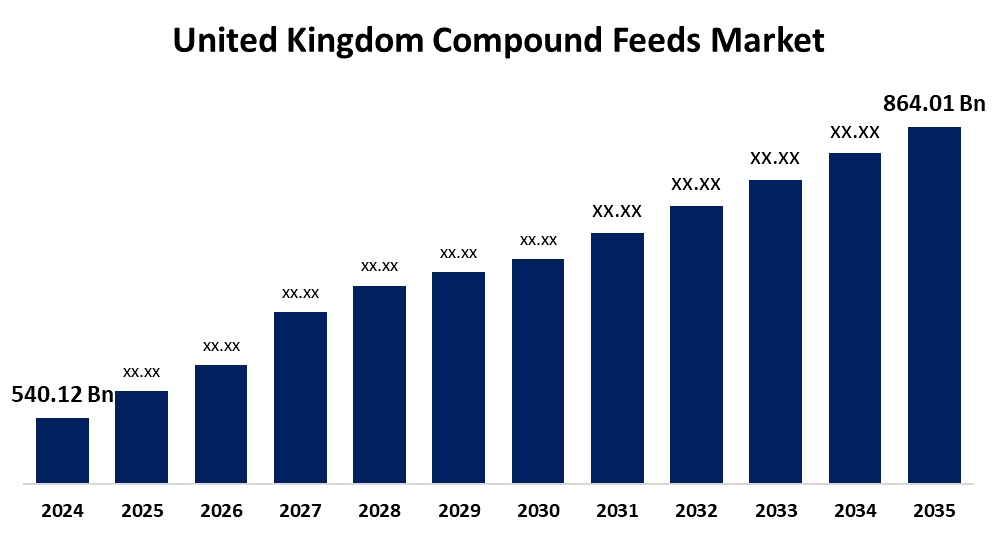

- The United Kingdom Compound Feeds Market Size Was Estimated at USD 540.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.36% from 2025 to 2035

- The United Kingdom Compound Feeds Market Size is Expected to Reach USD 864.01 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Compound Feeds Market Size is Anticipated to reach USD 864.01 Billion By 2035, Growing at a CAGR of 4.36% from 2025 to 2035. The demand for premium animal protein, improvements in the production of cattle, and farmers' awareness of nutrition. Relentless market expansion is also supported by technological advancements in feed formulation and effective supply systems.

Market Overview

The United Kingdom compound feeds market refers to the industry involved with the manufacturing and distribution of animal feeds that are nutritionally balanced and created by combining different ingredients and additives. These feeds are designed to address the nutritional requirements of aquaculture, pigs, cattle, and poultry. Compound feeds are essential to contemporary, intensive, and commercial animal husbandry methods throughout the United Kingdom because they improve animal health, increase productivity, and guarantee food safety. Increasing awareness regarding animal nutrition, the need for premium animal protein, and developments in feed formulation technologies. The increased focus on organic and sustainable farming methods is also promoting the use of sustainable feed components. Furthermore, there is significant room for expansion in the field of functional feeds that target immunity and productivity enhancements, particularly as livestock producers are seeking affordable, high-performing foods in the face of changing raw material prices. The development of precision nutrition, which modifies feed compositions by utilizing AI and data analytics. Furthermore, probiotic and prebiotic additions, in conjunction with alternative protein sources like insect meal and algae, improve animal health, sustainability, and feed efficiency in the livestock industry.

Report Coverage

This research report categorizes the market for the United Kingdom compound feeds market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom compound feeds market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom compound feeds market.

United Kingdom Compound Feeds Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 540.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.36% |

| 2035 Value Projection: | USD 864.01 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 94 |

| Segments covered: | By Animal Type, By Ingredient and COVID-19 Impact Analysis |

| Companies covered:: | Cargill, ForFarmers, AB Agri, Alltec, Midland Feeds, Charoen Pokphand Foods (CPF), Nutreco, De Heus, Land O’Lakes, New Hope Group, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing awareness of animal nutrition, the growth of the animals and poultry sectors, and the demand for premium animal protein. Compound feeds are being used by farmers more frequently in an effort to increase production and feed conversion ratios. Feed efficiency and animal health are further improved by technological developments in feed processing and the use of functional components like vitamins, probiotics, and enzymes. Market expansion is also aided by government support for sustainable agricultural methods and heightened awareness of food safety and traceability. The shift to specialized feeds for various animal species guarantees maximum performance and steady nutritional intake.

Restraining Factors

The different rates for raw materials have an impact on profit margins and production costs. Demand could be lowered by strict regulatory frameworks, worries about genetically engineered foods, and increased support for plant-based diets. Market expansion is also hampered by environmental concerns over extensive animal production.

Market Segmentation

The United Kingdom Compound Feeds Market share is classified into animal type and ingredient.

- The poultry segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom compound feeds market is segmented by animal type into ruminants and poultry. Among these, the poultry segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to a strong supply chain, effective feed conversion rates, and growing consumer demand for affordable, high-protein meals like chicken and eggs, the poultry segment is now the largest category in the UK compound feeds industry.

- The cereal segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom compound feeds market is segmented by ingredient into cereals, oilseeds, and protein sources. Among these, the cereal segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of they are widely accessible, reasonably priced, and have a high energy content. Effective animal development, productivity, and feed formulation depend on them as a primary energy source in livestock diets.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom compound feeds market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cargill, ForFarmers

- AB Agri

- Alltec

- Midland Feeds

- Charoen Pokphand Foods (CPF)

- Nutreco

- De Heus

- Land O’Lakes

- New Hope Group

- Others

Recent Developments:

- In April 2025, Cargill launched a new range of precision-formulated feed additives designed to enhance gut health in livestock. These additives focus on improving digestibility and reducing feed costs, aligning with the industry's push towards more efficient and sustainable feeding practices.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom compound feeds market based on the below-mentioned segments

United Kingdom Compound Feeds Market, By Animal Type

- Ruminants

- Poultry

United Kingdom Compound Feeds Market, By Ingredient

- Cereals

- Oilseeds

- Protein Sources

Need help to buy this report?