United Kingdom Commercial Amino Acids Market Size, Share, and COVID-19 Impact Analysis, By Type (L-Glutamine, L-Leucine, L-Tryptophan, L-Carnitine, and L-Arginine), By Application (Animal Feed, Food & Beverage, Pharmaceuticals, Cosmetics, and Nutraceuticals), and United Kingdom Commercial Amino Acids Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Commercial Amino Acids Market Insights Forecasts to 2035

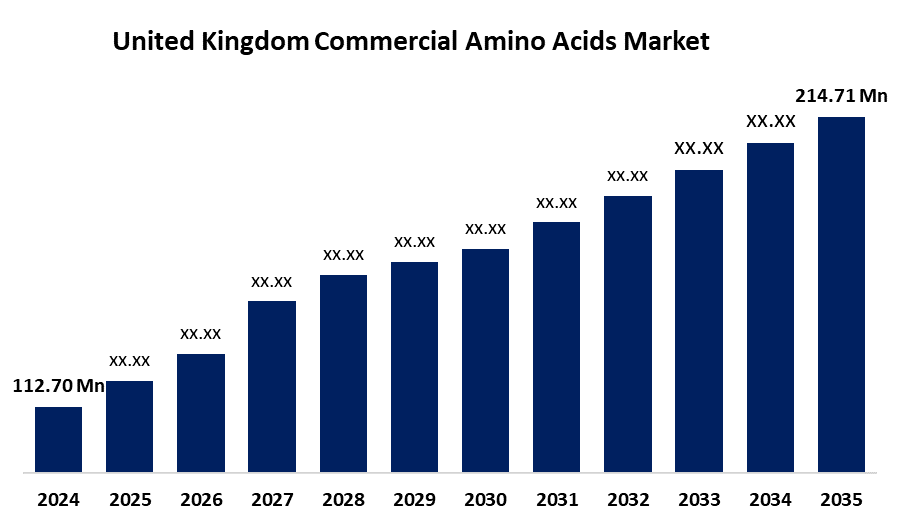

- The United Kingdom Commercial Amino Acids Market Size Was Estimated at USD 112.70 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.03% from 2025 to 2035

- The United Kingdom Commercial Amino Acids Market Size is Expected to Reach USD 214.71 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Commercial Amino Acids Market is anticipated to reach USD 214.71 million by 2035, growing at a CAGR of 6.03% from 2025 to 2035. The increasing demand for food supplements, medications, and animal feed. Growing fitness trends, rising health consciousness, and biotechnology breakthroughs have accelerated use across industries, improving applications for both human and animal health.

Market Overview

The United Kingdom commercial amino acids market refers to the industry involved in the manufacturing, distributing, and using of amino acids for a range of commercial purposes. include medications, food and drink additives, dietary supplements, cosmetics, and animal feed. Because they are necessary for both protein production and metabolic processes, amino acids are important in many different fields. Health trends, biotechnology advancements, and increasing consumer demand for nutritional and functional products are the main factors driving the market. The growing consumer demand for wellness and health things, including functional foods and protein supplements. The market potential is further fueled by the aging population, fitness-conscious customers, and burgeoning medicinal applications. Additionally, manufacturers now have more opportunities to innovate and expand their amino acid products due to the move toward sustainable and plant-based production methods, in addition to growing application in livestock nutrition and biotechnology research. produce of amino acids is accomplished by fermentation and biobased processes, improving purity and sustainability. Precision fermentation and sophisticated purification methods increase production and cost effectiveness. Product development and differentiation are additionally supported by customized amino acid blends for specific health benefits in medical therapy, animal feed, and sports nutrition.

Report Coverage

This research report categorizes the market for the United Kingdom commercial amino acids market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom commercial amino acids market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom commercial amino acids market.

United Kingdom Commercial Amino Acids Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 112.70 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.03% |

| 2035 Value Projection: | USD 214.71 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Ajinomoto, RSP amino acids, IRIS Biotech, PepTech Corporation, Synthetech, Bluestar Adisseo Co, CJ CheilJedang Corp, Ajinomoto Co.,Inc, Fufeng Group, ADM, Shandong Sanyuan Biotechnology, BASF, Meihua Group, Yantai Tianzheng Biotechnology, Others., and |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The consumers' growing understanding of the nutritional advantages of wellness and health products, like dietary supplements and functional foods. With amino acids being essential ingredients in medication formulations and therapeutic nutrition, the growing pharmaceutical industry also makes a substantial contribution. The demand for supplements containing amino acids has also increased as a consequence of the expansion of the sports nutrition and fitness sectors. Amino acids are crucial for enhancing the production and health of cattle in the animal feed industry. Technological developments in fermentation and biotechnology further facilitate market expansion by enabling affordable and environmentally friendly production.

Restraining Factors

The significant production costs linked to sophisticated purifying and fermentation techniques. Furthermore, market expansion may be impeded by regulatory obstacles, raw material price volatility, and competition from synthetic substitutes, particularly for small and medium-sized producers which have difficulty with scalability.

Market Segmentation

The United Kingdom commercial amino acids market share is classified into type and application.

- The L-glutamine segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom commercial amino acids market is segmented by type into L-glutamine, L-leucine, L-tryptophan, L-carnitine, and L-arginine. Among these, the L-glutamine segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing utilization in medication compositions for gastrointestinal and immunological support. Its use in healthcare settings is also being increased by the growing geriatric population and the need for post-surgery recovery supplements.

- The animal feed segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom commercial amino acids market is segmented by application into animal feed, food & beverage, pharmaceuticals, cosmetics, and nutraceuticals. Among these, the animal feed segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by increasing demand for high-quality protein sources in the diet of cattle. Animal development, feed efficiency, and general health are improved by amino acids like lysine and methionine, which promote sustainable farming methods and increase agricultural production in the UK.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom commercial amino acids market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Ajinomoto

- RSP amino acids

- IRIS Biotech

- PepTech Corporation

- Synthetech

- Bluestar Adisseo Co

- CJ CheilJedang Corp

- Ajinomoto Co.,Inc

- Fufeng Group

- ADM

- Shandong Sanyuan Biotechnology

- BASF

- Meihua Group

- Yantai Tianzheng Biotechnology

- Others.

Recent Developments:

- In May 2023, Evonik introduced an improved Biolys® line enriched with highly concentrated L-lysine through advanced fermentation. Aimed at enhancing animal feed nutritional efficiency in competitive UK and European markets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom commercial amino acids market based on the below-mentioned segments:

United Kingdom Commercial Amino Acids Market, By Type

- L-Glutamine

- L-Leucine

- L-Tryptophan

- L-Carnitine

- L-Arginine

United Kingdom Commercial Amino Acids Market, By Application

- Animal Feed

- Food & Beverage

- Pharmaceuticals

- Cosmetics

- Nutraceuticals

Need help to buy this report?