United Kingdom Cold Storage Market Size, Share, and COVID-19 Impact Analysis, By Storage Type (Facilities/Services and Equipment), By Temperature Range (Chilled, Frozen, and Deep-frozen), and UK Cold Storage Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Cold Storage Market Forecasts to 2035

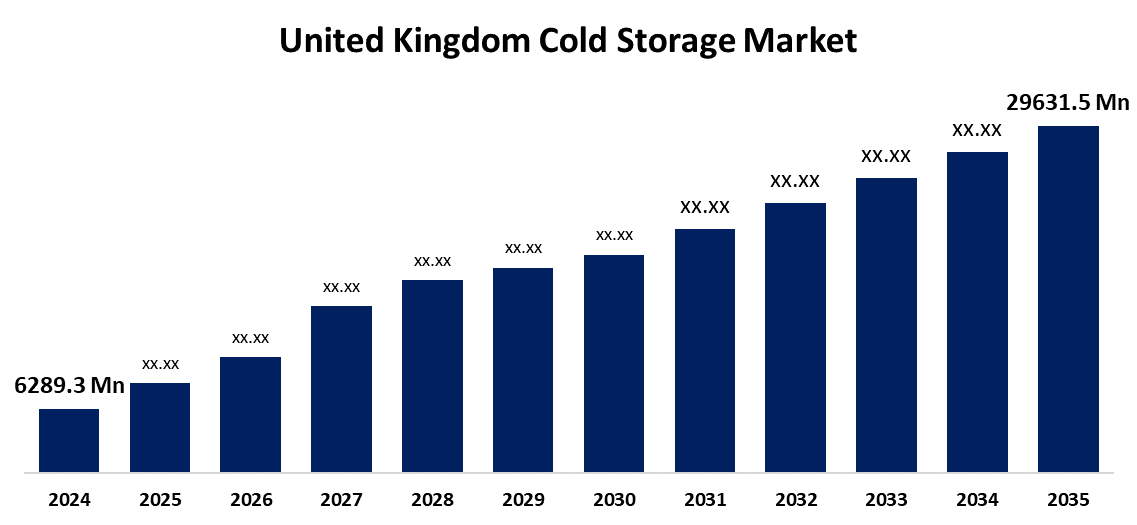

- The United Kingdom Cold Storage Market Size Was Estimated at USD 6289.3 Million in 2024

- The UK Cold Storage Market Size is Expected to Grow at a CAGR of around 15.13% from 2025 to 2035

- The UK Cold Storage Market Size is Expected to Reach USD 29631.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The UK Cold Storage Market Size is anticipated to Reach USD 29631.5 Million by 2035, Growing at a CAGR of 15.13% from 2025 to 2035. The market for cold storage in the United Kingdom is expanding in response to the growing demand for preserved foods, increased online grocery shopping, pharmaceutical cold chain requirements, and acceptance of enhanced energy-efficient storage technologies and automated systems.

Market Overview

The UK Cold Storage Market Size involves keeping perishable items like food, medicines, and chemicals at low temperatures to extend shelf life by slowing microbial growth. The market includes infrastructure such as refrigerated warehouses, transport, and distribution centers vital for maintaining the cold chain. The cold storage market in the UK is expanding at a healthy rate, fuelled by increased demand for perishable food, expanding online grocery shopping, and organized retail expansion. Refrigerated storage is an important component of the supply chain and maintaining goods that require temperature control. Due to the moves towards sustainability, cloud systems, robotics, and other energy-efficient options are being implemented to improve efficiency and reduce carbon footprints as well. Sustainability efforts are gaining traction, with companies investing in low-carbon designs, intelligent controls, and renewable energy to align with the UK's carbon reduction goals. The COVID-19 pandemic has reshaped consumer behavior, increasing focus on food security and supply chain resilience. Partnerships between food manufacturers and storage providers are on the rise, aiming to streamline logistics and ensure product quality. As restaurants and cafes reopen, demand for temperature-controlled storage is expected to steadily grow.

Report Coverage

This research report categorizes the market for the UK cold storage market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cold storage market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom cold storage market.

United Kingdom Cold Storage Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6289.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 15.13% |

| 2035 Value Projection: | USD 29631.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Storage Type, By Temperature Range |

| Companies covered:: | Utopia, XPO Logistics, Davies Turnbull, AGRO Merchants, Almarai, Wincanton, Portchester, Climate Controlled, NewCold, Lineage Logistics, Berkeley Logistics, Red Dot, Stenaline, Norish, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increased food consumption in the UK, increased demand for perishable items, and the growing urban population's taste for fresh, high-quality products are all driving the cold storage market's rapid expansion. Demand is further increased by the pharmaceutical industry's requirement for temperature-controlled storage, especially for medications and vaccines. Cold storage is crucial for preserving product quality and propelling ongoing market expansion because of technological developments that increase operational efficiency, such as better refrigeration systems and IoT integration.

Restraining Factors

The high cost is associated with establishing and maintaining a facility, which includes expensive refrigeration units and insulation. High cost of facility setup and maintenance, including expensive refrigeration systems and insulation. Ongoing energy and upkeep expenses, along with strict and region-specific regulatory requirements, create barriers especially in areas with limited infrastructure or high energy prices slowing market expansion.

Market Segmentation

The United Kingdom cold storage market share is classified into storage type and temperature range

- The facilities/services segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom cold storage market is segmented by storage type into facilities/services and equipment. Among these, the facilities/services segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising need for temperature-controlled storage in food and pharmaceuticals. The high setup costs depend on third-party providers for their rapid temperature-controlled storage. As the demand for online grocery shopping rises and healthcare relies on cold transport also grows, more options for temperature-controlled storage facilities will continue to be used.

- The frozen segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom cold storage market is segmented by temperature range into chilled, frozen, and deep-frozen. Among these, the frozen segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The frozen storage segment is the largest segment and well-established because it preserves the shelf life of various products through the proper management of temperature. This trend is growing due to the increased demands for ready-to-eat foods and the pharmaceutical industry's need for stable long-term equations for vaccines and essential medicines which supports proper storage.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom cold storage market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Utopia

- XPO Logistics

- Davies Turnbull

- AGRO Merchants

- Almarai

- Wincanton

- Portchester

- Climate Controlled

- NewCold

- Lineage Logistics

- Berkeley Logistics

- Red Dot

- Stenaline

- Norish

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom cold storage market based on the below-mentioned segments:

United Kingdom Cold Storage Market, By Storage Type

- Facilities/Services

- Equipment

United Kingdom Cold Storage Market, By Temperature Range

- Chilled

- Frozen

- Deep-frozen

Need help to buy this report?