United Kingdom Cladding Market Size, Share, and COVID-19 Impact Analysis, By Material (Steel, Aluminium, Composite Materials, Fiber Cement, Terracotta, Ceramic, and Others), By Application (Residential, Industrial, Commercial, Offices, and Institutional), and United Kingdom Cladding Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsUnited Kingdom Cladding Market Insights Forecasts to 2035

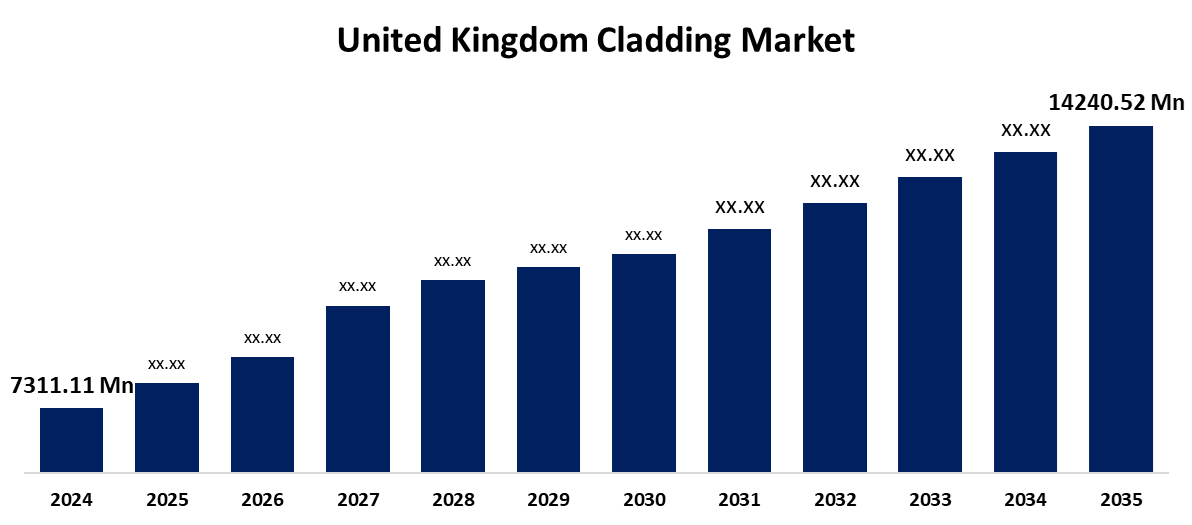

- The United Kingdom Cladding Market Size was estimated at USD 7,311.11 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.25% from 2025 to 2035

- The United Kingdom Cladding Market Size is Expected to Reach USD 14,240.52 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights and Consulting, The United Kingdom Cladding Market Size is anticipated to reach USD 14,240.52 Million by 2035, Growing at a CAGR of 6.25% from 2025 to 2035. The expansion of commercial building operations with the growing use of cladding to improve a structure's visual attractiveness is also anticipated to drive product demand during the projected period.

Market Overview

The United Kingdom Cladding Market Size is elaborated to the business that emphasizes producing, distributing, and installing materials to cover a building's exterior (and occasionally internal) surfaces. Cladding protects buildings from the elements, improves insulation, and adds to architectural design, among other practical and aesthetic uses. Cladding is a covering that is attached to the outside of a building or other structure for either functional or decorative reasons. In addition to providing insulation and protecting the underlying structure from environmental impacts, it also enhances the structure's aesthetic appeal. There are many different feasible cladding materials available, and the selection process depends on a number of aspects, such as architectural design, weather resistance, durability, and maintenance requirements. Wood, brick, vinyl, fiber cement, and composite materials are common cladding materials. Metals (such as steel or aluminum) are commonly used for cladding. The cladding system is usually composed of a structural backing, an insulating layer, and an exterior shell. Further, government incentives expand the market size and revenue dimension. For instance, the UK government has launched its largest-ever cladding removal initiative through the full rollout of the Cladding Safety Scheme (CSS). This marks a major step in addressing the building safety crisis that’s persisted since the Grenfell Tower fire.

Report Coverage

This research report categorizes the market for the United Kingdom cladding market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom cladding market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom cladding market.

United Kingdom Cladding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 7,311.11 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.25% |

| 2035 Value Projection: | USD 14,240.52 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Material, By Application |

| Companies covered:: | SIG plc, Ancon Ltd, Severfield plc, Cladco Composite Decking, Harley Facades Ltd, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom cladding is influenced by the expansion of the residential sector, the growth of the tourism industry, retail trade, and development in business sectors. The country's level of innovation is higher since technical advancements are being used to create goods with improved cleaning capabilities, extended operational lifespans, and minimal maintenance are anticipated to be crucial in driving the market upward over the forecast period. Various governments have implemented policies and programs to protect the environment as a result of growing environmental concerns and shifting consumer behavior. Improving building safety, especially with relation to fire resistance, is the driving purpose behind a variety of legislations and which helps to uplift the market expansion.

Restraining Factors

The market expansion could be hampered by expensive initial setup expenses, difficulty conducting regular maintenance, or assessing the materials due to the water and air barriers require routine examinations of the sealant connections.

Market Segmentation

The United Kingdom cladding market share is classified into material and application.

- The terracotta segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United Kingdom cladding market is divided by material into steel, aluminium, composite materials, fiber cement, terracotta, ceramic, and others. Among these, the terracotta segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is due to the product's fast and simple installation, waterproof and fireproof qualities, durability, recyclability, and resistance against UV radiation. These panels enhance a building's thermal performance and offer continuous insulation outside the main wall.

- The office segment held the largest market share in 2024 and is anticipated to grow at a remarkable CAGR over the forecast period.

The United Kingdom cladding market is segmented by application into residential, industrial, commercial, office, and institutional. Among these, the office segment held the largest market share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. Private offices and government buildings are included in the section. These buildings use claddings to give the structure thermal insulation, fire and weather resistance, and visual appeal.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom cladding market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- SIG plc

- Ancon Ltd

- Severfield plc

- Cladco Composite Decking

- Harley Facades Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom cladding market based on the below-mentioned segments:

United Kingdom Cladding Market, By Material

- Steel

- Aluminium

- Composite Materials

- Fiber Cement

- Terracotta

- Ceramic

- Others

United Kingdom Cladding Market, By Application

- Residential

- Industrial

- Commercial

- Offices

- Institutional

Need help to buy this report?