United Kingdom Coffee Market Size, Share, and COVID-19 Impact Analysis, By Product (Roasted, Instant, Ready to Drink), By Distribution Channel (B2B [Cafes, Hotels & Restaurants, Offices, Bakeries and coffee shops, and Others], B2C [Grocery Stores/Supermarkets, Hypermarkets, Convenience Stores, Online Retailers, Online Direct-to-Consumer (DTC), and Others]), and United Kingdom Coffee Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Coffee Market Insights Forecasts to 2035

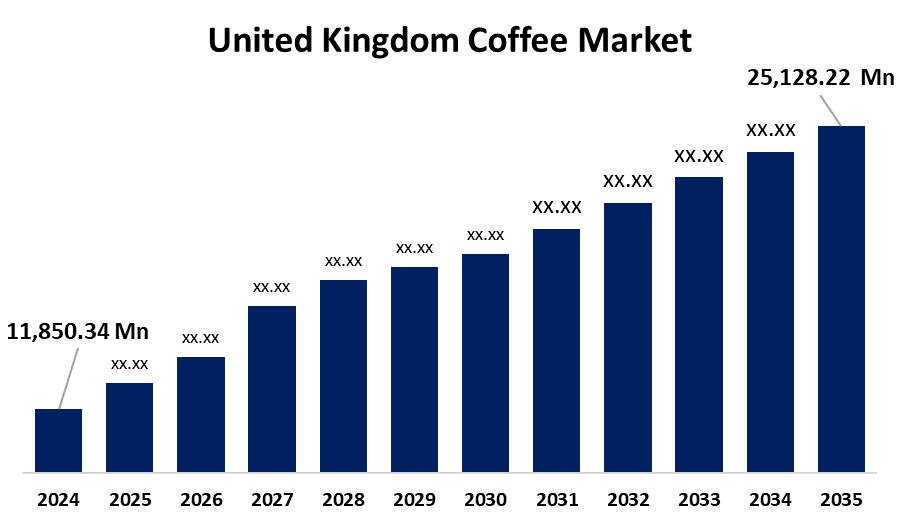

- The United Kingdom Coffee Market Size was estimated at USD 11,850.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.07% from 2025 to 2035

- The United Kingdom Coffee Market Size is Expected to Reach USD 25,128.22 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom coffee Market Size is anticipated to reach USD 25,128.22 Million by 2035, growing at a CAGR of 7.07% from 2025 to 2035. The coffee market is driven by it has numerous health benefits, such as a lower risk of heart disease, melancholy, Alzheimer's disease, and Type 2 diabetes, as well as longer lifespans, less pain, and higher fiber intake.

Market Overview

The United Kingdom coffee market refers to the business focused on the production, application, and consumption of coffee. It includes a variety of processing segments, such as coffee beans turning from green to bright red, which are harvested, processed, and dried. Caffeine is the ingredient that gives coffee its stimulating properties. The majority of customers drink coffee in the morning to increase their vitality. It is one of the most traded commodities in the world and is a fundamental part of food culture in many countries, particularly in the restaurant service industry. Further, novel technologies enhance the consumer experience by ensuring consistency and quality across coffee businesses. In the United Kingdom, consumers drink almost 95 million cups of coffee every day, which adds up to an incredible 2.8 billion cups a year, according to a report from the British Coffee Association. Coffee is regularly consumed by a significant majority of adults (more than 80%), with the average person eating three cups daily. Such kinds of data highlight the market growth opportunities for vendors and market players.

Report Coverage

This research report categorizes the market for the United Kingdom coffee market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom coffee market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom coffee market.

United Kingdom Coffee Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 11,850.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.07% |

| 2035 Value Projection: | USD 25,128.22 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 206 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product (Roasted, Instant, Ready to Drink), By Distribution Channel (B2B [Cafes, Hotels & Restaurants, Offices, Bakeries and coffee shops, and Others], B2C [Grocery Stores/Supermarkets, Hypermarkets, Convenience Stores, Online Retailers, Online Direct-to-Consumer (DTC), and Others]) |

| Companies covered:: | UCC Coffee, Keynote Coffee Limited, Costa Coffee, Bewiched Coffee, Siesta Coffee Drive Thru, Rave Coffee, James’s Gourmet Coffee, Black Sheep Coffee, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom coffee is driven by the rising popularity of coffee shops, which are popular gathering places for friends, family, coworkers, and business associates, leading to their recent spectacular growth. Furthermore, the demand for these coffee shops and cafes is increasing as a result of corporate leaders' shifting work habits and the facilities these establishments offer, such as free Wi-Fi and entertainment areas. Self-service kiosks and smartphone ordering increase productivity, attract customers, and boost market growth. Coffee consumption habits may be influenced by customers' growing knowledge of health and wellness. Research demonstrating the possible health advantages of moderate coffee use, such as antioxidants and possible illness prevention, can affect the attitudes and preferences of consumers.

Restraining Factors

The concerns about drinking coffee and other adverse health effects could hinder market expansion. Additionally, consuming too much coffee might result in caffeine-related problems like elevated heart rate, anxiety, insomnia, and gastrointestinal problems. The market is also suffering from some factors, like pricing fluctuations and trade regulations, during market growth.

Market Segmentation

The United Kingdom coffee market share is classified into product and distribution channel.

- The ready to drink segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period.

The United Kingdom coffee market is segmented by product into roasted, instant, and ready to drink. Among these, the ready to drink segment held a significant share in 2024 and is anticipated to grow at a rapid pace over the forecast period. This is due to coffee is a great fit for customers' hectic lifestyles, which has raised demand for quick solutions. Additionally, these drinks' popularity has been aided by their variety in terms of tastes, brewing methods, and other factors.

- The B2B segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United Kingdom coffee market is segmented by distribution channel into B2B [cafes, hotels & restaurants, offices, bakeries, and coffee shops, and others], and B2C [grocery stores/supermarkets, hypermarkets, convenience stores, online retailers, online direct-to-consumer (DTC), and others]. Among these, the B2B segment held the highest share in 2024 and is expected to grow at a substantial CAGR over the forecast period. This is because of an increased demand for unique and high-quality coffee beans among consumers. Besides, coffee producers, roasters, and brands can now sell their products on online platforms, reaching a wider audience and bypassing traditional retail channels.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom coffee market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- UCC Coffee

- Keynote Coffee Limited

- Costa Coffee

- Bewiched Coffee

- Siesta Coffee Drive Thru

- Rave Coffee

- James's Gourmet Coffee

- Black Sheep Coffee

- Others

Recent Developments:

- In April 2025, Nescafé officially launched its Espresso Concentrated range in Europe, beginning with the UK. This innovative product allowed coffee lovers to create barista-style iced coffee at home with ease. The concentrate dissolved quickly in water or milk, making it perfect for crafting iced lattes, americano, or even mixing with lemonade or juice for a refreshing twist.

- In January 2025, Atomo Coffee, known for its beanless coffee, made its UK debut at Hagen’s Espresso Bar in Mayfair, London. The company, which crafts coffee from upcycled date pits, aims to provide a sustainable alternative to traditional coffee while maintaining rich flavor and caffeine content.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom coffee market based on the below-mentioned segments:

United Kingdom Coffee Market, By Product

- Roasted

- Instant

- Ready to Drink

United Kingdom Coffee Market, By Distribution Channel

- B2B

- Cafes

- Hotels & Restaurants

- Offices

- Bakeries and coffee shops

- Others

- B2C

- Grocery Stores/Supermarkets

- Hypermarkets

- Convenience Stores

- Online Retailers

- Online Direct-to-Consumer (DTC)

- Others

Need help to buy this report?