United Kingdom Cloud Computing Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By End Use (BFSI, IT & Telecom, Retail & Consumer Goods, Manufacturing, Energy & Utilities, Healthcare, Media & Entertainment, Government & Public Sector, and Others), and UK Cloud Computing Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Cloud Computing Market Size Forecasts to 2035

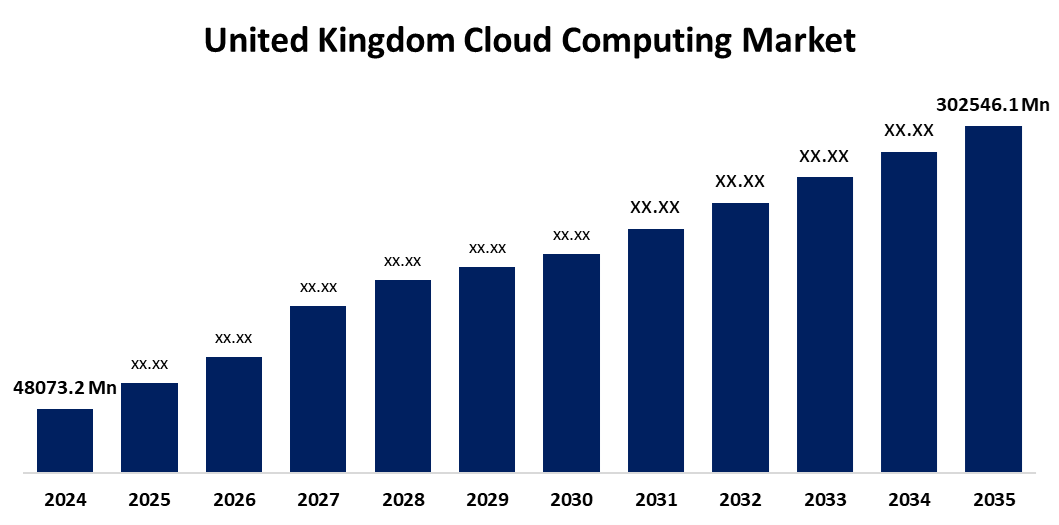

- The United Kingdom Cloud Computing Market Size Was Estimated at USD 48073.2 Million in 2024

- The UK Cloud Computing Market Size is Expected to Grow at a CAGR of around 18.2% from 2025 to 2035

- The UK Cloud Computing Market Size is Expected to Reach USD 302546.1 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Cloud Computing Market Size is anticipated to reach USD 302546.1 million by 2035, growing at a CAGR of 18.2% from 2025 to 2035. Big data, AI, and ML technologies are growing in popularity, which is driving up demand for high-performance, scalable cloud infrastructure.

Market Overview

The UK cloud computing market refers to using internet-based remote servers to store, process, and manage data, replacing traditional local systems. It offers scalable storage and computing power, allowing businesses flexible, on-demand access to data from any location. Increased use of big data, growing internet and mobile device penetration in the UK, and growing digital transformation across sectors are the main reasons propelling the growth of the cloud computing industry. Cloud platforms are crucial for enabling digital business processes as sectors modernise. Furthermore, it is projected that the adoption of IoT, edge computing, 5G, and real-time analytics powered by AI and ML would raise the value of cloud computing technology for many industries. The UK has a mature cloud market, which is rapidly developing across all sectors such as finance, healthcare, and public services. Government engagement and a competitive set of providers. Cloud computing offers speedy deployment and flexibility, especially via hybrid and multi-cloud, plus government providers are present, which provides easy engagement. The government assistance, SME uptake, and the move to remote work following COVID-19, the UK cloud computing business is growing quickly. Through data rules, governments are promoting safe cloud environments, while SMEs profit from scalable, reasonably. Cloud computing transforms business operations and strategy by improving agility, efficiency, and customer experiences.

Report Coverage

This research report categorizes the market for the UK cloud computing market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cloud computing market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom cloud computing market.

United Kingdom Cloud Computing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 48073.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 18.2% |

| 2035 Value Projection: | USD 302546.1 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 156 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Service Type, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Alibaba Group Holding Limited, Amazon Web Services (AWS), Google LLC, IBM Corporation, Microsoft Corporation, Littlefish, Transparity, HAYNE.cloud, Innovecom, YouCloud Ltd, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising demands of scalable and affordable IT solutions, plus reduced infrastructure costs and greater operational flexibility, are driving the cloud computing market in the UK. Further promoting growth is government investment, hybrid and multi-cloud adoption, and rapid deployment of cloud infrastructure. The epidemic hastened the change to remote work and digital transformation, highlighting the importance of safe and easily deployable cloud environments. Together, these components promote cloud consumption both in public services and business, creating space for creativity, efficiency, and agility.

Restraining Factors

Data privacy concerns, security threats, and pressure from regulators especially with sensitive data, are key reasons holding back the UK cloud computing industry. There is a higher potential for service interruption and data breaches through reliance on third parties. Increasing cloud adoption has also been stalled - particularly in established organisations - by an absence of cloud skillsets, inertia, and a resistance to change. These factors hamper the cloud computing market during the forecast period.

Market Segmentation

The United Kingdom cloud computing market share is classified into mining method and waste type.

- The software as a service (SaaS) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom cloud computing market is segmented by mining method into infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS). Among these, the software as a service (SaaS) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. SaaS applications are easy to use and deploy, requiring no complex installation or maintenance. Accessible on demand and priced via subscriptions, they provide a cost-effective, scalable solution, making them highly appealing to businesses of all sizes, from startups to large enterprises.

- The BFSI segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom cloud computing market is segmented by waste type into BFSI, it & telecom, retail & consumer goods, manufacturing, energy & utilities, healthcare, media & entertainment, government & public sector, and others. Among these, the BFSI segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cloud-based security solutions that provide advanced threat detection, data encryption, and access controls are being adopted by BFSI organisations as a result of the increased emphasis on cybersecurity and regulatory compliance. Prominent cloud service providers guarantee that BFSI companies can meet strict regulatory requirements while protecting customer data by providing compliance certifications for international financial regulations like GDPR, PCI DSS, and SOX.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom cloud computing market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Alibaba Group Holding Limited

- Amazon Web Services (AWS)

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Littlefish

- Transparity

- HAYNE.cloud

- Innovecom

- YouCloud Ltd

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom cloud computing market based on the below-mentioned segments:

United Kingdom Cloud Computing Market, By Service Type

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

United Kingdom Cloud Computing Market, By End Use

- BFSI

- IT & Telecom

- Retail & Consumer Goods

- Manufacturing

- Energy & Utilities

- Healthcare

- Media & Entertainment

- Government & Public Sector

- Others

Need help to buy this report?